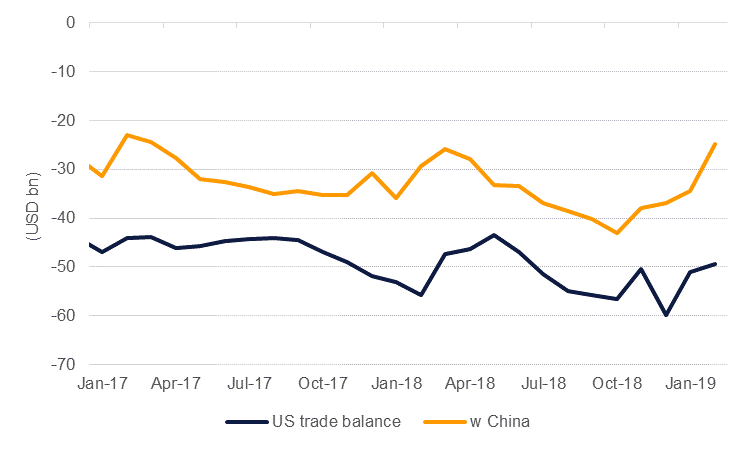

The US trade deficit narrowed to USD 49.4bn in February, its smallest level since June of last year. Exports expanded by 1.1% m/m while imports declined by 0.5% m/m. The trade deficit specifically with China narrowed sharply to USD 24.8bn, down 29%, as there was a major drop in imports from China thanks to tariffs that the US has put in place. The overall trade deficit was smaller than expected and means that trade won’t be as big a draw on GDP growth for Q1.

UK consumer prices rose by 1.9% in March, flat month on month and below market expectations for an acceleration. Lower food prices and recreation costs helped keep the index below 2%. Higher utility bills will help push inflation back up toward and over 2%, setting the market up for a Bank of England rate hike at some point either at the end of 2019 or next year provided Brexit proceeds in an orderly manner.

Japan’s manufacturing PMI remained in contraction for April although the pace of decline slowed. The Markit Japan PMI index hit 49.5 in April, from 49.2 a month earlier, its third month in a row below 50. New export orders declined, however, as there had still been uncertainty over trade negotiations between the US and China and how any deal would affect other Asian economies.

Abu Dhabi has amended real estate laws to allow foreigners to buy freehold property in the emirate in certain designated zones. The change should help to encourage more foreign direct investment into Abu Dhabi as previously only UAE and GCC nationals could own freehold land.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

The risk-on move in assets took a pause overnight and helped push USTs higher. Yields acrosee the curve slipped with 2yr down 1bp and the 10yr down less than 1bp overnight. Both tenors continue to see yields decline this morning by around 1bp apiece.

GCC bonds were stable yesterday with average yield on Bloomberg Barclays index closing unchanged at 4.06% amid no change in credit spreads at 157 bps.

The primary market awaits offerings from IDB and Majid Al Futtaim.

The DXY index held steady overnight as gains in the Euro were offset by modest declines in Sterling. A more active market calendar today with Eurozone and US PMIs may help to shake currencies out of their current ranges.

Both TRY and IND managed to appreciate overnight as political events affect both Turkey and India. There is still no clear outcome from local elections in Turkey, meanwhile national elections are underway in India.

Global equity markets saw a mixed performance overnight with gains in Europe offset by declines in the US. The S&P 500 fell 0.2% thanks to weaker health care stocks while in Europe the Dax and CAC were both up by 0.6%.

Regionally markets were all positive. The Tadawul added 1.1% overnight while the DFM was up nearly 0.8% and the Abu Dhabi exchange added 0.5%.

Oil prices slipped marginally overnight despite a drop in US crude stocks. WTI futures fell 0.45% to USD 63.76/b while Brent decline to USD 71.62/b, down just USD 0.1/b. crude inventories in the US fell by 1.4m bbl last week, smaller than the decline estimated by the EIA, while production fell by 100k b/d to still enormous level of 12.1m b/d. Exports stabilized and a drop in imports looks likely to have helped contribute to the decline in stockpiles.

Gold prices are holding around their lowest levels in 2019 as the healthy economic data out of China has helped to buoy risk sentiment. The yellow metal has declined nearly 11% ytd and is trading around USD 1,270/troy oz.