The US Secretary of State, Mike Pompeo, said Iran would face the ‘strongest sanctions in history’ if it did not change its foreign policy behaviour. The US withdrew from the JCPOA, the Iran nuclear deal, earlier this month and will re-impose sanctions on firms doing business with specific Iranian entities as early as August. Several major European companies have announced they are backing away from projects in Iran as the risk of doing business there has escalated and threatens their access to US financial markets. Across the Atlantic, French President Emmanuel Macron is scheduled to meet with Russia to discuss the Iran nuclear accord.

On the economic data front, the Chicago Fed national index in April came in at 0.34 vs est. 0.30 and the March index was revised upward to 0.32 from 0.1. 50 of the 85 monthly individual indicators made positive contributions, while 35 indicators affected the index negatively reflecting above trend growth.

Italy is expecting the Five Star Movement (M5S)/ League government to name their candidate for Prime Minister this week. Both parties are euro-sceptic, and their coalition discussions have included a (since-dropped) proposal that the EU should establish a procedure for countries to leave the euro-zone. Though the worries about breaking away from the Euro-zone have faded now, the new government is likely to plan major tax and basic income reforms which could increase budget deficits and require additional borrowing. Italy accounts for 15% of Eurozone’s GDP and 25% of its debt. Ongoing political and economic uncertainty depressed stock and bond prices with spread on 10year Italian government bonds now trading more than 155bps wider than the German Bunds.

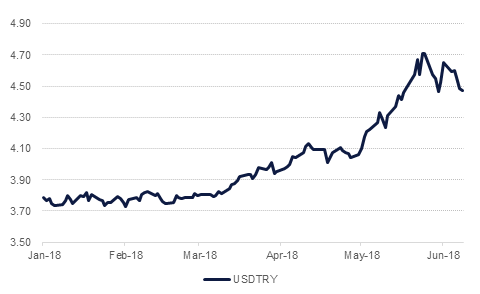

Turkish President Recep Tayyip Erdogan is likely to ultimately let the central bank (TCMB) hike interest rates to stem the accelerating decline in the value of the lira. Lira has fallen more than 15% over the last month and a half. With simultaneous presidential and parliamentary elections only 33 days away, Erdogan is likely to work towards appeasing voters and wining their confidence in managing the currency crisis.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries traded in a tight range amid lack of directional catalyst. Gains made following announcement from China and the US of putting trade war on hold were pared as the trading session progressed. Yields on the 2y UST, 5y UST and 10y UST closed at 2.56% (flat), 2.89% (flat) 3.05% (flat) respectively.

Italian government bonds continue to remain under pressure as investors await the contours of the new government. Yields on the 10-year government bond jumped +16bps to 2.38%.

Regional bonds drifted lower with the YTW on the Bloomberg Barclays GCC Credit and High Yield index rising +2bps to 4.70% and credit spreads widening 2 bps to 186 bps.

In terms of rating action, Moody’s downgraded Commercial Bank of Qatar and Doha Bank to A3 from A2. The outlook on both bank’s ratings remain negative. The rating agency attributed deteriorating asset quality and moderating capital adequacy as reasons for the downgrade.

GBP softened against the other major currencies during the Asia and Europe sessions, as politics weighed on the pound. Concerns over the next round of Brexit talks, concerns over continued softer than expected economic data and drama over the Italian coalition have resulted in GBPUSD falling to the lowest levels in 2018, reaching below 1.34. While the price trades below 1.3454 (the 50 week moving average), further losses are likely, and a weekly close below this key level could catalyse a greater slide towards 1.3270, not far from the 38.2% one year Fibonacci retracement of 1.3272.

Over the day ahead, investors will be scrutinizing speeches from Bank of England Governor Mark Carney and other policy makers for future hints on monetary policy. Any cautionary tone from, is likely to be bearish for GBP looking forward. However, on the other hand, the 14 day Relative Strength Indicator (RSI) is showing oversold conditions at 23.84, meaning that further losses may initially be reduced by profit taking.

Developed market equities closed higher as investors reacted positively to progress in trade talks between the US and China. The S&P 500 index and the Euro Stoxx 600 index added +0.7% and +0.3% respectively.

UAE bourses closed higher as investors welcomed the steps announced to further stimulate the economy. The steps included 10-year visas for select professions and the possibility of 100% foreign ownership of companies. The DFM index and the ADX index added +1.0% and +0.7% respectively. Real estate sector stocks led the gains with Damac Properties and Emaar Properties adding +5.2% and +3.3% respectively.

Oil prices continued to push higher on fear that the US would now impose sanctions on Venezuela following the outcome of that country’s election over the weekend. The US Secretary of State, Mike Pompeo, also said the US would be seeking to impose harsh sanctions on Iran, likely removing any breathing room for companies still looking to do business in the country. Brent futures closed up 0.9% at USD 79.22/b while WTI added 1.35% to close above USD 72/b.