Following reports yesterday that the U.S. would block inward investment from China, which contributed to a large drop in U.S. equities, the U.S. Director of the National Trade Council, Peter Navarro has sought to calm nerves saying there are no plans to impose investment restrictions on any country. The U.S. is merely investigating what China is doing according to Navarro, and Treasury Secretary Mnuchin will do an assessment by the end of the month on China’s policies. Navarro stressed the U.S. will defend itself against any threats to its technology, but also claimed that president Trump’s policies are being misinterpreted. He also noted that these policies are not something the markets should be worried about and even claimed that they should be positive for the markets, saying that President Trump just wants ‘free, fair, and reciprocal trade’.

President Xi meanwhile threatened that China would ‘punch back’ in a meeting with American corporate executives according to the Wall Street Journal. The article said that apart from reciprocal tariffs, China may choose to block M&A deals, delay licenses for trade, devalue the yuan, boost import inspections or use moral suasion on its population to avoid American products. China is also warming to its trading partners in Europe and Japan in response to the U.S. tariff threats and Xi suggested this could continue, while also continuing to deepen trading and economic ties in Asia.

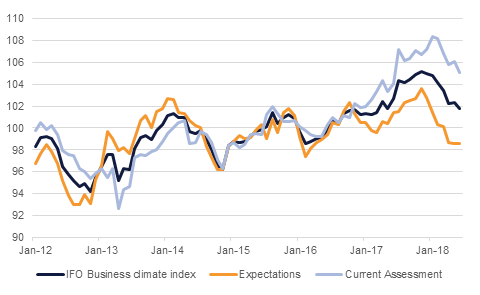

Meanwhile there was further evidence of the negative impact that trade fears may be having on business sentiment, with the German June IFO index declining for six of the past seven months in June. The IFO dropped to 101.8 in June from 102.3 in May, taking it to the lowest level in a year, and with the expectations component standing at the lowest level in two years. The data suggests that the weakness in Q1 GDP might not just be temporary, with the ECB having previously highlighted tariffs as one of the key risks to the Eurozone economy this year.

Treasuries continued their positive run following a sharp sell-off in equities and concerns over trade front. Yields on the 2y UST, 5y UST and 10y UST closed at 2.53% (-1 bp), 2.75% (-1 bp) and 2.88% (-1 bp) respectively.

Regional bonds drifted lower mirroring trend of weakness in the EM space. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +3 bps to 4.68% and credit spreads widened 5 bps to 199 bps.

The 5y Bahrain CDS widened 170 bps to close at 609. This is the widest levels since early 2009. The Bahrain 21s dropped 1.5 point to USD 93.3 while Bahrain 29s declined -2.75 point to USD 79.44.

The JPY continues to strengthen against most other major currencies amidst growing trade tensions between the US and China. Elsewhere the USD also pulled back against other major currencies as equity markets plunged, highlighting that trade wars may not be perceived as a unanimous positive for the US economy relative to the rest of the world. EURUSD recovered above 1.17 for the first time in seven days, leaving a peak at 1.1720. Dollar-bloc currencies, however, softened perhaps on the assumption that they share more in common with their vulnerable EM neighbours.

Developed market equities declined sharply as a prolonged trade war between the US and other countries appear certain. The S&P 500 index and the Euro Stoxx 600 index dropped -1.4% and -2.0% respectively.

Regional markets drifted lower with the DFM index losing -2.1% and the Qatar Exchange dropping -0.8%. Drake & Scull closed limit down on above average volumes. It appeared that the stock suffered from margin calls following reports earlier in the month that its largest shareholder had pledged their shares in the company as a collateral to a financial institution.

After testing low levels during the course of trading yesterday oil benchmarks settled only a little lower. Brent gave up 1.1% to close at USD 74.73/b but did move to a USD 73/b handle at one point during the day. WTI gave up less ground and closed at USD 68.08/b. The market is still trying to understand exactly how much oil OPEC+ will add to markets following their agreement on Friday and over what time frame. Meanwhile ongoing disruptions to Libyan export terminals raise doubts about how much crude the North African producer can get onto markets.

Market structure have diverged sharply following the OPEC+ agreement with 1-2 month WTI backwardation as wide as USD 1/b while Brent is much narrower at USD 0.16/b. The gains in the front of the WTI structure are related to disruptions to Canadian supplies which may persist for several weeks, more than a reaction to the OPEC+ deal. This has also helped to narrow the Brent/WTI spread although this is most likely a pass-through phenomenon rather than permanent shift in market dynamics.

Click here to Download Full article