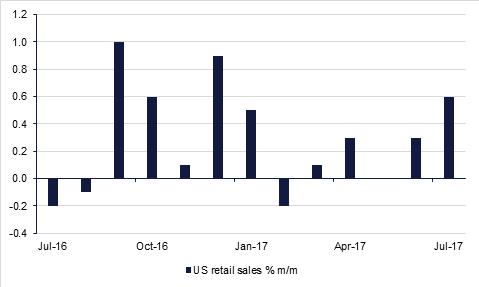

US retail sales rose 0.6% in July, much stronger than expected especially when combined with upward revisions to May and June. Furthermore sales ex-autos were also up by a hefty 0.5%. The data reinforces expectations that consumption will contribute positively to growth in Q3. The dollar rose on the news as did bond yields although with inflation still subdued it is unlikely that there will be any change in the Fed’s messaging about taking their time to raise interest rates further. Other data from the US was also positive with the NAHB house price index climbing to 68 in August from 64 in July. Housing starts will be released later today and the markets will also watch out for the minutes from the July FOMC meetings where they will be looking for further insights about the timing of balance sheet normalization which is widely expected to be announced in September.

UK inflation remained at 2.6% in July, less than the market anticipated causing the markets to doubt if the Bank of England would make good on its promise to raise interest rates soon. Not only was CPI steady but there were signs that pipeline price pressures were also easing as input and output price producer price inflation both fell back. The last few months have been littered with mixed messages about interest rates from the Bank with the minutes of the last MPC meeting showing officials backing off a little from their prior position where an increasing number were looking to tighten policy. The pound dropped back on the inflation news and it now awaits news on employment and wages which are due out today.

Finally Germany saw its GDP growth reported at 0.6% in Q2 yesterday, a little softer than expected but still firm enough to mean that Eurozone GDP will probably be confirmed at 0.6% as well later today.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

|

| Time | Cons |

| Time | Cons |

| UK Unemployment | 12.30 | 4.5% | US Housing starts | 16.30 | 0.4% |

| Eurozone Q2 GDP | 13.00 | 0.6% | US FOMC minutes | 22.00 |

|

Source: Bloomberg.

The move back to risk assets helped yields climb the past two days. Yields on 10yr USTs closed almost 5bps higher at 2.26% while the positive US retail sales figures helped the curve steepen with the 2-10 spread back above 90bps. Softer than expected inflation figures in the UK helped push gilt yields lower while bunds were largely unchanged.

GCC bonds were well bid with credit spreads on Bbg Barclays GCC index tightening 5bps to 142bps and yield narrowing a bp to 3.36%. In the corporate development, Dana Gas reported better than expected results yesterday reflecting 77% increase in net profit to $23 million for the first half 2017. However bonds remain under pressure pending outcome of the court case relating to sukuk illegality.

EA Partner bonds fell further even though Etihad Airways stated plans to provide no further support to its minority owned Air Berlin which filed for bankruptcy. EAPART 20s closed down by almost a point with yield rising to 9.46% (+30bps).

GBP was the main mover yesterday falling back on weaker than expected UK inflation data, which cast doubt on the likelihood of a Bank of England interest rate hike anytime soon. The USD also benefited across the board from the strong retail sales data from the US. While this is unlikely to twist the argument in favour of a Fed rate hike in September, it may make December a more serious contender for a move, in line with our own expectations.

Of technical significance is the recent movements of NZDUSD cross, which while virtually unchanged this morning at 0.7234, has had two previous days of declines which have broken the supporting baseline of the daily uptrend that had been in effect since 12th May 2017. This exposes vulnerability to further declines towards the 100 day moving average of 0.7151.

Developed market equities continued to hold onto their recovery from declines of last week amid stronger than expected economic data both in the US and the Eurozone. The Euro Stoxx 50 index added +0.3% while the S&P 500 index closed flat.

Regional equities continued to suffer from weak corporate earnings. The DFM index and the Tadawul dropped -0.2% and -0.3% respectively.

Union Properties, which accounted for nearly one-third of total volume on the DFM, dropped -4.3% after the company reported a net loss of AED 2.29bn for Q2 2017. The company attributed the loss to provisions following the finding out of an accounting error made in 2015. Marka dropped -5.1% after the company reported losses for Q2 2017.

Telecom Egypt gained +1.1% after the company reported a 22% y/y increase in Q2 2017 net profit to EGP 1.27bn.

Oil prices held roughly flat overnight as the market weighed a draw in US inventories against disappointing figures from China. Data from the EIA will be out later this evening with expectations for a draw in crude stocks of over 3m bbl. Both the Brent and WTI futures curves remain flat while volatility is sagging from recent highs.

Gold has lost ground two days running as risk-off trades ebbed, taking the rest of the precious metals down with it. Confirmation of capacity closures in China helped push aluminium futures up 1.3% to just shy of USD 2,050/tonne.