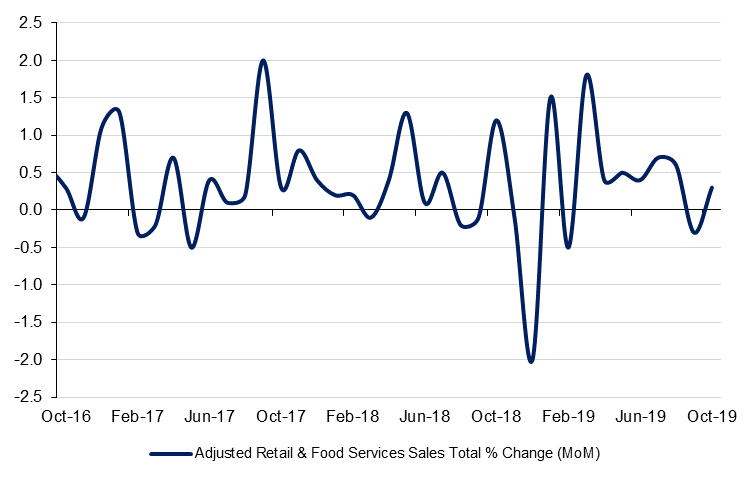

Mixed economic data out of the US on Friday revealed that despite slowing to trend, the US economy remains healthy in comparison to its developed counterparts. A rise in gasoline and motor vehicle prices helped retail sales climb 0.3% m/m in October, following a 0.3% m/m decline the previous month. This expansion was greater than the 0.2% m/m expected by the market and shows that while consumption is slowing, it its only slowing gradually. Given that Q3 personal consumption grew at 2.9% annualized, this report indicates that Q4 consumption is likely to remain solid.

Industrial production in the world’s largest economy fared less well in October, with a 0.8% m/m decline adding to the 0.3% m/m decline of September. However, the headline figure is misleading and can mainly be attributed to strikes at General Motors and a fall in utility usage. With GM’s employees returning to work, and the recent colder weather, one can expect a strong rebound in industrial production in November.

Saudi Arabia said on Sunday that it will seek to raise between USD 24-USD 25.6bn from the listing of Saudi Aramco, floating just 1.5% rather 5% of its total shares to investors at a price that will value the company at between USD1.6tn-USD1.7tn. The delta here was valuation with financiers contrasting their expectations for bumper domestic demand at the high end of the valuation around USD 1.8 tn or higher against foreign institutional investors who are more inclined to a valuation of about USD 1.2tn -1.5 trillion. Aramco announced a 30-32 riyal share price range on Sunday. The IPO will rely heavily on demand from domestic retail investors, as well as Saudi funds, regional investors and other sovereign funds. Saudi officials have visited China and Russia in recent weeks in a bid to underpin demand.

Egypt’s central bank cut rates by a further 100bps on Thursday, taking advantage of disinflation which has seen price growth slow to just 3.1% last month.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Commentary from Fed Chair Jerome Powell that rates were on hold along with oscillations on the trajectory for trade talks between China and the US acted as a dampener for US treasury yields over the course of last week. Yields on 10yr USTs fell 11bps along with declines across much of the rest of the curve. Ten-year USTs ended the week at 1.83% while 2yr USTs closed at 1.61%

UAE bonds held relatively steady last week with little overall change on the Bloomberg BUAEUL index.

Last week, the dollar softened against a basket of major currencies, the Dollar Index falling by 0.36% to close at 98.001. Despite breaking the 50-day moving average (98.276) during the week, the index was unable to hold onto these gains and even closed just below the 100-day moving average (98.019). However, the weekly close above the 61.8% one-year Fibonacci retracement (97.8956) means that the dollar remains underpinned. Analysis of the montly candle chart shows that for a third time, support has been found at the 61.8% five-year Fiboancci retracement (97.3492) and while the price remains above this level, the dollar is likely to maintain its firmness.

Developed market equity markets had a green day across the board. In the United States, the Dow Jones closed 0.80% higher at 28004.89, while the Nasdaq added 0.73% to reach 8540.83 and the S&P500 rose 0.77% to hit 3120.46. On the other side of the Atlantic, results were similiarly positive and Euro Stoxx rose 0.62% to close at 3711.61, while the DAX climbed 0.47% to 13241.75 and FTSE 100 appreciated 0.14% to close at 7302.94.

Oil markets ended the week on a positive footing as markets responded to news that trade discussions between China and the US were reaching their “final stage” even as Wilbur Ross, the US Commerce Secretary noted that there would be no deal until there was a “deal on everything.” The outcome of trade talks between both countries will push and prod oil prices over the next few weeks and we would caution that markets have previously priced in an imminent deal only for policymakers to subvert it with new, stringent requests. Brent futures settled at USD 63.30/b, up 1.3%, while WTI closed the week at USD 57.72/b, a gain of 0.8%.