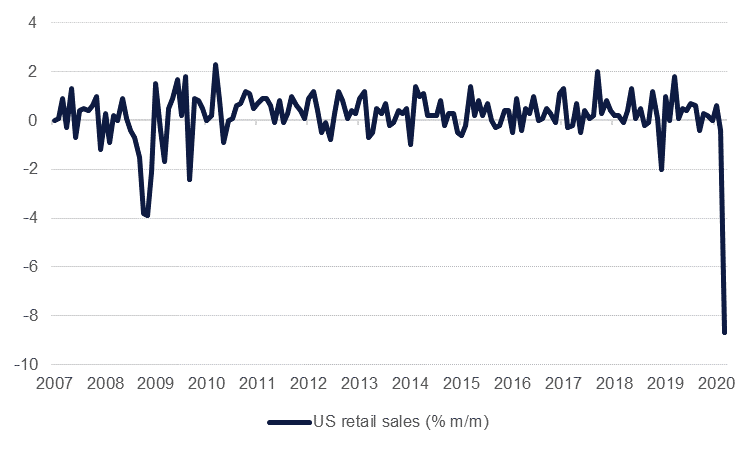

Data out of the US is beginning to better reflect the negative impact of the coronavirus pandemic more accurately with dreadful data prints for retail sales and industrial production. Retail sales fell by 8.7% m/m in March, its worst ever performance, with purchases of necessities—essentially groceries—the only segment showing any growth. Industrial production was down 5.4% m/m, the worst monthly decline since the Second World War. Motor vehicle production was down almost 30% in a single month as workers have been ordered home. We would expect data for April to be just as bad, if not worse, as the US has endured the full brunt of the virus this month. The Fed’s Beige Book affirmed the dire state of the US economy, noting companies were shutting down across the country along with prices moving lower.

Saudi Arabia has launched a USD 7bn Eurobond with three tranches (5.5Y, 10Y and 40Y maturities) that were heavily oversubscribed. The kingdom raised USD 5bn in debt in January, but a sharp decline in oil revenues will result in much larger deficit this year than had been planned. Separately, Saudi Arabia announced a series of new measures on Wednesday to support businesses and households in the coming weeks. These include SAR 50bn set aside to make payments due to contractors, a 30% discount on electricity bills for two months, allowing some businesses to pay their utility bills in installments and wage support for some freelancers in key sectors that are no longer allowed to work due to coronavirus restrictions. The IMF cautioned that regional debt will increase to 95% of total GDP as governments take measures to combat coronavirus.

The Bank of Canada kept rates unchanged at 0.25% overnight but expanded the range of debt it will buy to keep Canada’s financial system flush with liquidity. Both high quality corporate and provincial debt will now qualify with the bank to buy up to CAD 60bn worth of bonds. Meanwhile in Australia, employment held up better than the market had expected for March with the unemployment rate ticking up only slightly to 5.2%. The economy actually added almost 6,000 jobs compared with expectations for a 30,000 drop in employment.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher as risk assets gave up a part of their early week gains. The curve bull flattened with yields on the 2y UST and 10y UST ending the day at 0.19% (-2 bps) and 0.63% (-12 bps) respectively. The 2y USTs is now yielding less than 0.20%, a level close to the lows early this year.

Regional bonds came under renewed pressure following reversal in risk sentiment. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose to 4.39% and credit spreads widened to 378 bps.

Saudi Arabia raised USD 7bn from a three-tranche bond offering. The 5.5y (USD 2.5bn) and 10.5y (USD 1.5bn) were priced 260 bps and 270 bps over USTs while the 40y tranche was priced to yield 4.55%. The order book exceeded USD 40bn. The current Saudi 55s yields 4.33%.

The dollar climbed as risk aversion returned off the back of news from the U.S. that saw retail sales and manufacturing data posting historic declines, fueling concerns around the magnitude of the economic downturn. After closing on Tuesday at 99.887, the DXY oversaw an uptrend for most of the day but met resistance just below the 100 mark. It has since regained some of those losses in the early hours of this morning, now trading at 99.840.

Euro and Sterling both declined as the dollar firmed. The Euro was on the verge of breaking the 1.1000 level but has since slumped to 1.0880 this morning whilst GBP painted a similar picture, falling over 1% to reach 1.2480. Similarly the AUD and NZD both experienced declines both falling over 2.40% from Tuesday's closing price.

Equities

Developed market equities closed lower as economic data and corporate earnings continued to provide a glimpse into the damage to the global economy from the coronavirus. The S&P 500 index and the Euro Stoxx 600 index dropped -2.2% and -3.3% respectively.

Regional equities gave up most of its previous session gains amid weak global backdrop. The DFM index and the Tadawul dropped -2.2% and -0.9%. Petrochemical stocks remained under pressure in Saudi Arabia with Saudi Aramco losing -1.3%. Beyond that, banking sector stocks were major losers.

Oil prices have been unable to catch a break as negative data and market assessments continue to pile on. Brent was down more than 6% overnight to settle at USD 27.69/b while WTI closed below USD 20/b for the first time since 2002. The IEA’s latest market report expects that demand will fall by more than 23m b/d in the second quarter compared with the same period last year and that on average total demand will fall by more than 9m b/d in 2020. This enormous drop in demand means that OPEC countries have room to produce only a bit more than 8m b/d in Q2 in total! OPEC’s share of the production cut deal reached at the weekend means that total output from the group will still be around 28m b/d, leaving the market oversupplied by roughly 20m b/d.

That oversupply is already showing up in the US weekly oil data with crude stocks in the US rising by 19m bbl last week, the most ever, while total product and crude stocks were up nearly 22m bbl. Demand indicators continue to fall with product supplied falling by 649k b/d in a single week (representing a near 7m b/d y/y). US production slipped marginally by just 100k b/d last week.