Despite the optimism prevalent following positive vaccine trial results over the past two weeks, data out of the US continues to highlight that the economic recovery remains fragile. As coronavirus cases climb rapidly, many states are imposing new checks on activity; yesterday California implemented an ‘emergency break’, reimposing many restrictions, and New Mexico began a new two-week lockdown. With no fiscal support on the horizon, the fourth quarter will be a difficult one for US consumers as jobs in the hospitality and retail sectors are hit once more, and this has already been illustrated by retail sales data released yesterday. Retail sales growth in October fell to a six-month low of 0.3% m/m, compared to a downwardly revised 1.6% in September. Consumption had held up surprisingly well to now, but with permanent job losses rising, and the potential for a renewed rise in temporary job losses, it could come to weigh on the economic recovery more broadly. In this regard, US policymakers can take some solace from the industrial production figures also released yesterday, which actually expanded 1.1% m/m in October following a 0.4% contraction the previous month. Manufacturing’s 1.0% gain was the sixth month of growth in a row.

UK Prime Minister Boris Johnson has announced a new green plan, aimed at forestalling climate change and boosting jobs in green industries. Notable proposals within the broad-ranging plan include the banning of the sale of new petrol and diesel cars from 2030, investment in renewable and nuclear energy generation, and a drive to make homes more efficient. Johnson claims that his plan will generate as many as 250,000 new jobs, on the back of GBP 12bn in spending. These investments into new industries could be crucial in the years ahead, depending on how great the structural changes to the UK economy are in a post-coronavirus world. Bank of England Governor Andrew Bailey spoke yesterday, highlighting that new business models could emerge, and that a ‘major commitment’ from the financial services industry might prove decisive in whether or not these succeed.

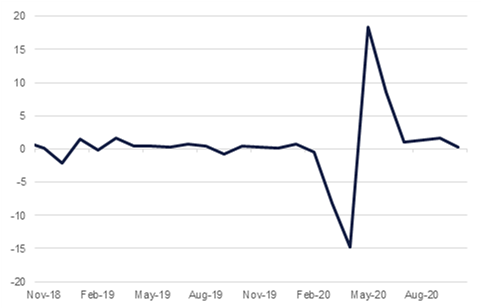

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The rally in risk-assets paused overnight as anxiety over rapidly rising virus numbers in the US offset some of the enthusiasm surrounding vaccine possibilities. US treasuries were higher across much of the curve with most of the action in longer-tenor securities. Yields on the 2yr UST settled back below 0.17%, a drop of a less than 1bp, while 10yr UST yields gave up nearly 5bps to close out at 0.8570%. Weaker than expected retail sales in the US for October also dampened market excitement as Q4 is unlikely to benefit from the lingering effects of fiscal stimulus introduced earlier in the year.

Aramco priced USD 8bn in a multi-tranche deal. Saudi Arabia’s national oil company sold USD 500m 3yr at +110bps, USD 1bn 5yr at +125bps, USD 1.5bn 10yr at +145bps, 30yr USD 2.25bn at 3.3% and a USD 2.25bn 50yr bond at 3.65%. Total orders were more than USD 20bn.

National Bank of Kuwait priced a USD 300m security (10yr maturity) at 2.5%.

The US dollar extended losses overnight even as markets repositioned toward haven assets. The DXY index fell by 0.24%, largely driven lower by a gain in sterling as markets await the announcement of a Brexit deal which is reportedly imminent. GBP rallied 0.36% on the day to settle at 1.3246. EUR also closed higher, although the gains were more muted.

Commodity currencies were the main losers on the day with the AUD, NZD and CAD all ending weaker. The OPEC+ joint ministerial monitoring committee stepped back from endorsing an extension of further production cuts, weighing on oil prices in the short run.

The weak US retail sales data dampened some of the enthusiasm seen over the past two weeks in equity markets, especially in the US. All three major indices closed down on the day, with the NASDAQ, S&P 500 and Dow Jones losing 0.2%, 0.5% and 0.6% respectively. Europe showed a similar story, with both the FTSE 100 and the DAX recording slight declines, although the CAC managed to eke out a gain of 0.2%. Within the region, the DFM gained 0.8%, while the Tadawul climbed 0.5%.

Oil markets failed to take much heart from the OPEC+ JMMC overnight as ministers from some of the most important producers didn’t fully back a deal to extend production cuts in to 2021. Brent settled lower, down 0.16% at USD 43.75/b overnight and extending losses this morning. WTI futures gained modestly to close at USD 41.43/b but have erased those gains today and are down 0.6%.

The OPEC+ JMMC concluded with a statement affirming that producers needed to be “vigilant, proactive and prepared to act.” Had there been broad consensus that an extension was necessary we would have expected to see more positive headlines around it following yesterday’s meeting. Markets may thus be set up for a tense few weeks ahead of the official OPEC meeting at the end of the month.

Also not helping the near term outlook for crude, the API reported a build in US crude stocks of around 4.2m bbl last week along with builds in gasoline. EIA data will be released later this evening with a smaller build expected than that from the API’s report.