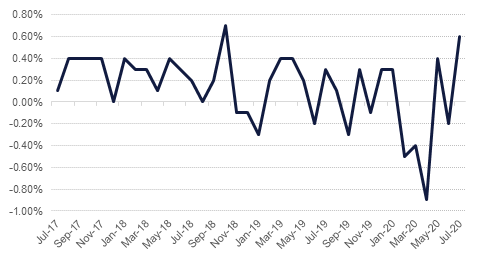

The US Labor Department reported that the producer price index for final demand went up 0.6% m/m last month, marking the biggest gain since October 2018 after a 0.2% m/m decline in June. Portfolio management fees and rising costs for gasoline were key drivers behind the July gains. While the overall trend in producer inflation remains subdued amid signs that the economy's recovery from the Covid-19 recession was fading, the jump diminishes the risk in the short-term of deflation entrenching. Measured year on year the PPI dropped 0.4% in July after falling 0.8% in June. Core PPI which excludes the volatile food, energy and trade services components, increased 0.3% m/m in July after a similar rise in June. The core PPI edged up 0.1% y/y in July after ticking down 0.1% y/y in June. The core personal consumption expenditures (PCE) price index rose 0.9% on a year-on-year basis in June. July's core PCE price index, which the Fed tracks, will be released later this month.

The UK Office for National Statistics said the number of people in work in Britain has dropped by the most since 2009 on signs that the pandemic is taking a heavy toll on labour markets as the government huge job-protection scheme is due to close at the end of October. The self-employed led the drop with 220,000 fewer people were working in the three months through June. Separate tax data for last month showed that the number of staff on company payrolls had fallen by 730,000 since March. This is raising concerns that mounting job losses are expected as Britain winds down its job-retention scheme. While the unemployment rate held at 3.9%, that reflected more people who had given up looking for work and thus are not counted as unemployed. 300,000 people who said they were working but getting no pay. Pay fell by the most in more than 10 years in the April-June period, down 1.2%, Excluding bonuses, pay fell for the first time since records began in 2001.

Germany’s ZEW investors' economic sentiment index rose to 71.5 from 59.3 points the previous month. This showed that investor sentiment picked up more than expected in August, reflecting hopes that Europe's biggest economy is on the road to recovery after the Covid-19 induced slowdown. Experts were much less optimistic about current conditions, with that index dropping to -81.3 points from -80.9 the previous month.Germany’s economy shrank by a record 10.1% in the second quarter. The German government is hoping it’s EUR 130 billion stimulus package will help kickstart growth, expecting the economy to shrink by 6.3% this year and expand by 5.2% in 2021.

Source: US Bureau of Labor Statistics, Emirates NBD Research

Source: US Bureau of Labor Statistics, Emirates NBD Research

US Treasuries continued to sell off across the curve overnight even as political fighting in the US prevents a new fiscal deal from being reached. Yields on 2yr USTs rose almost 2bps to 0.1489% while the 10yr yield saw its biggest upward move in weeks, adding almost 7bps to close at 0.6415%, almost 10bps higher than a week ago.

Yields were higher across the board in Europe with 10yr gilt yields up almost 7bps to close at 0.197%, bunds up 5bps at -0.479% and French bond yields up by almost 4bps. EM USD bonds were roughly flat overnight although yields did slip marginally to 4.10%.

There was minimal movement once again for the dollar on Tuesday. The DXY index seems to have found a key area of support around the 93.200 level and has picked up some steam early this morning to trade at 93.860. PPI data out of the US came back slightly better than expected, providing a slight boost to the currency which remains firm above the 93 handle. USDJPY experienced a quiet session but advanced in the afternoon following an increase in UST yields. The pairing rallied to 106.75 this morning and the next key indicator will be the 50-day moving average of 106.90.

The euro briefly advanced above the 1.18 level following ZEW data revealing that investors have raised their expectations of a recovery for the German economy. The currency reversed all of these gains in the evening however as the dollar strengthened and now trades at 1.1720. The same can be said for Sterling, the currency reached a high of 1.3131 but was unable to hold onto its momentum and has fallen to 1.3030.

The RBNZ kept rates on hold at 0.25% but has increased in large scale asset purchases (Kiwi QE) to NZD 100bn, up from NZD 60bn previously. The central bank also indicated that it was in ‘active preparation’ on negative rates and may consider buying foreign assets to put some downward pressure on the NZD. Considering the dovishness of the RBNZ statements the NZD is performing reasonably well, down by 0.2% to 0.6561 at the time of writing after earlier plummeting to 0.6520.

After briefly looking like it would break February’s record high yesterday, the S&P 500 in the end closed down 0.8% on the day in late trading. The index sold off after Senate Majority Leader Mitch McConnell cast doubt on the prospects of a near resolution to the political wrangling over renewed fiscal support for those struggling during the coronavirus pandemic. The Dow Jones and the NASDAQ also lost over the day, at 0.4% and 1.7% respectively.

European equities fared much more positively, though today may be a different story as the US political stalemate embeds. The FTSE 100, the the DAX and the CAC were up 1.7%, 2.0% and 2.4% respectively, likely boosted by prospects – however caveated – or a Covid-19 vaccine after news from Russia, and fairly positive ZEW survey data from Germany. In the region, the DFM closed up 0.2% and the Tadawul 1.2%.

Oil prices failed to hold onto peak values overnight and both Brent and WTI closed lower. Brent futures came within sight of USD 46/b but closed at USD 44.50/b, down 1.1%. WTI fell by 0.8%, settling at USD 41.61/b after nearly hitting USD 43/b. API data indicated a draw of around 4m bbl of crude last week but wasn’t enough to offset the failure in Washington to make any political headway for a new fiscal support deal and escalating virus numbers globally—Auckland in New Zealand has had to reimpose lockdown despite the country’s highly successful campaign against the virus.

In its latest Short-Term Energy Outlook the EIA revised up its projection for US oil supply in 2021 to 11.14m b/d, compared with 11.01 previously. However, they cut their projection for 2020 although still see it coming it around 11.3m b/d with little additional downward moves.