An upward revision to US GDP growth figures sparked a renewed rise in equities yesterday, with stock markets hitting new record highs. The economy actually saw y/y growth of 2.1% in the third quarter, compared to the earlier figure of 1.9% and quicker than the 2.0% recorded in Q2. Looking ahead to Q4, data yesterday showed a 0.6% rise in durable goods orders, compared to expectations of a -0.9% contraction. This bodes well for a stronger end to the year than had been anticipated, especially given that underlying capital goods orders excluding aircraft performed particularly well, expanding 1.2%.

However, this positive momentum could yet be derailed by a deterioration in trade talk negotiaitons with China. While noise around a potential deal has been positive this week, US President Donald Trump yesterday signed off on legislation in support of Hong Kong protestors which has drawn Chinese ire. The bill stipulates reviews of Hong Kong’s special status, and bans the export of crowd control equipment to the special administrative region of China. The Chinese have threatened retaliation, which could extend to the trade discussions. US markets are closed for Thanksgiving today.

Saudi Arabian Crown Prince, Mohammed bin Salman, was on a state visit to the UAE yesterday, where he signed a number of economic commitments between the two countries. There were four new memoranda of understanding, including a commitment to build a new oil refinery with a capacity of 1.2mn b/d, and to launch a new digitcal currency between the two countries’ banks. There was also a renewed commitment to seven earlier agreements, including the joint tourist visa announced earlier this year.

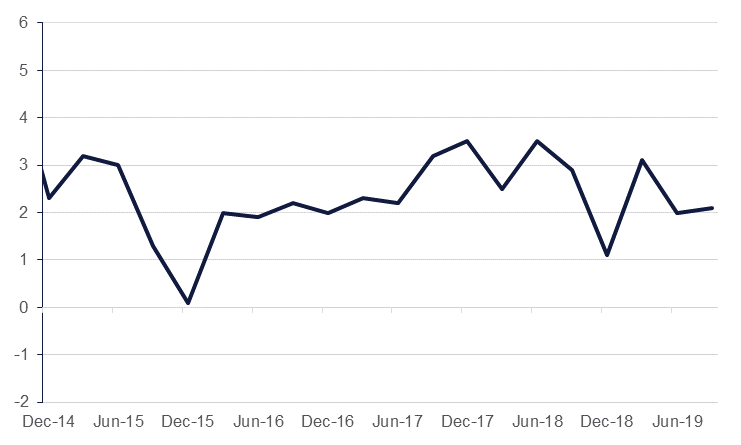

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed lower following better than expected GDP data from the US. However trading activity was fairly limited ahead of holiday. Yields on the 2y UST and 10y UST closed at 1.62% (+4 bps) and 1.76% (+2 bps) respectively.

Regional bonds closed largely unchanged. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained flat 3.25% while credit spreads tightened 3 bps to 153 bps.

The dollar lifted a little overnight, supported by the better than expected Q3 GDP revision, and stronger durable orders data. The DXY reached up to 98.44 from 98.28 at the open in New York, but later retraced after personal income data missed estimates. Thanksgiving in the US today will keep FX direction muted, although the overnight news that President Trump signed a bill supporting protesters in Hong Kong put some limited upward pressure under the JPY, as it raised concerns about the fate of US-China trade talks. The pound is firming gently as opinion polls in the UK continue to point to an outright victory for the governing Conservative party, the latest one suggesting a 68 seat majority.

Developed market equities closed higher amid better than expected economic data from the US and continued optimism over trade deal. The S&P 500 index and the Euro Stoxx 600 index added +0.4% and +0.3% respectively.

Regional equities had a sluggish day with most indices trading sideways. Kuwait stocks were an exception with most market heavyweights closing higher. The KWSE PM index gained +1.2%.

Oil prices weakened as crude inventories in the US rose last week. Brent futures settled overnight down by 0.3% at USD 64.06/b and are pushing lower this morning while WTI was off by 0.5% at USD 58.11/b and is continuing to move lower today. US production pushed to a new record high of 12.9m b/d, up 100k b/d week/week and an increase of 1.2m b/d y/y.