In the US, ADP employment figures were released yesterday, which showed that private sector job growth was at the strongest in three months in September. Firms added a total of 749,000 new jobs in September, exceeding expectations of 649,000. All eyes will now be on the non-farm payroll figures released tomorrow, the last such report before the November election. There were also relatively positive signals regarding the prospects of a new deal on fiscal support, and while Treasury Secretaty Steven Mnuchin told the press yesterday that there was no agreement as yet, he did say that talks with Democrats would continue.

Saudi Arabia’s preliminary budget statement showed the kingdom estimates this year’s budget deficit will reach SAR 298bn (-12% of GDP), less than our estimate of SAR 356bn (-13.9% GDP). The ministry of finance is also more optimistic on GDP growth this year, estimating it at -3.8% against our revised forecast of -5.2%. For 2021, the government plans to reduce spending by -7.3% to SAR 990bn. Separately, employment data released today showed a record high unemployment rate of Saudi nationals at 15.4% in Q2 2020, up from 11.8% in Q1. While the number of Saudis employed in the public sector increased 0.5% q/q, the number of nationals employed in the private sector declined -2.3% q/q. The number of expatriates employed in the private sector also declined in Q2.

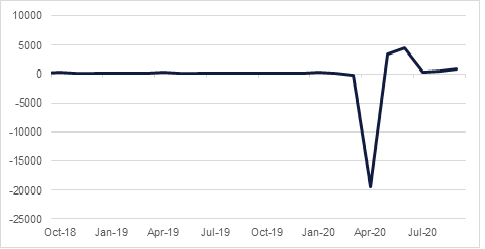

There were positive data signals from Germany yesterday. Retail sales for August rose 3.1% m/m, far exceeding expectations of 0.4%. Unemployment in September fell to 6.3%, from the 6.4% level at which it held over the previous three months. This marked the first fall in the jobless rate since the start of the Covid-19 crisis. Meanwhile, July data also released yesterday showed that the number of people on the kurzarbeit scheme, which has helped to keep the headline unemployment rate relatively low, declined to 4.2mn in July, from 4.6mn in June and a peak of 6.0mn in April. While Germany has not seen new Covid-19 cases rise again to the same extent as in France, the UK and Netherlands in recent weeks, new restrictions imposed by Chancellor Angela Merkel yesterday could weigh on this recovery.

In the UK, the final data for Q2 GDP were released, with the figures adjusted modestly to show a contraction of -21.5% y/y rather than the previously reported -21.7%. While this was one of the worst Q2 performances by a major economy, BoE Chief Economist Andy Haldane yesterday berated the press for being too negative in its reporting, and for not focusing on the 9% m/m rise in activity in June. He maintained that the three major challenges currently facing the UK economy – Covid-19, looming Brexit deadlines and rising unemployment – are being over-egged and that the situation is more positive than is being presented by the media. He also cast doubt on the need for negative interest rates in the UK.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The UST curve closed higher on the final day of September on optimism that a deal between the Republican administration and Congressional Democrats may be in the offing. Yields on 2yr USTs were slightly higher at 0.127% while on the 10yr yields gained more than 3bps to close at 0.684%. as the political cycle around the US presidential elections heats up we would expect more volatility in UST levels but that ultimately they will be trending higher—slowly—provided the economic recovery holds.

Yields were higher across the board in Europe with 10yr gilt yields up almost 5bps at 0.227% while gains in OATs and bunds were around 2bps each. With a broadly risk-on tone taking hold of markets both high yield and emerging market (USD) bonds gained.

Turkey’s sovereign wealth fund—the TWF—is in the market for a Eurobond but has not revealed a target for either its size or maturity.

The USD moved tentatively on Wednesday. The DXY index ended the day unchanged but has dipped slightly this morning to reach 93.700, after briefly touching a high of 94.190 in the afternoon. Some slightly better than expected economic data out of the US prevented the greenback from suffering further losses. USDJPY also recorded minor losses for the day and is hovering around the 105.50 region.

The EUR bounced off of lows of 1.1685 amid hopes for a new fiscal stimulus deal, and has held firm at 1.1745 this morning. The GBP has also advanced off the back of a slightly improved market mood to reach 1.2940. Both the AUD and the NZD also consolidated gains, trading at 0.7180 and 0.6630 respectively.

The better-than-expected payrolls data boosted US equities yesterday, with all three major indices closing higher on the day. The NASDAQ and the S&P 500 gained 0.7% and 0.8% respectively, while the blue-chip Dow Jones gained 1.2%. Things were not so positive in Europe, where a series of less-than-spectacular earnings announcements and job losses added to the gloom wrought by a renewed surge in cases and restrictions on movement. The FTSE 100 and the DAX lost -0.5%, while the CAC closed 0.6% lower.

November Brent futures closed the month at USD 40.95/b, down 0.2% on the day and the first monthly decline on Brent futures since March. December contracts are now trading at USD 42.31/b, flat from overnight. WTI futures rallied 2.4% overnight and are flat in early trading today at USD 40.20/b.

The EIA reported a draw on US crude stocks of around 2mn bbl last week with most of the draw happening on the west coast. Total crude production was flat last week at 10.7mn b/d while product supplied was down by almost 1mn b/d. distillates in particular fell back, down by around 300k b/d w/w.