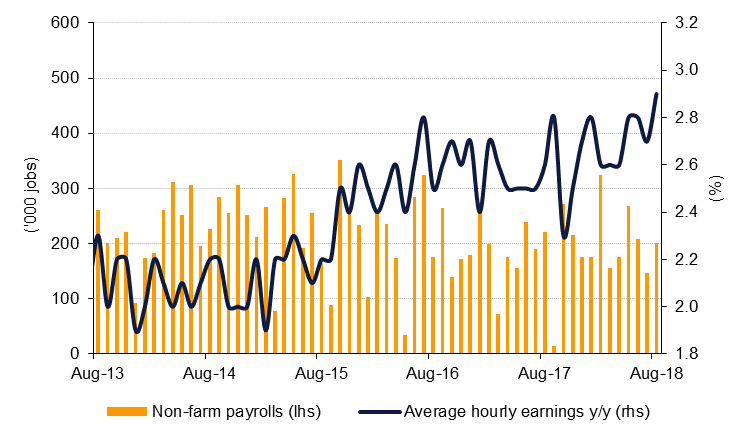

The latest non-farm payrolls report for the US all but cemented in place an interest rate hike from the Federal Reserve later this month. The US added 201k new jobs in August, an increase on the 147k jobs reported for July. The headline unemployment rate held steady at 3.9% thanks to a decrease in the labour forced but the broader U-6 unemployment measure (tracking workers in part-time jobs who want full-time work) continued to move lower. Most critically, wage growth accelerated to 2.9% y/y in August, its fastest pace of growth since June 2009. The positive labour market data will clear any hurdles for the Fed as it prepares to raise rates later this month although the market is still doubting whether a fourth rate hike for this year will follow in December. The US economy in isolation looks able to absorb another rate hike; however, if the current sell-off in emerging markets begins to weigh on business sentiment in the US the market may question the Fed’s conviction about another rate move this year.

US president Donald Trump has threatened to impose an additional USD 267bn of tariffs on goods from China, an escalation of the USD 50bn already in place and USD 200bn currently under consideration. A public commentary period on the USD 200bn of tariffs has ended and the president may impose tariffs imminently. Were the US to fully enact all the proposed tariffs virtually all trade with China would be subject to barriers, including mobile phones, which have so far been excluded. Trade relations between the US and Canada remain in the lurch as another week passed with no conclusion on revisions to NAFTA while president Trump also said that the US was engaging in trade talks with Japan.

Some of the emerging markets most caught up in the financial markets sell off took a breather at the end of the week with currencies appreciating in Argentina, Turkey, India and Indonesia on Friday. Country risks are idiosyncratic and policy responses to the current rout are likewise distinctive to each country. The RBI has reportedly stepped into to keep the INR from moving to far away from the 72 level while the currency weakened by more than 1% last week.

Source: Emirates NBD Research

Source: Emirates NBD Research

Stronger than expected economic data out of the US continued to defy all fears of any negative impact of stronger dollar or the trade wars on the US economy and boosted the case for continued rate hikes in the US. UST Yield curve shifted upward with yields on 2yr, 5yr, 10yr and 30yr UST closed the week at 2.70% (+8bps w/w), 2.82% (+8bps, w/w) and 2.94% (+8bps, w/w) and 3.10% (+8bps, w/w) respectively.

Yields on sovereign bonds rose across the Atlantic in sympathy with the UST. Yields on 10yr Bunds and Gilts closed higher at 0.39% (+6bps, w/w) and 1.46% (+5bps, w/w) respectively. With continued risk appetite, credit spreads narrowed somewhat with CDSA levels on US IG and Euro Main closing a bp tighter at 60bps and 64bps respectively.

Though emerging market bonds remained under pressure from the wide spread sell off in EM assets, GCC bonds benefited from rising oil prices and improving economic conditions. Credit spreads on Barclays GCC bond index tightened 4bps over the week to 168bps, however, rising benchmark yield saw average yield on Barclays GCC bond index to close higher at 4.46% (+3bps, w/w).

The dollar gained against most of the other major currencies last week, the Dollar Index climbing 0.29% to 95.365. In the process, the index was able to climb back above its 50-day moving average (95.06) and close the week above this level. While the index trades above this support level, the risk of a retest of 96.984, the 2018 high seen in August remains a possibility, however for further more meaningful gains, the index needs to close above the 100-week and 200-week moving averages (95.501 and 95.565 respectively). A weekly close above these resistance levels may trigger further gains towards 76.4% five-year Fibonacci retracement of 97.940.

Most regional equity markets started the week on a positive note. The DFM index and the KWSE PM index added +0.6% and +0.4% respectively. Gains on the DFM index were led by midcap stocks with Drake & Scull and DXB Entertainments adding +6.1% and +5.1% respectively.

Oil markets slipped last week as the impact of a tropical storm hitting production facilities in the US Gulf of Mexico was minimal and a sell-off in emerging markets and further trade disputes between the US and China weighed on overall market sentiment. Brent futures fell by less than 1% to close the week at USD 76.83/b while WTI fell nearly 3% and ended the week at USD 67.75/b. On a technical basis, WTI looks at risk for more downside in the short-term as short scale moving averages encroach on longer ones; a downside target for WTI is a move to a USD 65/b handle.

Forward curves moved in opposite directions last week although both the Brent and WTI curves remain in backwardation. The 1-2 month spread in Brent is now at USD 0.35/b, its widest level since July this year while in WTI the corresponding spread has narrowed to USD 0.2/b. The same story holds true for longer-dated spreads as well.

US inventory data was delayed one day thanks to a public holiday in the US at the start of the week. Total crude stocks fell by more than 4.3m bbl, larger than the market had been anticipating. However, there were solid builds across the rest of the barrel. Refinery demand ticked up to 96.6% utilization, well above its five-year average even as refinery margins—particularly the RBOB/WTI crack—weakened last week. Headline margins for Singapore refiners were relatively flat in gasoline last week while the plummet in fuel oil prices continues. The East/West fuel oil arb has narrowed to USD 26/tonne, its lowest level since early July.