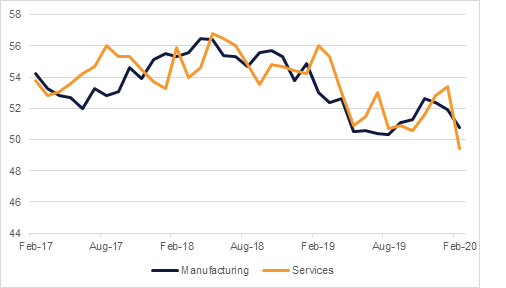

Risk-off sentiment returned at the close of the week, as the US PMI survey released Friday painted a picture of an economy under mounting pressure. The composite figure came in at 49.6, down from 53.3 the previous month. This marked the first contractionary sub-50.0 reading since a government shutdown in 2013, as the negative impact of the Coronavirus outbreak became apparent. Services dropped to 49.4 (the first contraction in four years), while manufacturing held up a little better at 50.8 – though even this was below expectations.

In contrast to the poor US survey, European PMIs improved in February. The Eurozone composite rose from 50.0 to 51.9, confounding expectations of a sub-50 reading. Services rose from 52.5 to 52.8, and while manufacturing remained negative at 49.1, this was the highest reading since March last year. In the UK, the composite survey rose from 51.3 in January to 51.6, with both services and manufacturing in expansionary territory.

In the region, SAMA Governor Alkholifey said he expects GDP growth in the kingdom to accelerate this year, driven by faster non-oil private sector growth. While we also expect headline GDP growth to pick up this year, this is largely due to low base effects from last year’s oil production cuts, rather than faster non-oil sector growth. The budget for this year shows the government plans to cut expenditure by nearly -3% from 2019 which may weigh on non-oil sector growth. In the UAE the central bank’s latest quarterly report shows a slight increase in private sector employment in Q4 2019, at 0.3% q/q and 2.0% y/y. However, average salaries across most categories of employment continued to decline, except for clerks and unskilled workers whose average salaries rose modestly in the last quarter.

Lebanon suffered ratings downgrades from both S&P and Moody’s over the weekend, as questions remain over the country’s ability and willingness to cover its obligations. Yields on its Eurobond maturing next month have hit 1,920%. In Egypt, the CBE opted to keep its benchmark overnight deposit rate on hold at 12.25% and the EGP strengthened to levels not seen since the start of Egypt’s reform programme in late 2016.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed sharply higher tracking a broad risk-off mood in financial markets. The combination of coronavirus outbreak gathering pace outside of China and weak macroeconomic data weighed on investor sentiment. More than the direction, the quantum of move in USTs relative to other asset classes and the sharp increase in volume traded was a surprise. Yields on the 2y UST and 10y UST ended the week at 1.35% (-7 bps wo-w) and 1.47% (-11 bps w-o-w) respectively. The 10y USTs closed below 1.5% level for the first time since September 2019.

Regional bonds continue to benefit from moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -6 bps w-o-w to 2.87% and credit spreads widened 4 bps w-o-w to 143 bps.

The dollar index gained ground for a third week running although the pace of weekly gains (0.14%) was relatively muted by recent levels. The Euro managed to recover some ground at the end of the trading week thanks to a relative outperformance for Eurozone PMIs helping the single currency close at 1.0847. GBP slipped over the week, down by 0.6% at 1.2964 against the USD over the week even as inflation, PMI and labour market data showed some signs of strength.

As markets grow anxious over the spread of Covid-19 to other core Asian economies, trade-focused currencies sank. JPY is losing some of its safe haven appeal, pushing above 112 against the USD during the week and closing at 111.61 while both the AUD and NZD were among the week’s major losers.

In the EM space, TRY weakened to 6.0953—its sixth consecutive weekly decline—as the TCMB cut rates mid-week while the EGP continues to add strength following on the CBE’s decision to keep rates on hold and maintain a healthy positive real yield for EGP-debt.

Regional equities closed lower following weak cues from global markets over the weekend. The DFM index and the Qatar Exchange dropped -0.7% and -0.4% respectively on the back of losses in market heavyweights. Emaar Properties and Qatar Islamic Bank lost -0.3% and -0.6% respectively.

Oil markets managed to hold on for another week of gains, with both Brent and WTI futures rising more than 2% last week. Brent closed at USD 58.50/b while WTI settled at USD 53.38/b. Both contracts slipped in their final day of trading as fears that the Covid-19 outbreak was entrenched elsewhere in Asia—South Korea and Japan in particular—weighed on markets. Poor PMI data from the US also helped drag risk markets lower at the end of the week as the US composite PMI for February fell to 49.6, its weakest level since 2013. US economic data has generally held up in recent prints but the dip in business activity may reflect waning confidence in the outlook for the rest of the year should Covid-19 erode external demand.

Several major OPEC producers are considering a stand-alone cut of 300k b/d according to press reports. Saudi Arabia, the UAE and Kuwait have reportedly discussed the additional cuts as achieving a broader OPEC+ consensus on cutting output has proven to be a challenge. The plan has been denied by official sources from the countries and on its own would do little to offset the significant drop in crude demand from Chinese refineries. OPEC has officially confirmed its next extra-ordinary meeting for March 5th and will hold a session with partners such as Russia the following day.