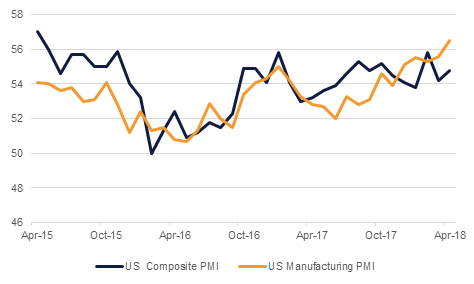

Risk appetite duly improved yesterday benefiting equities, US bond yields and the dollar. On top of the background factors related to North Korea and optimism over trade, economic data was also broadly favourable yesterday. The US manufacturing PMI rose 0.9 points to 56.5 while US existing home sales were up 1.1%. There has been some conjecture about whether the Eurozone is slowing down but yesterday’s readings of activity suggest this view may have been a little exaggerated. PMI activity data in the Eurozone did show a leg down in Q1, with the composite index falling from 58.8 in January to 55.2 in March. However, April data showed the index stabilizing, while other readings of activity have also held up better including the European Commission’s Economic Sentiment Indicator.

Germany has been in the spotlight of concern, but here too the April composite index was relatively reassuring, improving to 55.3 from 55.1, with France’s index also rising to 56.9 from 56.3. One of the suspicions behind the softer Q1 activity data is that the firmer Euro is a contributing factor. This theory looks plausible and it will be interesting to see how Mario Draghi explains matters following the ECB Council meeting later this week. The Bundesbank acknowledged in its monthly report that German Q1 GDP growth could be weaker than in previous quarters, but it maintained that that the boom in the German economy is continuing and pinned most of the blame for any slowdown on strikes in the metal and electronics industries, and an unusually strong wave of flu infections.

The Iraqi oil ministry on Monday announced plans to auction off exploration contracts for 11 new blocks later in the week. Reportedly, 14 firms have expressed interest in the tender. Although Iraq’s oil production currently remains constrained by the OPEC agreement, the government has approved an increase in crude production capacity to 6.5mn b/d by 2022, compared to 5.0mn b/d currently. In Libya, meanwhile, an attack on an oil pipeline has cut production by 80 k b/d, and will take some days to repair.

US treasuries closed lower amid focus on whether the 10y UST yield breaks over 3% or not. The front end of the curve led the losses with yields on the 2y UST, 5y UST and 10y UST closing at 2.47% (+2 bps), 2.82% (+2 bps) and 2.97% (+1bps) respectively.

Regional bonds closed lower following moves in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index closed at 4.49% (+5 bps). Credit spreads widened 3 bps to 173 bps.

NMC Healthcare is looking to sell USD 450mn convertible bonds with a fixed coupon of 1.875% and an initial exchange price set at a 50%-60% premium to the reference share price. Elsewhere, Saudi Arabia raised USD 1.33bn from a three-tranche SAR sukuk sale.

The USD was stronger again yesterday benefiting from improving risk sentiment as well as from firmer economic data. With 10-year bond yields probing 3.0% USDJPY was a significant beneficiary rising well above the psychologically important 108 barrier. The dollar also gained ground over the EUR and GBP, with softer than expected Australian inflation data overnight also hurting the AUD. The key to whether the dollar can sustain these moves will depend on interest rates and whether these can maintain their recent rallies. Fundamental factors suggest they will, with the US budget deficit on the rise, but the markets also have to keep geopolitical risks in mind and these have not entirely gone away.

Developed market equities closed mixed with the S&P 500 index closing flat and the Euro Stoxx 600 index adding +0.4%. Technology stocks continue to weigh on indices with Nasdaq losing -0.3%.

The Tadawul continued to lead regional markets higher. The index gained +1.0% following better than expected corporate earnings.

In terms of stocks, Bank Al Jazira gained +5.1% after Ahli United Bank said it has acquired a 7.3% stake in the bank. Elsewhere, Damac Properties dropped -7.1% after the company approved a lower cash dividend of AED 0.15 per share compared to proposed dividend of AED 0.25 per share.

The EGX 30 index added +1.0%. Juhayna Food Industries rallied +3.9% after reporting better than expected earnings.

Oil prices oscillated in a wide band to start the week as comments from Iran’s oil minister suggested the country was not prepared to endorse a further extension of OPEC’s current production cut agreement. However, the market largely interpreted US president Donald Trump’s tweet about OPEC last week as a pre-emptive move to shift blame for high prices to the producers’ bloc and not his administration’s pending decision on re-imposing sanctions on Iran. Brent prices managed to gain 0.9% on the day and WTI rose nearly 0.4%.

Click here to Download Full article