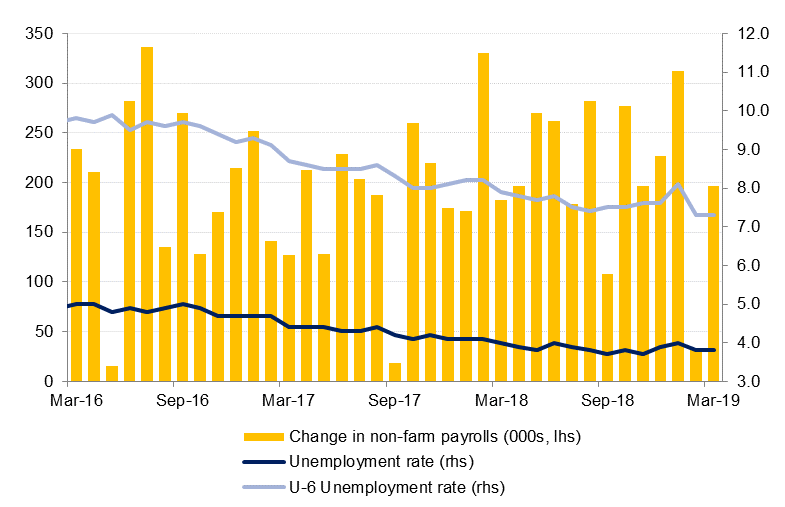

A disappointing US February jobs report on Friday capped off a week that was dominated by downward growth forecasts, weak economic data and policy announcements from some of the most important policymakers in the world. U.S. nonfarm payrolls rose by only 20,000 jobs in February, down from 311,000 the previous month. Despite the disappointing headline figure, the unemployment rate declined from 4.0% to 3.8% and hourly wages increased from 3.1% y/y to 3.4% y/y. Special factors related to the weather were also responsible for the weak headline payrolls figure, with a rebound expected in March.

Chinese export data showed a huge 20.7% y/y plunge in February, the biggest deterioration since 2016 and far exceeding the 4.8% y/y drop that was expected. With markets concerned about the effects of trade tariffs on the second biggest economy of the world, they could not have had a better illustration of it. CPI inflation also slipped to 1.5% in February from 1.7% and new yuan loans fell back from January’s record high to CNY885bn.

Weakness in Eurozone data also saw the ECB downgrade its growth forecast for the year from 1.7% to 1.1%, and also restore emergency stimulus measures. President Draghi not only confirmed another round of TLTRO loans, but also pushed out the time frame for both rate hikes and a possible reduction of asset holdings. At the same time Draghi was keen to stress that despite these measures the risks still remain tilted to the downside as he warned that the central bank cannot solve the problem of ‘pervasive uncertainty’.

Egypt’s inflation rate accelerated to 1.7% m/m and 14.4% y/y in February, driven largely by a 3.5% m/m rise in food & beverage prices. Higher food prices offset declines in clothing & footwear and furniture & equipment prices last month. The rise in inflation makes another near-term rate cut by the Central Bank of Egypt less likely, although we think there will be scope for further easing later this year. The headline Dubai Economy Tracker Index was unchanged at 55.8 in February. Stronger output growth was offset by slightly softer growth in new work and a record decline in employment.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries closed higher as weak jobs data coupled with further reinforcement of Fed’s ‘patient approach’ by Jerome Powell weighed. The Fed Chair said ‘With nothing in the outlook demanding an immediate policy response and particularly given muted inflation pressures, the committee has adopted a patient, wait-and-see approach to considering any alteration in the stance of policy’.

Yields on the 2y UST, 5y UST and 10y UST closed at 2.46% (-9bps w-o-w), 2.43% (-12 bps w-o-w) and 2.62% (-13bps w-o-w).

Regional bonds closed lower for the first time since the start of the year. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +4 bps w-o-w to 4.32% and credit spreads rose +15 bps w-o-w to 180 bps.

EA Partners II said that an ‘event of default’ occurred as only USD 6.7mn out of USD 8.4mn due as coupon on March 1 2019 was paid. The issuer also said that it expects to be unable to pay further interest under the notes in full.

FX

Last week the Dollar Index (DXY) climbed 0.88% to close at 97.306, the index’s highest weekly close in 2019. Of note is the USDJPY cross which declined 0.65% last week to close at 111.16 and break back below the 100 and 200-day moving averages (111.36 and 111.40 respectively). Despite these declines, the price remains above the 61.8% one-year Fibonacci retracement (110.73). While this remains the case, further advances can be expected towards the 112 handle. This scenario is made even more likely by the observation that last week, the price found strong support at the 50 and 100-week moving averages (110.79), the weekly low.

Equities

Regional equities started the week on a negative note. The DFM index and the Qatar Exchange dropped -0.6% and -0.2% respectively. Dubai Islamic Bank and Emaar Properties dragged the broader index lower with losses of -0.8% each.

In Saudi Arabia, it was clarified that ‘there are no current plans to hike Zakat on the private sector’. The country’s tax authority said it is focusing on efforts to create an attractive investment environment in Saudi Arabia.

Commodities

Oil markets managed to drift higher in a week that was missing any real catalyst to push prices out of their current range. WTI added 0.5% over the five days to close at USD 56.07/b while Brent futures managed a 1% gain to end the week at USD 65.74/b.

The EIA, OPEC and IEA will release their latest market reports this week where all eyes will be on whether demand growth is revised lower in line with weakening growth projections: the OECD cut its economic growth forecasts so the IEA’s projections for an acceleration in demand growth look set to be revised lower. OPEC is signaling to the market to not expect much as next month’s meeting as they still don’t view the crude market as balanced. The UAE’s energy minister, Suhail al Mazrouei, said the production cuts would remain in force until the market is balanced, which we don’t expect will occur on current demand projections until the middle months of the year.