The Dallas Fed released its quarterly energy survey, showing a modest deceleration in activity in the oil and gas sector for Q4. The index, which functions like a PMI for oil and gas firms in the Dallas Fed’s catchment area, dropped to 3.6 for Q4, down from 10.9 in Q3. Overall, H2 2023 was an improvement on the first six months of the year when the index averaged around 1.

Survey respondents from exploration and production firms noted positive but slower oil production activity in Q4 while natural gas output increased. Capex in Q4 was neutral. Oil and gas service firms were more negative, reporting another quarter of outright contraction in activity after a weak Q3.

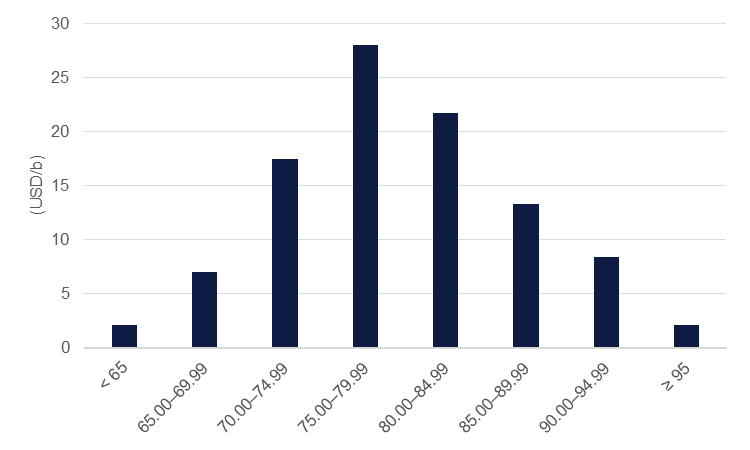

Among the most interesting elements in the Dallas Fed survey are firms’ price estimates for the year ahead. A large majority of firms—80%--expect WTI prices to end 2024 between USD 70-90/b, roughly in line with our own forecast of USD 75/b for Q4 24 and an annual average of USD 77.50/b for 2024.

Source: Dallas Fed, Emirates NBD Research.

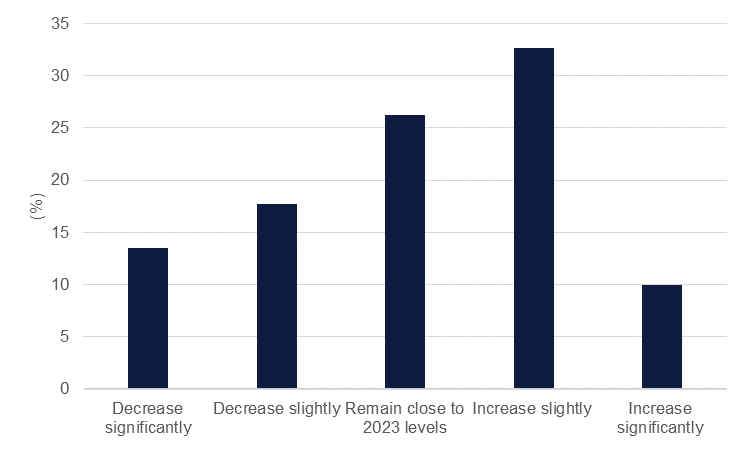

Source: Dallas Fed, Emirates NBD Research.

Capital spending plans look as though they will remain flat or fall next year with 57% of survey respondents planning to cut or keep spending flat and only 10 % expecting a “significant” increase. Responses to the survey suggest a downbeat outlook for the global economy that is dragging on oil prices along with apparent misgivings on whether OPEC+ cuts will have a meaningful effect on supporting prices.

Source: Dallas Fed, Emirates NBD Research.

Source: Dallas Fed, Emirates NBD Research.

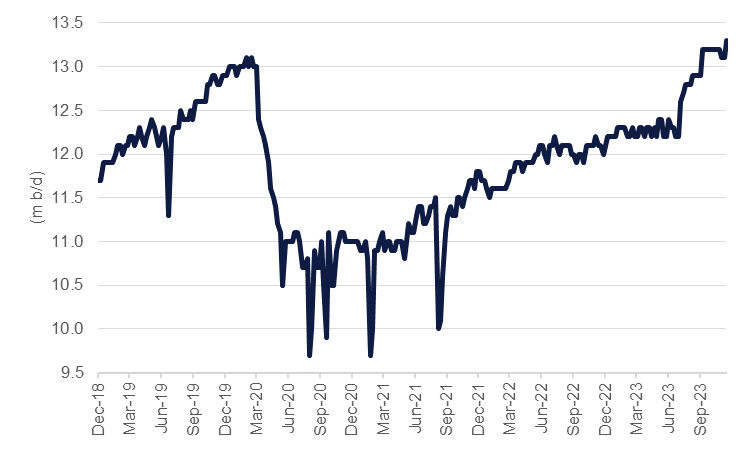

US oil production has hit record levels this year, rising to 13.3m b/d in early December according to weekly estimates published by the EIA. Output is set to hit a record annual average in 2024, according to the EIA, which forecasts an average of 13.1m b/d for 2024, up from 12.9m b/d for 2023. The steady increases in production from the US will be a challenge for OPEC+ next year as the voluntary production cuts announced by several members at the end of November should help to put a floor under prices and benefit producers in the US oil patch. OPEC countries attempted a price war in 2015-16 to try and push shale producers out of the market only for the sector to bounce back strongly and see the US surpass both Russia and Saudi Arabia as the world’s largest oil producer.

Source: EIA, Emirates NBD Research.

Source: EIA, Emirates NBD Research.