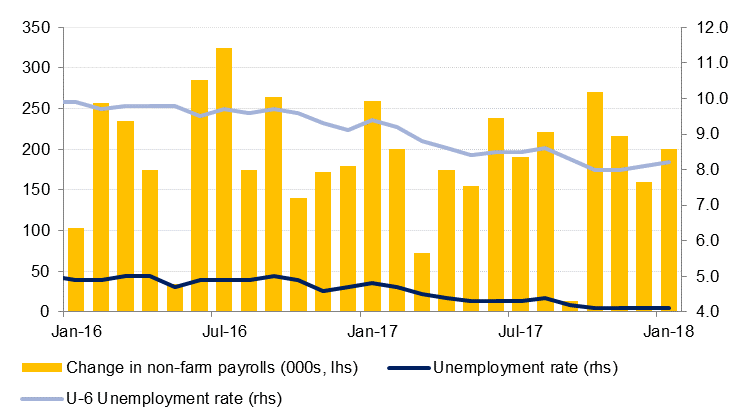

US non-farm payroll numbers were released on Friday, with new job creation exceeding consensus expectations. Jobs increased by 200,000 compared to projections of 180,000, while unemployment met expectations at 4.1%. Crucially, average hourly earnings rose 2.9% y/y, which sent tremors through markets as the likelihood of more than three rate hikes this year increased. Yields on 10-year treasuries rose to the highest level in four years, the dollar pared some of its recent losses, and US equity indices posted significant declines. Equity indices in Asia have also fallen as Monday has started.

Japan’s services PMI figures for January were released this morning, rising from 51.1 to 51.9, a three-month high. New business inflows contributed to the stronger performance, and the survey showed that optimism among businesses was at the highest levels for 56 months. Importantly, the survey also showed inflationary pressures are increasing, raising prospects for monetary tightening. The Bank of Japan denied rumours of stealth tapering at the end of January, with Governor Haruhiko Kuroda insisting that the bank remains committed to its easy monetary policy.

Discussions in Germany between Angela Merkel’s CDU and the SPD over forming another grand coalition were not resolved in time to meet a self-imposed deadline on Sunday, and talks are set to resume today. Germany has been without a government since the vote on September 24. Major sticking points in the negotiations are over healthcare and labour market policy. There has reportedly been progress, but the SPD may need more concessions to get member approval –SPD members will get to vote on any agreement.

Foreign reserves in Egypt have risen to a record USD38.2bn, climbing USD1.2bn in January. According to Central Bank of Egypt Governor Tarek Amer, inflows to the banking system were up USD5.6bn, and USD1.5bn to the central bank.

Fixed Income

The strongest-in-this-decade wage growth in January added to the bearish speculation on US treasuries as increase in inflation expectations cemented the belief that the Federal Reserve will stay on course for raising interest rates at least three times in 2018, if not more. Yields on 10-year USTs rose to 2.84%, its highest in four years. Yields on 2yr, 5yr and 30yr also closed the week higher at 2.14% (+3bps), 2.59% (+10bps) and 3.09% (+15bps) respectively, though the 2yr yields declined 2bps on Friday after the US employment report.

Regional bonds followed the move in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 10 bps to 3.96% while credit spreads tightened 3 bps to 141 bps.

The primary market issuances continue to grow with Noor Bank and Burgan Bank looking to raise money in the first half of 2018. Qatar Islamic Bank said in a statement that it will seek shareholder’s approval to raise Sukuk limit from USD 3bn to USD 4bn.

The Dollar Index rose 0.14% last week, to close at 89.195 and snap a 6 week losing streak. For a second consecutive week, loses were halted as the index found support close to the 38.2% five year Fibonacci retracement of 88.43. Despite this level holding, the index remains technically vulnerable while it remains below 90, the base that had initially held since September 2016 but was breached last week. With the price remaining below these levels, further tests of 88.43 are the path of least resistance with a break of this support paving the way for more significant declines towards 85. Should the index break back above the 90 level, the initial target is likely to be 91.36.

Regional equities started the week on a negative note following a weak close to global equity markets over the weekend. The Qatar Exchange led the losses with -2.7% drop. The sell-off across markets was broad based with all market heavyweights closing in the red. Emaar Properties dropped -1.2% while Industries Qatar declined -2.9%.

Oil markets ended the week lower in a week whipsawed by financial volatility. Brent futures closed down 2.75% on the week at USD 68.58/b, falling as much as 1.5% on Friday alone. WTI gave up slightly more than 1% on the week to close at USD 65.45/b. The strength in market structures diverged across both contracts as the 1-2 month backwardation in WTI hit new highs of around USD 0.40/b while in Brent the backwardation has been steadily softening and is now around USD 0.30/b. Prices have started the week off on a softer footing as well, with both contracts down more than 1% in early trading.

The drilling rig count in the US has added rigs two weeks in a row, gaining six new rigs last week and keeping the overall count within sight of 800 in total. However, speculators took some money out of long oil positions, cutting net length in WTI by more than 14k contracts and Brent by more than 6.5k contracts. We would place most of the blame for last week’s softness in oil down to movements in the dollar whose weakness had hitherto been taken for granted as a supportive factor.