New US home sales rose by more than expected in August, as the impact lower borrowing costs feeds through to demand. New home sales rose 7.8% m/m against expectations of a 3.8% rise. The July figure was also revised upwards. The key US data release today is the final reading of USD GDP growth in Q2, which is expected to be unchanged at 2.0%.

Tariff news continues to dominate the headlines, with the US and Japan signing an initial limited trade pact potentially boosting US agricultural exports to Japan. Talk on a more comprehensive deal are continuing. Separately, the WTO authorised the US to impose around USD 8bn worth of tariffs on EU goods as soon as next month, in response to illegal state aid to Airbus. The WTO is still to rule on the EU’s countersuit on US subsidies to Boeing. The US tariffs will likely apply to some non-aircraft items including luxury food and consumer products.

ECB board member Sabine Lautenschlaeger (Germany) tendered her resignation to Mario Draghi yesterday in a surprise move. She was a hawk and had opposed the further easing of monetary policy this month. New ECB chief Christine Lagarde is likely to continue with Draghi’s plan to boost growth and inflation, while also likely pushing governments harder to boost spending.

Bulgarian economist Krisalina Georgieva has been appointed Managing Director of the IMF. Argentina is likely to be at the top of her list of priorities, given the IMF’s USD 56bn program with the country that currently appears to be on hold, at least until after the 27 October election.

Lower inflation and continued appreciation of the EGP is likely to lead to a 100bp rate cut at today’s CBE meeting.

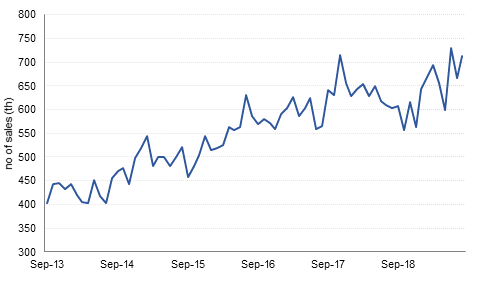

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed lower as risk sentiment revived over optimism on the trade front. The curve shifted higher and bear steepened with yields on the 2y UST, 5y UST and 10y UST closing at 1.67% (+5 bps), 1.60% (+8 bps) and 1.73% (+9 bps) respectively. The move in repo rates has now forced the Federal Reserve Bank of New York to raise the maximum size of action to USD 100bn from USD 75bn.

The move in benchmark yields coupled to slew of new issues has put pressure on regional bonds. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +2 bps to 3.24% even credit spreads tightened 6 bps to 153 bps.

Samba and Islamic Development Bank raised USD 1bn and USD 1.5bn respectively in 5 year paper which was priced MS+140 bps and MS+50 bps respectively. The pipeline for primary issues continue to build. Taqa became the latest corporate to hire banks for a possible sale under its GMTN program.

The dollar recovered losses seen in the wake of news that the opposition Democrats were commencing a formal impeachment inquiry against President Trump. The U.S. President also said that a trade deal with China was possible helping the USD to firm. The pound also gave back the gains seen yesterday following the unanimous ruling by the UK's Supreme Court that the government’s suspension of Parliament was unlawful. PM Johnson showed no sign of backing down on his commitment to take the UK out of the EU by 31st October as he appeared in Parliament, with all the signs pointing to a general election after this date. The New Zealand dollar rallied following the RBNZ's unchanged policy decision earlier, which left rates unchanged, but produced less dovish than expected guidance.

Developed market equities closed mixed amid optimism over trade talks between the US and China following comments late in the day from the US President Donald Trump that an agreement could be reached sooner than expected. The S&P 500 index added +0.6% while the Euro Stoxx 600 index dropped -0.6%.

Regional equities closed largely mixed. The Tadawul slipped -0.5% while Egyptian equities recovered some of their recent losses. The EGX 30 index added +3.2%. In terms of stocks, Commercial Bank International added +5.0% while Samba dropped -2.8%.

Oil markets sank further overnight as negative news continues to compound and weigh on prices. Brent futures fell 1.1% to settle at USD 62.39/b while WTI edged to USD 56.49/b, a loss of 1.4%. Press reports have indicated that Aramco has been able to restore its production capacity to over 11m b/d as repair work has an impact following attacks on key sites earlier this month. Processing at Abqaiq is up to 4.9m b/d after having been nearly completely halted following the attacks.

Outside the Middle East the EIA didn’t help sentiment toward oil. Total crude stocks rose 2.4m bbl last week and there were builds across much of the rest of the barrel. Refining slowed to below its five-year average for this time of year while imports also dipped.

A survey by the Dallas Fed of oil and gas companies noted that price levels were the main concern that would limit growth in production, whether in the Permian basin of elsewhere. The Dallas Fed noted that overall activity in the sector had fallen in Q3 with the business activity of oil field service firms contracting. There is considerable concern on the accuracy of EIA data with respect to wells that may be deterring E&P companies from investing if they feel there is an enormous wave of oil waiting to hit markets. However, most see the drilling rig count in the US bottoming out soon.