Sentiment was duly buoyed by the weekend decision to restart trade talks between the U.S. and China, with stock markets rallying and bond markets easing back a little. The S&P 500 Index saw record highs in the wake of the agreement, with President Trump saying that the new round of talks is already underway. However, hours later, the U.S. published a list of USD4bn worth of European products that may get hit with tariffs as retaliation for European aircraft subsidies, underscoring how trade tensions are not likely to go away and that market pressures will probably return.

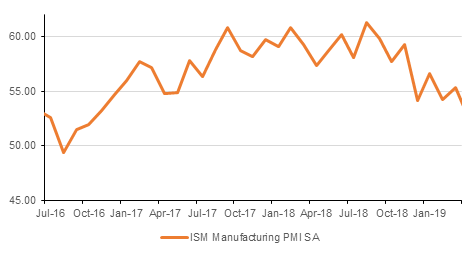

Also the start of the week brought manufacturing PMI activity reports across much of the world and these continued to reveal a softening picture in the U.S. and much weaker one elsewhere. The U.S. ISM manufacturing index dipped 0.4 points to 51.7 in June, its lowest level since September 2016, and a little weaker than had been expected, after slipping to 52.1 in May. The employment component rose to 54.5 from 53.7. Production increased to 54.1 versus 51.3. New orders fell to 50.0 from 52.7 and is the weakest since September 2015.

The UK June manufacturing PMI was much worse than expected dropping to a 76-month low of 48.0 down from May's 49.4. The data shows that the sector is continuing to contract following the stock-building driven expansion seen in Q1. At 48.0, the indicator is at its lowest level since February 2013 and the month-on-month contraction was also the most rapid monthly decline seen since 2012. A combination of high inventories and declining new orders drove the weakness, adding to the usual themes of Brexit uncertainty and slowing economic growth in Europe.

Meanwhile the Eurozone aggregate manufacturing PMI also contracted for a third month in June with a headline reading of 47.6. This represents a downward revision from the preliminary reading of 47.8 and a slowdown from May’s 47.7. The data reflects a slump in new orders and a decline in business confidence as economic growth has slowed down across the region.

Source: Bloomberg,Emirates NBD Research

Source: Bloomberg,Emirates NBD Research

Thanks to de-escalating US-China trade tensions, US treasury yields rose across the curve yesterday. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed at 1.79% (+4bps), 1.79% (+2bps), 2.02% (+2bps) and 2.55% (+2bps) respectively. In contrast, sovereign bonds across the pond continued to rally in the face of weakening economic data. Yield on 10 yr Gilts declined 2bps to 0.81% and those on 10yr Bunds declined 3bps to -0.36% yesterday. Credit protection costs declined yesterday with CDS spread on US IG and Euro Main closing down by a bp each to 53bps and 51bps respectively.

Regionally, GCC Bonds closed higher with yield on Bloomberg Barclays GCC index falling by 5bps to 3.60% mainly on the back of 8bps declining in credit spreads to 162bps as rising prospect of continued oil production cuts boosted the case for higher oil prices.

Adding to the heightened M&A activity in the region, DP World announced acquisition of Topaz Energy and Marine Ltd, a leading international critical logistics and solutions provider with fleet of 117 vessels operating predominantly in the Caspian Sea, MENA, and West Africa region, for USD 1.1 billion. In the primary market, KSA yesterday had a global investor call. A Euro-denominated dual-tranche 8- and 20-year Regulation S / Rule 144A benchmark senior notes offering is likely to follow in the near future subject to market conditions.

The USD recovered in the wake of the weekend G20 meeting as the markets lowered their Fed rate cut expectations, leaving the odds of a 50 bp cut much lower and boosting the USD as a result. EURUSD traded back below 1.13, down from the 1.1360 highs seen earlier in the day. Weaker European PMI data, alongside more dovish ECB comments, saw sentiment toward the Euro fade. USDJPY also rallied as risk appetite improved following the resumption of trade talks.

Global equities had bit of a relief rally over the US-China trade talks optimism. Dow Jones and S&P 500 gained 0.4% and 0.8% respectively while FTSE 100 and Euro Stoxx 50 closed up by

1.0% and 0.7% respectively. Positivity is continuing in the Asian bourses with Hang Seng and Nikkei both up by 1.26% and 0.11% in early morning trades today despite Hong Kong being embroiled in the unprecedented protests against the controversial bill allowing extraditions to mainland China . That said, Shanghai comp is trailing down by 0.06% so far this morning.

Regional GCC markets were mixed amid marginally weakened oil prices. Abu Dhabi Index was down 0.3%, however Dubai index gained 1.7% mainly on the back of gain in banking shares. Saudi Arabia’s Tadawul closed up by 0.6%, reflecting continued benefit of cash inflow on the back of index inclusion.

OPEC agreed to extend its production cuts into the first quarter of 2020 as ministers remain concerned over demand conditions and growth in inventories in some countries, particularly the US. The decision follows on from an apparent bilateral agreement between Russia and Saudi Arabia to extend the cuts even though other OPEC members were not consulted. Oil markets responded positively to the news although we expect the extensiosn was largely already priced into markets. How effective the cuts will be in terms of turning prices around and putting balances into sustained stock draws is up for debate, however.

The impact of production cuts is already weighing on growth in OPEC countries but given the healthy supply growth picture for producers like the US, Canada and Norway for the next 12 months, OPEC members have no other option but to maintain cuts to prevent prices from crashing lower. Even with 100% compliance from all OPEC+ countries that are restricting output, oil market balances will move into a surplus of almost 1.5m b/d in Q1 2020.

Gold prices moved back below USD 1,400/troy oz, falling by 1.8%, its largest single day move since November 2016. The relatively positive conclusion to the G20 meeting spurned haven assets in favour of risk assets. As markets reconsider the prospect of a Fed rate cut as early as this month then gold’s recent gains may prove short-lived.