.jpg?h=600&w=800&la=en&hash=EDC56B9A24609FD2EC604BDCE0FB5556)

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

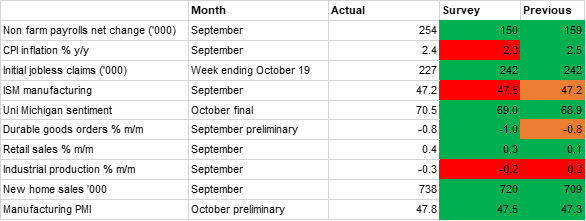

The US economy has had another strong month of data according to our monthly scorecard, with the bulk of the indicators continuing to show green, indicating both an improvement on the previous month and a beat on expectations. The robust performance of the economy has contributed to dampening bets on Fed easing over the past month. The labour market data due this week, culminating with the non-farm payrolls report due on Friday, could further reduce the odds on two more cuts from the FOMC this year, which is currently our core view. In any case, the prospect of another large 50bps cut from the Fed appears remote, a position underscored by the release of the minutes from the last FOMC meeting which showed that while there was only one dissension on the decision at the last meeting, not everyone was necessarily in favour of the larger cut.

The readjustment in rate cut expectations really began with the strong week of labour market data we saw last month, when the net gain in jobs in September came in at 254,000, substantially higher than the predicted 150,000 and up from 159,000 the previous month (itself revised up from the initial reading of 142,000). Job gains were broad based across a range of sectors, with the leisure and hospitality and healthcare sectors seeing particularly strong growth. Headline U3-unemployment meanwhile dipped back to just 4.1%, down from 4.2% previously and 4.3% in July, with the measure some way off the FOMC’s September projection of 4.4% at end-2024.

On the other side of the Fed’s dual mandate there was a modest upwards surprise in headline CPI inflation in September as it came in at 2.4%, compared with the predicted 2.3%. This was still down from the 2.5% logged the previous month and was the lowest reading since early 2021, before the surge which drove price growth to its highest levels in decades. However, core inflation picked up modestly, to 3.3% from 3.2% previously, and taken together the data would again point towards a more cautious approach from the Fed than the initial 50bps cut may have suggested to some observers.

Elsewhere in the data the production side of the economy continued to be the underperformer, as has been the case all year. The preliminary S&P Global manufacturing PMI for October did beat the previous month and expectations, but it was nevertheless below the neutral 50 line for the fourth month in a row. The ISM manufacturing survey for September was unchanged on the previous month at 47.2 but missed the predicted 47.5. This marked the sixth consecutive sub-50 reading for the index. Meanwhile, industrial production contracted 0.3% m/m, and was our only indicator that both missed expectations and deteriorated compared with the previous reading.

On the other hand, consumer demand and sentiment were relatively upbeat. Nominal retail sales expanded by 0.4% m/m in September, accelerating from the 0.1% rise the previous month. The core performance, stripping out fuel and car purchases, was even stronger, registering a 0.7% expansion. New home sales were higher than expected in September, and there was an improvement in consumer sentiment also. The University of Michigan index has been fairly weak all year despite the robust labour market and easing inflation, with cumulatively higher prices over the past several years appearing to dampen spirits. However, last month the second reading for the index put it at 70.5, a six-month high. Greater post-election certainty combined with an ongoing reduction in interest rates should serve to further bolster sentiment in the coming months.