Source: Bloomberg, Emirates NBD Research

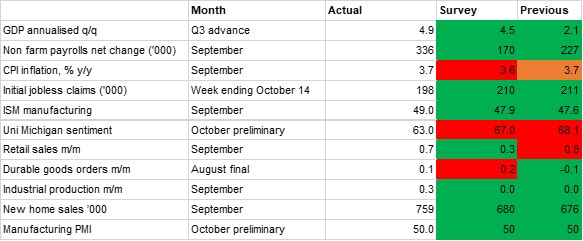

Source: Bloomberg, Emirates NBD ResearchOur macroeconomic scorecard for the US was almost universally green this month, underscoring the remarkable outperformance of the US economy heading into the final quarter of the year. The Federal Reserve has implanted a cumulative 525bps of rate hikes since it began raising rates in March 2022 in the most aggressive tightening seen in decades, but the economy has failed to show any undue signs of strain as yet.

This was confirmed by the GDP print for the third quarter, which showed annualised q/q real GDP growth of 4.9%, up from 2.1% in Q2 and higher even than the bullish consensus projection of 4.5%. Personal consumption performed especially strongly as it expanded 4.0% (from 0.8% in Q2), with consumers seemingly shrugging off the more onerous borrowing costs so far and continuing to spend. Growth was also supported by private investment, part of which was a build-up of inventories. While this might turn into a drag in the final quarter, it is indicative of businesses’ robust expectations as to consumer demand in the run-up to the holiday season. The quarter ended on a positive note for consumers as retail sales expanded 0.7% m/m, down only modestly from 0.8%. Even stripping out autos and petrol, sales were still up 0.6% on the month.

With student loan repayments set to start again, and consumer confidence still especially low (the University of Michigan consumer sentiment index declined in September) the expectation is that there will be some falling off in consumer demand through the fourth quarter, but so far this year it has surpassed expectations. The IMF recently revised up its 2024 growth forecast for the US from 1.0% to 1.5%, and chatter around the chance of a soft landing has amplified in recent weeks, with Treasury Secretary Janet Yellen highlighting the likelihood in the wake of the GDP results.

Looking at the two sides of the Fed’s dual mandate, this appears increasingly feasible. The labour market continues to perform strongly, with a large upside surprise of a net gain of 336,000 jobs in September’s NFP report, far higher than the predicted 170,000, and up from (an upwardly revised) 227,000 the previous month. The headline U-3 unemployment rate held steady at 3.8%. Meanwhile, initial jobless claims have remained low, falling back to 198,000 in the week to October 14, from 211,000 on the previous print. On inflation, the headline CPI inflation figure stayed steady at 3.7% y/y in September, but core PCE inflation slowed to 2.4% q/q in the third quarter, from 3.7% previously. We hold to our view that the FOMC will hold rates steady this week, and indeed that the next move for rates will be downward, albeit not until well into 2024.

A notable outperformer on our scorecard has been new home sales, which came in at 759,000, up from 676,000 the previous month and beating expectations of 680,000. This 12.3% m/m gain is in contrast to the 2.0% decline in existing home sales in the same month, however, and is in part an effect of the higher interest rate environment. The average 30-year fixed mortgage rate for new customers hit 8.0% in October for the first time since 2000, while the prevailing rate remains around 3.7%. As such, homeowners are reluctant to move, reducing the availability of existing homes on the market. Over the longer term this could have implications for the US economy through reducing labour mobility.