Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

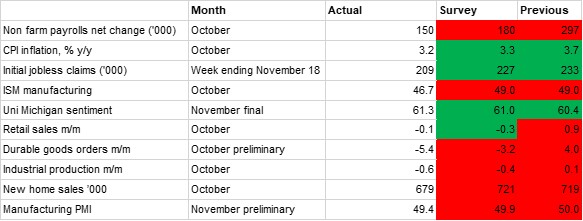

Our latest macroeconomic scorecard for the US paints a somewhat more mixed picture than the previous month’s, with a greater share of data points coloured red than green. This is likely in part simply a reflection of the particularly strong prior month, with the upside surprise on the initial Q3 GDP growth print (4.9% q/q annualised) mirrored in a number of other data points from September. Additionally, though, it is likely also indicative that the anticipated softening in economic performance as the Fed’s monetary tightening takes effect is starting to play out.

There have been no unduly concerning data releases over the past month, and there is little expectation at present that there will be a recession in the US. Indeed, a soft landing appears more likely, and the consensus growth forecast for 2024 is 1.2%, compared with a projected 2.4% this year. Nevertheless, the data has been turning weaker, and activity is expected to slow from here as excess savings are run down and the strength of the consumer starts to diminish. From a rates point of view, this supports our belief that the Fed’s rate hiking cycle is now complete.

Higher rates are starting to impact the monthly data releases more meaningfully, and retail sales declined 0.1% m/m in October, compared with a 0.9% expansion the previous month. New homes sales have also continued to decline, dropping to 679,000 (annualised) in October, down from 719,000 the previous month, as high mortgage rates have constrained demand. Meanwhile, business investment has also deteriorated in the high rates environment as durable goods orders declined by a greater-than-expected -5.4% m/m in October. This was skewed by the transportation sector and the UAW strike, but stripping these out, growth was flat in October while September’s growth was just 0.2%.

There is also mounting evidence of a slowdown from the labour market, with the monthly nonfarm payroll report coming in under expectations with a net gain of 150,000 in October, down from 297,000 the previous month (itself downwardly revised from the initial reading of 336,000). The October print was also 30,000 below expectations, and while the UAW strike will have accounted for much of that shortfall, the reading was nevertheless the second-softest since 2020. The headline unemployment figure ticked up to a near two-year high of 3.9%, from 3.8%. Other surveys have likewise suggested a softening labour market, and both the manufacturing and services PMI surveys for November showed a decline in employment as firms noted weaker demand and elevated cost pressures, with the decline in the services employment index the first since mid-2020.

While growth is softening, we do not anticipate a near-term pivot from the FOMC and hold to our view that rates will be held where they are until mid-2024 when we expect that the Fed will begin a run of 25bps cuts. Jerome Powell has been more equivocal about the balance of risks in recent statements, but he maintains that the ‘question of rate cuts just doesn’t come up’ and that if ‘it becomes appropriate to tighten policy further' then the FOMC would 'not hesitate to do so’. At 3.2% y/y in October, headline CPI inflation was at its lowest level since 2021, but it remains higher than the Fed would like it to be.