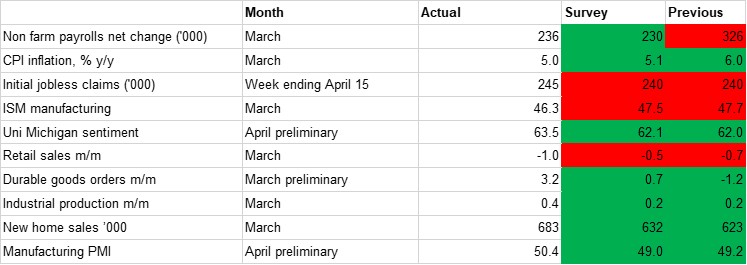

Our macro-scorecard for the US and its most followed data points released over the past month is somewhat improved compared to the previous issue: the bulk of the indicators are flashing green, indicating that they beat both the previous month’s readings and analyst expectations, in contrast to the more red seen in the February print. However, some of the headline readings are not quite so sanguine as they appear, with the devil in the detail in certain cases.

On inflation, for instance, the 5.0% y/y seen in March was the lowest level since May 2021, down significantly from the 6.0% seen in February and lower even than the consensus projection of 5.1%. On the face of it this could lead to assumptions that price growth is slowing rapidly enough to prompt the Federal Reserve to bring its rate-hiking cycle to a close after the 475bps already implemented. However, core inflation ticked up on the annual measure in March, rising to 5.6% y/y, from 5.5% previously, while the m/m measure was at 0.4%, down just modestly from 0.5% in February. While there were some encouraging signs, such as the slowdown in shelter cost rises, we expect that the FOMC will still follow through with one final 25bps hike at its upcoming May meeting given the ongoing stickiness of core inflation.

The likelihood is though that this will be the final rate hike from the Fed in this cycle, and we anticipate that rates will then be held steady through the close of the year. Most of the data points we follow are showing some evidence of a trend slowdown implying that the interest rate hikes to date are starting to work, even if there were some upside surprises in the past month. While on the other hand, even with renewed concerns around the banking sector we do not see sufficient weakness to prompt a cut from the FOMC through this year. On the other side of the Fed’s dual mandate from price growth, the labour market has started to slow, with the net gain of 236,000 jobs in the NFP print for March representing the lowest level since the December 2020 contraction. Initial jobless claims hit 245,000 in the week to April 15, higher than the one-year average of 213,000.

The high interest rate environment is starting to take its toll on the US economy, and retail sales surprised to the downside in March as they contracted 1.0%, compared with expectations of a slighter 0.5% drop. The key driver was a decline in new car sales and fuel prices, with more onerous financing conditions likely weighing on demand for new autos. And while there was an upside surprise in new home sales in march as they rose 9.6% m/m, this was driven by particular circumstances around mortgage rates swinging lower in response to the banking sector stress that month.

Higher rates and a softening environment also appear to be impacting business investment. While durable goods orders in March rose 3.2% m/m on the headline measure, this was driven by a surge in orders for aerospace manufacturer Boeing. Stripping out the defence and aviation sectors, durable goods orders actually declined 0.4% in March, greater than the predicted 0.1% contraction. Other production side surveys for the past month have been mixed. While industrial production surprised to the upside with a 0.4% gain, and the S&P Global manufacturing PMI survey turned modestly positive, the ISM manufacturing survey sank further into contractionary territory.