.jpg?h=600&w=800&la=en&hash=911AF292A433C213455BB25451523740)

Source: Bloomberg, Emirates NBD Research

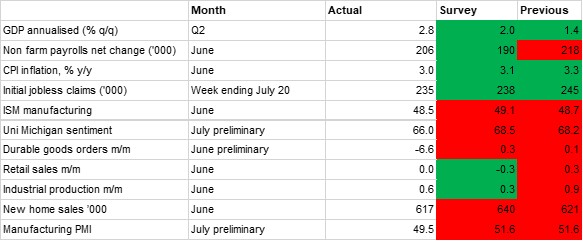

Source: Bloomberg, Emirates NBD ResearchUS GDP growth surprised to the upside for the second quarter, logging an annualised q/q expansion of 2.8%. This was up from 1.4% in Q1 and was considerably stronger than the predicted 2.0%. The overshoot is also slightly at odds with our monthly macroeconomic scorecards for the quarter, which have tracked moderately more red than green over the past three months.

The key driver of the stronger-than-expected GDP growth in the second quarter was personal consumption, as the US consumer’s resilience to higher rates and faster-than-usual price growth continued. Personal consumption accounted for 1.6pp of total GDP growth in Q2 as it grew 2.3% q/q, up from 1.5% in Q1. Looking at the monthly data prints in our scorecard, retail sales were flat m/m in June, but the May figure was revised on the second print to a 0.3% expansion. And stripping out autos and gas, growth in June was actually a robust 0.8% m/m, supporting the GDP growth figures. The fact that non-store purchases (largely internet shopping) have accounted for a larger share of the growth in retail sales in recent months suggests that US shoppers are becoming more discerning as their incomes have been hit. The University of Michigan consumer sentiment index fell in July, missing expectations. Nevertheless, this has not led to a slowdown in activity as yet. Services in particular continue to be well supported, and consumption here accounted for 1pp of the Q2 GDP growth print.

In any case, the outlook for consumption is if anything looking brighter as the rapid price growth of the past several years has moderated. Even if the final mile of bringing down inflation has proved the hardest, at 3.0% y/y last month headline CPI growth was at the joint lowest since March 2021 (inflation had fallen to 3.0% last June before accelerating once more). This leaves wages in real growth territory as average hourly earnings grew 3.9% y/y in June. Core PCE inflation, the Fed’s preferred measure of price growth, slowed to 2.9% q/q in Q2, down from 3.7% the previous quarter.

Even as core PCE has slowed, however, it still came in a little hotter than had been predicted (2.7%), and we see nothing in the data that would bring forward our expectation of a first rate cut from the Fed to next week’s meeting. This is especially the case given that employment data continues to outperform. Nonfarm payrolls saw a net gain of 206,000 last month, beating the predicted 190,000, and while the April numbers were revised substantially lower, and job openings have come down, the labour market generally does not look in need of overt support just yet.

That being said, government jobs and healthcare have been the primary drivers of the job gains of late, and there were declines in retail jobs in the latest print. Jerome Powell acknowledged that the risks facing the Fed’s dual mandate were becoming more evenly balanced when he addressed Congress earlier this month, as ‘labour market conditions have now cooled considerably.’ We hold to our expectation of a first 25bps cut from the FOMC at the September rate-setting meeting.

On the production side of the economy, the data of the past month was somewhat mixed. The S&P Global and ISM PMI surveys both came in weaker on the previous month, and the S&P Global manufacturing index dropped back into contractionary territory once again. However, industrial production logged a robust 0.6% m/m expansion, beating the predicted 0.3%. Durable goods orders saw a sharp 6.6% m/m decline, but this was driven by the volatile aerospace sector. Investment in business equipment (both machinery and computers/ electronics) rose at a faster pace in June relative to the prior three months.