.jpg?h=600&w=800&la=en&hash=C0F5CEE5D0E3E10A8570451CAC8EBFD4)

Source: Bloomberg, Emirates NBD Research

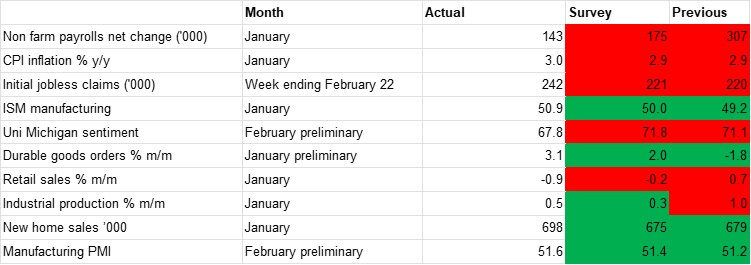

Source: Bloomberg, Emirates NBD ResearchOur regular US macro scorecard has given a mixed signal this month. GDP growth for Q4 2024 was confirmed at 2.3% q/q (softer than the initial forecast of 2.7%) and the data suggest that 2025 is off to a softer start as political noise is seemingly starting to impact behaviour. This has been especially apparent in confidence surveys as the US Conference Board measure fell to 98.3 in February, down from 105.3 previously while the University of Michigan consumer sentiment survey fell from 67.8 on the initial print to 64.7 on the final reading, significantly lower than the 71.1 recorded in January. Both the current conditions and the expectations components of the survey declined, with responses from Democrats and independents materially more downbeat.

The University of Michigan survey also saw a sharp rise in five-10 year inflation expectations to 3.5%, the highest in over three decades, in a concerning development for the Fed following on from the upside surprise in the January CPI print. Headline inflation was at 3.0% y/y, confounding consensus predictions that it would be maintained at the 2.9% rate seen over the previous two months. The minutes from the end-January FOMC meeting showed that officials expected the downwards path for inflation to be uneven and they noted that businesses could start to pass on any higher costs related to tariffs to consumers. Official Fed commentary has maintained that FOMC members will look through this noise when making their rate-setting decisions, with Jerome Powell telling the Senate Banking Committee earlier this month than the Fed will ‘stay out of politics, stay out of elections…and just try to focus on the data’. While the scale and scope of tariffs remains quite unclear, the threat of them appears to be having an impact already.

The potential disruption from tariffs was also apparent in the S&P Global PMI survey for February, as while the manufacturing component surprised to the upside at 51.6, up from 51.2 in January, the services component materially disappointed as it fell to a contractionary 49.7, the first sub-50 reading since January 2023. This was down from 52.9 in January with respondents citing concerns around federal government policies. And while the headline manufacturing index did register an uptick, some firms noted an upwards spike in their input prices stemming from tariff-related hikes from suppliers. Durable goods orders data for January meanwhile suggests that some companies have accelerated their purchase of non-defence capital goods as they look to import ahead of potential tariffs.

On the labour market front there is some evidence of a slowdown, but nothing that suggests an overwhelming malaise as yet. The NFP print for January was for a net gain of 143,000 jobs, the slowest pace in three months and missing the predicted 175,000. However, the previous two months saw a combined upwards revision of 100,000 and headline U-3 unemployment ticked down to 4.0% from 4.1% previously. Initial jobless claims in the week to February 22 did rise to the highest level this year at 242,000 but the continuing claims measure fell the previous week.