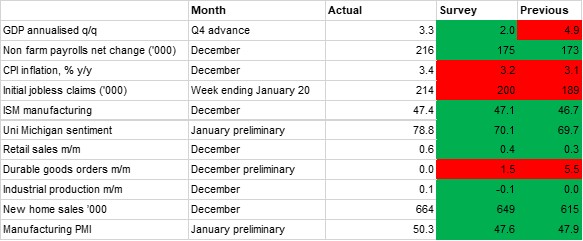

A roundup of the most widely followed monthly macro data points from the US, compared with expectations and the results of the previous month.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Our macroeconomic scorecard for the US was largely green for December as the bulk of the data points released over the past month came in higher than had been anticipated, meaning the US economy ended 2023 in a much better position than had been expected at the start of the year when projections of a recession were commonplace. The outperformance was confirmed by the GDP data released last week which showed full-year 2023 growth at 2.5%, an acceleration on the 1.9% recorded in 2022 and confounding earlier expectations of a contraction. The annualised q/q growth rate in the final quarter was 3.3%, a slowdown from Q3’s 4.9%, but still well above the consensus projection of 2.0%. Despite the aggressive tightening implemented by the Federal Reserve since it started hiking rates in March 2022, personal consumption has remained robust, and it expanded 2.8% in Q4. This strong consumption was maintained through the end of the year, with retail sales expanding 0.6% m/m in December, beating the predicted 0.4% and up from 0.3% previously.

There was little in the way of negative surprises in the recent data. Headline CPI inflation did accelerate in December, coming in at 3.4% y/y, up from 3.1% in November and above the predicted 3.2%. Along with the recent labour market data that has been stronger than anticipated, this reaffirms our view that rate cuts will not start until the middle of the year. Nevertheless, there has been nothing in the price data that will have been overly worrisome for the Federal Reserve, and we remain convinced that monetary policy will ease through the second half. The PCE deflator for December, the Federal Reserve’s inflation target, held steady at 2.6% y/y for a second month while the core PCE deflator dropped to 2.9% y/y. For Q4, the core deflator was 2.0%, unchanged from the previous quarter and in line with expectations.

As mentioned, on the other side of the Fed’s dual mandate the labour market has remained robust, precluding any need by the Fed to implement cuts sooner. Nonfarm payrolls saw a net gain of 216,000 in December, well above the market prediction of 175,000. And while there was a fall in the labour force, and some signs of cooling in certain sectors, the general conditions remain remarkably robust for this stage in the monetary policy cycle. Meanwhile, initial jobless claims in the week to January 20 were higher than anticipated (214,000, compared with the predicted 200,000), but the previous week there was a sizeable surprise to the downside.

One characteristic of the US economy over the past 12 months is that while the employment and growth have outperformed, with retail sales holding up through the year, consumer sentiment has remained weak throughout, with the sticky inflation informing respondents’ views more than anything else. With the tide turning on the price growth front, this trend is starting to reverse, and the University of Michigan consumer sentiment index saw a marked upside surprise in the preliminary reading for January as it rose to a more than two year high of 78.8, up from 69.7 the previous month, which was the biggest one month jump in nearly two decades.

While the production side remains under pressure, with the ISM manufacturing survey still indicating a contraction, this was at a less acute pace in December than in November, while the S&P Global manufacturing PMI turned positive in the preliminary January reading, rising from 47.9 in December to 50.3. While extended lead times owing to weather-induced transportation delays will have boosted the index, respondents also noted easing inflationary pressures.