.jpg?h=600&w=800&la=en&hash=C0F5CEE5D0E3E10A8570451CAC8EBFD4)

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

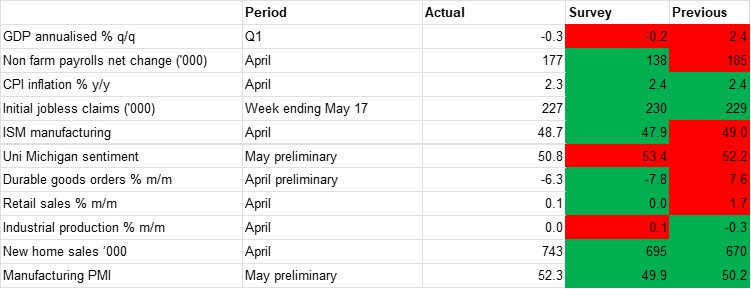

The data out of the US is holding up fairly well to date despite elevated uncertainty around US trade policy under the confrontational presidency of Donald Trump. This is well illustrated by our monthly scorecard, which still shows a higher level of green than red, meaning that the most-followed data points continue to improve both on the previous print and on analyst expectations. There is a lot of noise within this data, however, with some evidence of firms and consumers bringing activity forward in order to evade potentially higher levies down the line, so it might be several months before we can ascertain more definitively the impact this uncertainty is having on growth.

The Q1 GDP print is a case in point. One of only two of our tracked data points of the past month that was worse than both the previous print and expectations (the Michigan sentiment index was the other), annualised q/q growth was -0.3% in Q1, worse than the predicted -0.2% and compared with the 2.4% recorded in Q4 2024. However, the first quarterly GDP contraction since 2022 was largely due to a surge in imports which were up 41.3% q/q annualised as businesses attempted to front-run President Trump’s tariffs. When this likely reverses in the second quarter we would expect to see a much stronger growth print, especially as other data points have broadly held up through the past month.

This uncertainty in the data was an aspect acknowledged by Jerome Powell when the Fed held rates steady for the third time in a row on May 7, and the rate-setting committee made clear that it would remain in wait-and-see mode for the time being. The two most important monthly data releases for the Fed, the NFP and CPI prints, are in any case not flashing any alarm signals still. There was a net gain of 177,000 jobs in April, somewhat lower than the (downwardly revised) gain of 185,000 the previous month but still a solid number and well above the predicted 138,000. There were strong gains in jobs in healthcare and warehousing, likely explained by the surge in imports ahead of the tariffs introduced on April 2. The unemployment rate was unchanged at 4.2%. Headline CPI inflation, meanwhile, was softer than expected in April at 2.3% y/y, down from 2.4% previously.

The risks to price growth, however, are certainly weighted to the upside given the likely inflationary aspect of the tariffs, even if these have been scaled back in many cases, and inflation expectations that continue to head higher. The preliminary University of Michigan sentiment survey put year-ahead inflation expectations at 7.3%, up from 6.7% in April. Equally, the headline reading fell for a fifth consecutive month, with nearly three-quarters of respondents citing tariffs as a key concern. If this weakening soft data starts to manifest more directly in the hard data then we could see a sharper slowdown in activity in the second half. That being said, developments around tariffs news will remain key – the hiatus seen over the several weeks before Friday’s threats against the EU helped the Conference Board consumer confidence index surprise to the upside in May.