Our macroeconomic scorecard for the US is mostly green this month, with almost all of the most-followed macroeconomic indicators performing better than both the previous readings and analyst expectations. While some of these readings are not especially strong, they are nevertheless still better than had been anticipated at this stage in the hiking cycle, while the labour market has shown particular resilience. With inflation proving fairly sticky as well, there remains a chance of a further rate hike by the Fed at the upcoming June meeting, although this is not our core view. Our expectation remains that growth will weaken through the rest of the year as the lagged effect of cumulative hiking, coupled with tighter credit conditions stemming from the recent banking sector uncertainty, serves to dampen demand. The tentative debt ceiling deal, while averting the arguably far worse scenario of a debt default, will also put a break on growth in the quarters ahead as it limits federal spending.

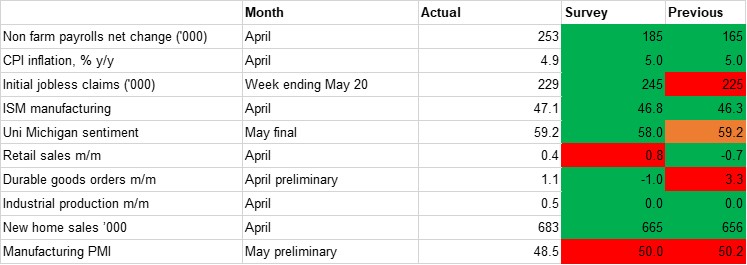

The most recent data suggests that the second quarter has got off to better start than had been expected, following on from the annualised 1.3% q/q growth seen in Q1, revised up on the second reading from the preliminary print of 1.1%. However, that is not to say that they indicate especially strong activity, with manufacturing in particular still looking weak. The preliminary manufacturing PMI survey for May fell to 48.5, after briefly rising tentatively above the neutral 50.0 level the previous month to 50.2, which was the first expansionary reading since October. The ISM manufacturing survey has also remained resolutely below the 50.0 mark at 47.1 in April, the sixth consecutive contractionary reading – albeit an improvement on the previous month. Industrial production surprised to the upside in April as it expanded 0.5% m/m, but this was on the back of a downward revision for March from 0.4% growth to 0.0%. Meanwhile, durable goods orders, while up 1.1% m/m on the headline reading, were down 0.2% when stripping out transport, suggesting that high interest rates and a weakening environment are starting to weigh on capital expenditure.

As has been the case in much of the world, the services PMI survey in the US has been stronger than those for manufacturing, rising from 53.6 in April to 55.1 in May. This has been supported by a resilient consumer, with the upward revision to Q1 GDP growth largely predicated on personal consumption growth which was revised up to an annualised 3.8% q/q growth on the second print. This might also come under pressure if the American consumer starts to tighten their belt in the coming months, however, and there are indications that this is already happening as retail sales came in weaker than anticipated in April, expanding 0.4% compared to a predicted 0.8%. Consumer sentiment was a little stronger than expected in May according to the University of Michigan survey, but at 59.2 it remains low by historical standards.

Spending to now has been supported by the outperforming labour market, and there was another big upside surprise in April’s nonfarm payroll print, showing a net gain of 253,000 jobs, far higher than the predicted 185,000. Initial jobless claims have ticked up, but the most recent print for the week to May 20 came in below expectations. On the other side of the Fed’s dual mandate, the headline CPI print was a bit lower than predicted at 4.9% y/y in April, but other price growth indicators have been less positive: core CPI remained static at 5.5% y/y while core PCE was up 0.4% m/m and 4.7% y/y, above expectations of 0.3% and 4.6%. This was the biggest monthly gain in the Fed’s preferred inflation measure since the start of the year, and feeds into speculation that the FOMC may not be done just yet, a view supported by the minutes from the May meeting that indicated a variety of viewpoints among members.