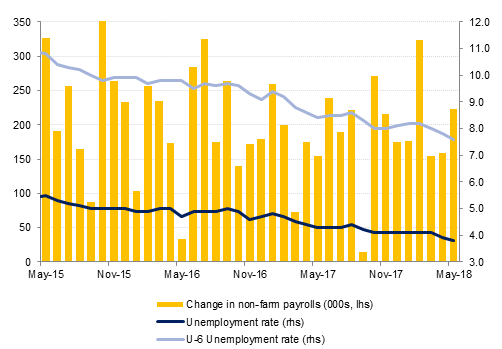

US non-farm payrolls beat market expectations at the end of last week, with 223k new jobs added in May, against forecasts for a 190k rise. The April number was revised slightly lower to 159k from 164k previously. Overall however, the employment report painted a picture of continued tightening in the labour market across all sectors; job growth was broad-based with a strong increase in construction, manufacturing and professional services as well as retail and services. Unemployment fell to 3.8%, the lowest since April 2010 and even the broader U6 unemployment rate reached a 17-year low. Average hourly earnings rose 0.3% m/m (2.7% y/y), also higher than forecast. Separately, the ISM manufacturing index rose by more than expected to 58.7 in May, signalling faster GDP growth in Q2. Overall, it now appears certain that the Fed will push ahead with another 25bp rate hike at this meeting later this month, despite increased uncertainty about trade policy and political developments in Europe.

Indeed the strong US economic data on Friday was overshadowed by news that the US exemptions for steel and aluminium imports from Canada, the EU and Mexico would be revoked, triggering announcements of tariffs on some US exports to those countries. The trade issue dominated the G7 Finance Ministers’ meeting in Canada over the weekend, and is likely to remain in the headlines this week as US/ China negotiations continue and ahead of the G7 leaders’ meeting on Friday.

Eurozone political risk eased for the time being with the formation of a new government in Italy at the end of last week. While the immediate risk of another election has receded, the populist government of Five Star Movement and the League looks set to clash with the EU if they implement their election promises, including reducing the pensionable age, introducing a ‘citizen’s income’ and cutting taxes. In Spain, Prime Minister Rajoy lost a vote of confidence and has been replaced by head of the opposition Pedro Sanchez. Sanchez has already indicated he will stick with the current budget, so the economic impact of the change is likely to be limited in the short term.

Stronger than expected non-farm payrolls data out of the US did little to counterbalance the rising fears of trade wars. Safe haven bid saw treasuries gaining ground during the week with yields on the 2y UST, 5y UST and 10y UST closing at 2.47% (flat w-o-w), 2.74% (-2bps w-o-w) and 2.90% (-3 bps w-o-w).

Regional bonds closed largely unchanged as fall in benchmark yields was offset by rising credit spreads. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +2 bps to 4.61% and credit spreads widened by 4 bps to 191 bps.

S&P affirmed Bahrain’s ratings at B+ with stable outlook. The rating agency said that the government’s access to international capital markets has proven crucial for replenishing Bahrain’s reserves. It also added it sees financial backing for Bahrain’s exchange rate arrangement from neighbouring countries being forthcoming. Last week, Bahrain 21s dropped 1 point to close at USD 97.3 and Bahrain 29s lost 3 points to close at USD 85.3.

According to reports, EA Partners failed to sell debt obligations of Air Berlin and Alitalia in EA Partners II bond due in June 2021. The remarketing agency will restart auction of claims with deadline of bids on 11 June 2018. EA Partners II is currently trading at USD 70.28 (-1 point) and EA Partners I is trading at USD 72.52 (-1 point).

The dollar was mostly unchanged last week, the Dollar Index trading 0.07% lower at 94.188. The DXY encountered resistance at the psychologically significant 95 level, last seen in November 2017, where selling pressure drove the price lower. However, the daily uptrend remains intact despite the close just below the 61.8% one year Fibonacci retracement (94.20). Part of these losses may be attributed to profit taking as the 14 day relative strength indicator showed that the dollar was overbought. While the price remains above 93.10, a retest of the 95 handle remains likely in the short term, a breach of which may be followed by a climb towards 95.60.

USDJPY rose 0.10% last week, reaching 109.52 after further gains were halted by resistance at the 100 week moving average (109.73) and the price was driven below the 50% one year Fibonacci retracement (109.65). Over the week ahead, it is likely that these levels are retested. Should they be broken, a test of the 200 day moving average of 110.20 is possible. On the downside, further declines may be limited by support at the 50 day moving average (108.47), the 38.2% one year Fibonacci retracement (108.44) and the 100 day moving average (108.14).

Saudi equities outperformed its regional peers. The Tadawul added +2.0% as investors reacted positively to changes in the cabinet. Al Rajhi Bank and Samba rallied +5.2% and 4.7% respectively. Elsewhere, the DFM index added +0.8% on the back of strength in Emaar Properties (+2.1%) and Dubai Islamic Bank (+2.8%).

Oil markets diverged last week, sending the Brent/WTI spread to USD 10.98/b, its widest level since Q1 2015. Brent futures closed the week up 0.46% while WTI gave up more than 3%. The widening gap is a consequence of insufficient pipeline infrastructure in the US to allow crude to move out of producing regions to higher value export terminals. One of the few options for US producers is storage and inventories in the US have essentially held flat since the start of the year.

E&P companies continued to add rigs last, putting two new rigs in play and taking the total to 861 targeting oil. Compared with the same time last year there are 128 more rigs at work, largely concentrated in the Permian basin in Texas.

Investors continue to close out long positions in both Brent and WTI futures and options. Total speculative length between the two benchmarks fell by over 100k contracts last week, largely due to longs being closed on the back of profit taking. Volatile spreads at the front of the curve, including Brent briefly dipping into contango, are cutting the incentive to stay in a long-only position.