The ongoing imbalance between the record number of job openings in the US and the still high level of unemployment is evidence that there remain considerable frictions in the labour market. While some of this is no doubt owing to the still very real threat posed by the coronavirus pandemic itself – the US continues to record very high levels of daily new cases, while parts of the country have a comparatively low vaccination rate when compared with other OECD countries – there are mounting indications that there are other factors at play, brought to the fore by the pandemic but no longer dependent on it. The so-called ‘Great Resignation’ will potentially take longer to iron out than even the residual health concerns and has potential long-run implications for inflation and monetary policy.

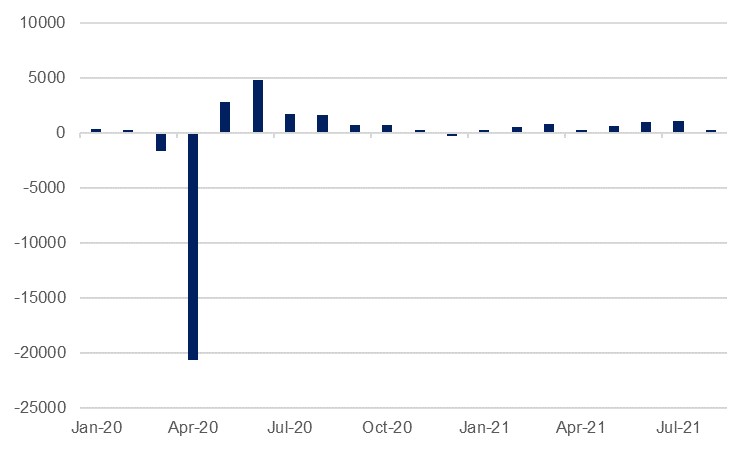

The latest non-farm payrolls print for August disappointed markedly to the downside. Showing a net gain of just 235,000, it was some half a million short of consensus projections and marked a considerable slowdown from the previous month’s 1.05mn. Some of this slowdown can be directly attributed to the ongoing pandemic crisis in the US; the Delta variant saw new case numbers soar to an average of 136,000 a day last month, and it was retail and hospitality, the sectors most likely to be affected by the virus, that showed the weakest performance in the August jobs report. There have also been arguments that the mismatch in August was down to the pandemic-related support packages that remained in play, with people reluctant to return to work while they could still rely on this income. With these benefit packages having largely expired in September, it will be interesting to see if there is a marked acceleration in the NFP figure for this month, but the evidence from those counties that removed the support early suggests that it was not the determining factor in the slow take-up of jobs. Childcare issues may also have been a factor, and with most schools having now returned to in-person teaching (the recent surge in cases has forced a reversal in this process in some districts) this should be alleviated also.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

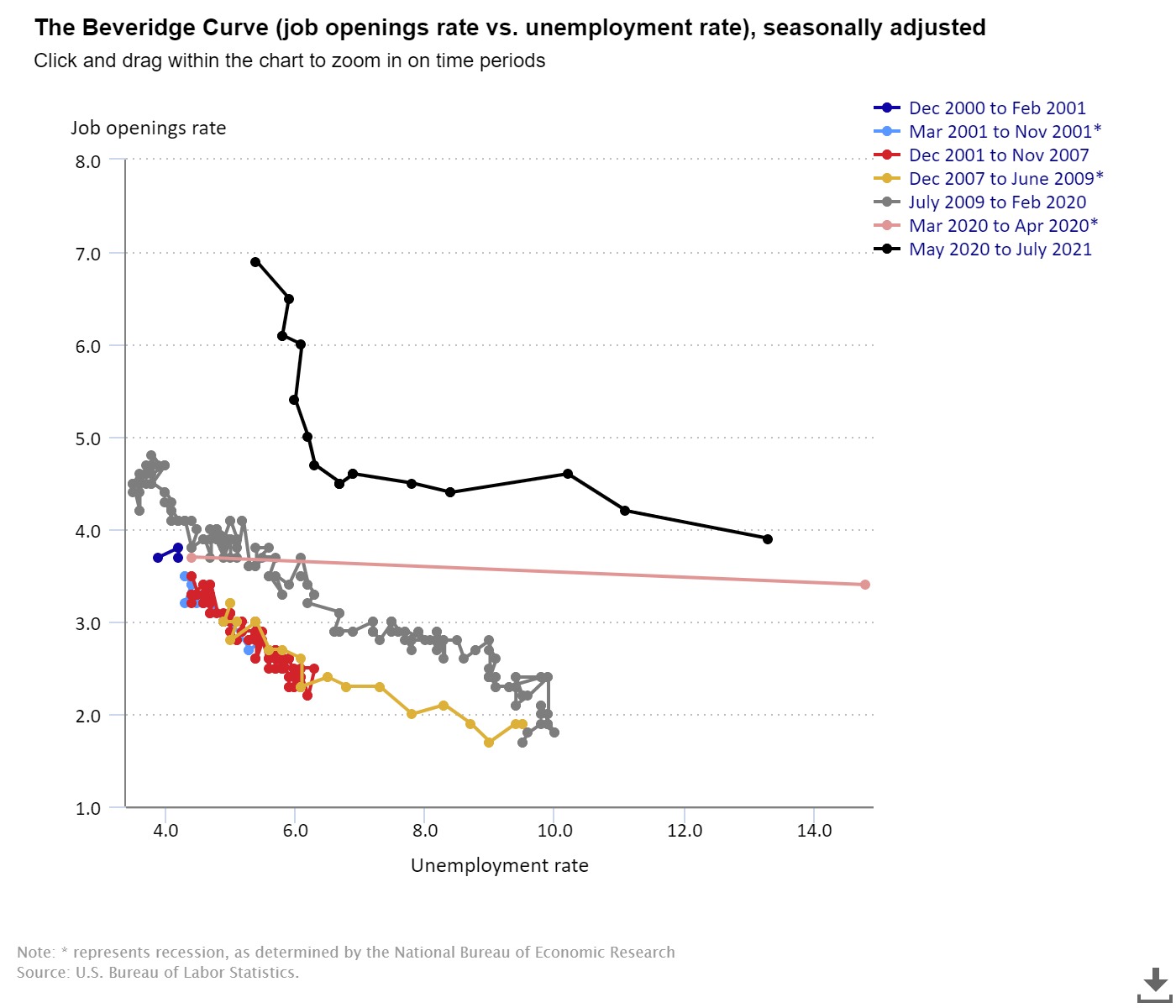

However, the evidence suggests that there is more to the mismatch than simply concerns over catching Covid-19 that is forestalling the recovery in total employment levels (still 5.3mn fewer jobs than there were prior to the pandemic). While the headline U-3 unemployment rate is falling after spiking to 14.8% in April 2020 (the US did not implement the kind of furlough schemes seen elsewhere which kept the jobless rate lower in countries such as the UK) it remains fairly high at 5.2%, even while job openings have risen to a record 10.9mn. This has seen the Beveridge Curve, which plots openings against joblessness, shift markedly outwards up and to the right when compared to previous economic crises (see chart below), suggesting that there has been a serious deterioration in the matching efficiency of the US labour market. Some of this is due to those factors mentioned above, but there has also been a rising number of people opting out of the labour market altogether.

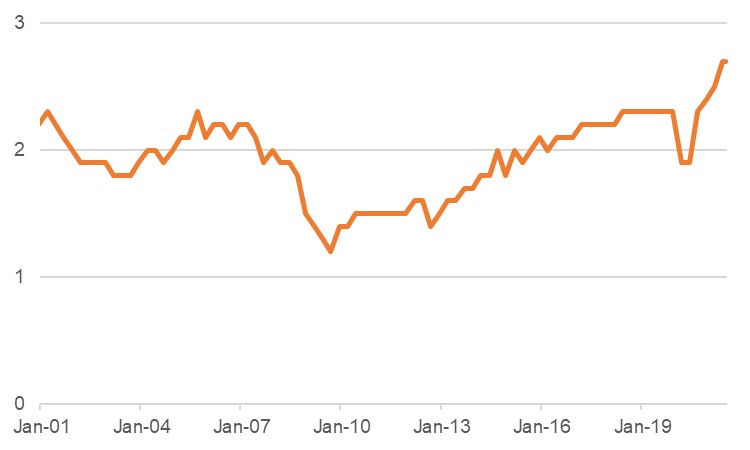

In recent months there have been in the region of 4mn people quitting their jobs in the US each month, pushing the quits rate up to series highs of 2.8% in April, and still 2.7% in June and July; the long-term average is for a level of 1.9%. It is worth noting that the quits rate understandably fell during the peak of the pandemic crisis last year, so some of these higher levels can be put down to pent-up demand for change. The sheer level of openings will also encourage more movement, as people line up new opportunities. But even allowing for this these current levels are high, and anecdotal evidence suggests that more people are reassessing their place in the workforce, whether that be people opting to restart education or training, opting for a career break after feeling burnt out during the pandemic, deciding they no longer wish to work in hospitality jobs or jobs a long way from their home, or debating whether they actually need to work at all (the quits rate does not tend to capture those leaving work to retire, but the number of people opting to retire early has also reportedly risen). Having been given a taste of more flexible working conditions, some employees might not appreciate being called on to return to offices or otherwise traditional pre-pandemic modes of working. Others who lost their jobs might have decided not to return to working, with the effect of this likely more stark than in European countries where furlough and kurzarbeit kept workers attached to their firms.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

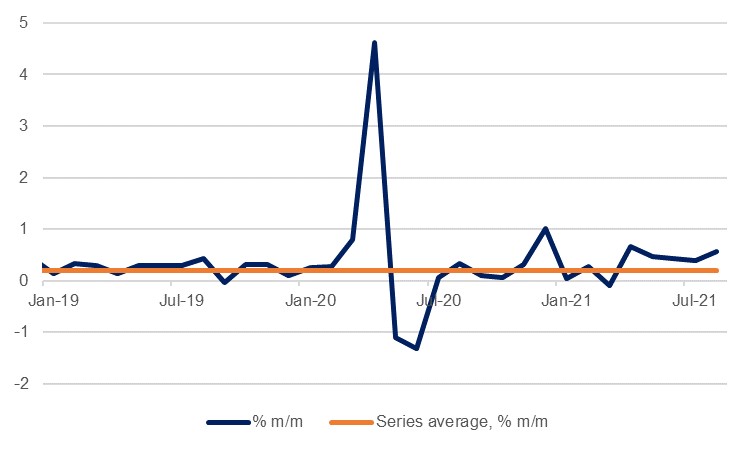

How long these conditions last is open to question. The impact of the pandemic will ease eventually even if that means living with Covid-19 rather than eliminating it. People will readjust, and there may come a greater personal impetus to return to work. Firms are also implementing more measures to encourage and incentivise their workers, with high-profile instances such as Bumble allowing employees an extra week off to combat burn-out amid a more general move by firms to allow more flexible working patterns than had been usual before the pandemic, such as a two/three home/office structure, or offering to pay for further education. But most salient is that firms are also having to increase their compensation offering in order to retain or hire staff, especially in an environment of higher (albeit falling back) inflation and high levels of competition for workers. While the latest NFP report surprised to the downside on the key jobs number, the wage growth of 0.6% m/m was a more rapid pace than had been anticipated.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

These potential wage pressures will be a key concern of the FOMC in the months and years ahead. We hold to the Fed’s view that most of the recent inflation drivers have indeed been transitory, and the slowdown in the last month’s inflation reading would support this, but rising wage expectations could precipitate their own price pressures. It also brings the Fed’s commitment to full employment into question – how long will the FOMC actually tolerate rising price growth in pursuit of this, if it is longer-lasting structural issues that are preventing it rather than a dearth of opportunity? There is certainly political support for boosting lower-income wages, with President Biden telling businesses to ‘pay them more’ in order to solve staff shortages. While growth for blue collar wages have outpaced the growth in managerial and professional wages in recent months, that obscures the loss of countless blue collar jobs over the past 18 months, slower wage growth for lower income strata prior to the pandemic, and the more rapid growth in asset wealth than wages over recent decades.

Looking at the longer term, the pandemic has also accelerated trends that had been posing a future challenge for policymakers for years, regarding the very nature of work and employment in a society that is increasingly automated. With labour shortages weighing on firms, the impetus to automate and increase productivity will be even greater than usual, with an increasing number of jobs likely to simply cease to exist. Over the longer term this would require re-skilling of workers whose jobs have been made redundant by automation and could lead to increased inequality with lower skilled workers remaining unemployed while unemployment rates of higher skilled workers continues to decline.

While labour market frictions are currently most visible in the US labour market, the underlying issues are pertinent in many other markets. In the GCC, where residency is still largely tied to employment, and where lower skilled labour is imported, these frictions will likely have less of an impact in the short term. Ultimately however, the region will have to compete globally for talent and may need to offer similar incentives to attract and retain highly skilled individuals.