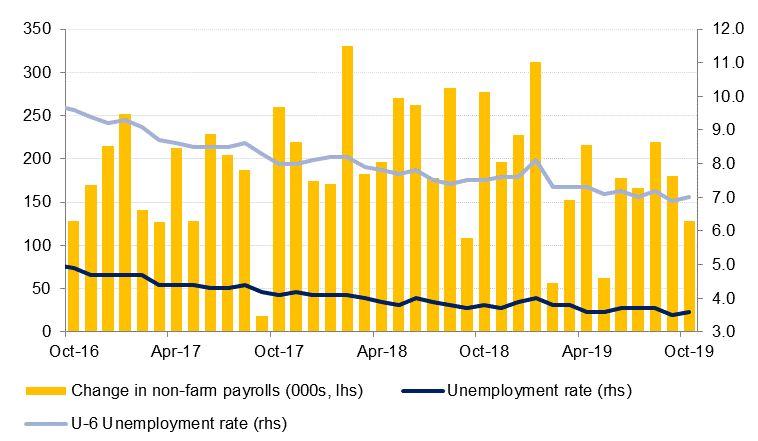

US jobs data came in well above expectations on Friday, with 128k new non-farm jobs added in October, despite the General Motors workers’ strike. The market had been expecting a rise of 85k. In addition, the previous two months’ jobs data was revised higher by a net 95k. The unemployment rate rose slightly to 3.6% as the labour force increased by 325k. Employment grew the most in the leisure & hospitality sector, although healthcare, professional & business services and construction all posted increased hiring. Manufacturing jobs showed the biggest decline last month, reflecting the GM strike, and should rebound as those workers return in November. Overall, despite relatively muted wage growth of 0.2% m/m, the October payrolls data confirms that the US labour market remains strong, and bodes well for consumption heading into the fourth quarter. It also adds support to the view that the Fed is likely to remain on hold for the rest of this year.

In the Eurozone, advance Q3 GDP data came in slightly better than forecast at 0.2% q/q, unchanged from Q2. The market had expected a slowdown to 0.1% q/q. However, annual GDP growth remains soft at 1.1% y/y and inflation in October slowed further to 0.7% y/y from 0.8% in September. The preliminary Eurozone GDP data suggests that Germany likely avoided a technical recession in Q3, although official data will only be released later this month.

In Saudi Arabia, Aramco has announced it will list on the Tadawul stock exchange with trading likely to start in December. Reports indicate a valuation of USD 1.6-1.8bn is being targeted, although some banks have suggested the valuation may be lower. Aramco also announced lower tax rates that would come into effect in 2020 and incentives for retail investors. Separately, the Ministry of Finance released its pre-budget statement over the weekend, showing that both revenue and expenditure are likely to come in lower than the original budget targets for this year. The government expects the budget deficit to narrow to 4.7% of GDP this year, before widening to -6.5% of GDP in 2020. Importantly, the government has signalled a -2.7% decline in expenditure in 2020, as revenue is expected to be down -9.2% y/y.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries ended the week higher after digesting a neutral rate cut from the Federal Reserve, stronger than expected jobs data and slightly disappointing manufacturing data. A revival in risk sentiment held little sway on USTs. Overall, yields on the 2y USTs, 5y USTs and 10y USTs ended the week at 1.55% (-6 bps w-o-w), 1.54% (-8 bps w-o-w) and 1.71% (-8 bps w-o-w).

Regional markets continued to trade in a very tight range. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained flat w-o-w at 3.28%. The yield has remained in a narrow range of 5 bps since the start of October 2019. Having said that, credit spreads rose 6 bps w-o-w to 160 bps.

FX

Last week’s increase of 0.77% resulted in EURUSD closing the week at 1.1166. As a result of the movement, the price was able to break back above the 100-day moving average (1.1124) as well as the 38.2% one-year Fibonacci retracement of 1.1143. The weekly close above these levels opens up a possibility of a test of the 1.12 level, not far from the 200-day moving average (1.1197). Should this hurdle be overcome, then we can expect a retest of the 50% one-year Fibonacci retracement (1.1224) and the 50-week moving average (1.1233) to follow in quick succession.

A 0.87% increase in GBPUSD over the last five days means that GBPUSD was able to reverse the decline from two weeks ago and advance further. Currently trading at 1.2946, the price is still well above the 61.8% one-year Fibonacci retracement (1.2838) and the formerly resistive 50-week moving average (1.2733) which was breached two weeks ago. Analysis of the daily candle chart shows that the 50-day moving average has performed a golden cut on the 100-day moving average, indicating that further gains are likely in the week ahead. Should the 76.4% one-year Fibonacci retracement (1.3045) be broken and closed above, we could see the price testing the 50-month moving average (currently 1.3254) for the first time since June 2015.

Although USDJPY had a constructive first day of trading last week, these gains were quickly reversed and the price closed 0.45% lower on Friday at 108.19. Of note is that the price tested the 200-day moving average (109.04) on three days last week, the first time it has tested this key level since May 2019. Although these tests failed, the price closed just above the 38.2% one year Fibonacci retracement (108.18). Having now closed above this level for the previous four weeks, it is too early to rule out further upside for USDJPY. Analysis of the daily candle chart also shows the 50-day moving average has completed a golden cut on the 100-day moving average and the 14-day RSI (Relative Strength Indicator) has shifted to show a bullish bias. This leaves us to conclude that further gains may be realized in the week ahead, with the first hurdle being the previously mentioned 200-day moving average.

Equities

Regional equities closed largely lower as investors possibly pared existing positions to prepare for the IPO of Saudi Aramco. Both the DFM index and the Tadawul closed more than 1% lower.

Saudi Aramco provided further details about the proposed offering which included bonus shares for retail investors if they retain the stock for six month, more details about changes to the royalty payment to the government and their proposed capex plans. The company plans to issue its prospectus on 9 November 2019.

Commodities

Oil prices closed the week with a bit of positive momentum on hopes that a US-China trade deal could be reached soon. Brent futures jumped more than 2.4% on Friday to settle at USD 61.69/b while WTI added 3.7% to close at USD 56.20/b. Commentary from China’s Commerce Ministry appears to have sparked the rally thanks to a “serious” conversation between trade representatives from both the US and China. However, oil futures still ended the week lower thanks to sluggish performance across much of the rest of the week.

Saudi Aramco has officially begun its IPO process, notifying the domestic exchange of its intention to list. We expect oil markets to fixate on Aramco news over the coming weeks including the publication of the company’s prospectus which may shed more light on production costs and outlook, dividend strategies and how the company plans to adapt in a world on the verge of a substantial energy transition away from oil and gas. Already the company has announced some changes in royalty schemes, lowering the rate to 15% from 20% on Brent prices below USD 70/b but raising it on higher price levels (45% on USD 70-USD 100/b and 80% on +USD 100/b).