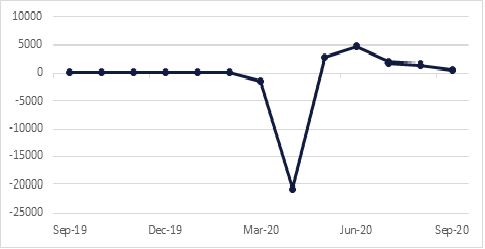

The US Labor Department’s employment report showed nonfarm payrolls added 661,000 jobs last month, the smallest gain since the jobs recovery started in May, after increasing 1.489 million in August. Every sector added jobs, except the government sector, which shed 216,000 jobs because of the departure of temporary workers hired for the census and as a shift to online learning in schools resulted in layoffs at state and local government education departments. Employment in the leisure and hospitality sector accounted for nearly half of the gain in nonfarm employment rising by 318k. Payrolls are 10.7mn below their pre-pandemic level, with just over half of the 22.2mn jobs lost during the pandemic being recouped. Employment growth peaked back in June when payrolls jumped by a record 4.8mn jobs. There were 3.8mn people who had lost their jobs permanently, up 345k from August. The unemployment rate fell to 7.9% in September from 8.4% in August as 695k people left the labor force.

Eurozone inflation fell to -0.3% y/y in September, its lowest in more than four years, from -0.2% a month earlier. Core inflation, which excludes volatile food and energy costs, dropped to 0.4% from 0.6%, well below the ECB’s target of almost 2%. Furthermore services inflation slowed and the cost of imported industrial goods fell. The figures on Friday are raising pressure on the European Central Bank to add stimulus, as an ongoing recession will likely keep price growth below its target for years to come. However markets don’t expect action soon, as ECB policymakers have long said that more data, particularly around 2021 fiscal policies, will be needed before they can take further steps

On Friday, Saudi Arabia’s King Salman issued an order exempting real estate deals from a 15% value-added tax (VAT), imposing a new 5% tax on transactions. The government in July tripled VAT to 15% to boost non-oil revenues, however this has impacted domestic demand. The government will bear the cost of the new real estate transaction tax for properties worth up to 1mn riyals for Saudi citizens purchasing their first home. The step comes as the kingdom seeks to invigorate an economy impacted by the double whammy of low oil prices and the COVID-19 pandemic, with the economy shrinking by 7% in the second quarter and unemployment hitting a record high of 15.4%. The Saudi Housing Minister said the tax cut would help attain a target of increasing housing ownership by Saudis to 70% percent by 2030.

The Central Bank of Kuwait re-iterated its commitment to maintain the dinar’s peg against a basket of currencies (largely USD). 12m forwards had risen to the highest level since June following the change in Kuwait’s leadership last week, likely reflecting concerns about the government’s ability to finance a widening budget deficit without parliamentary approval of a public debt law.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US treasuries slipped at the end of the week even as the market digested news that US President Donald Trump had contracted Covid-19 and the September non-farm payrolls came in weaker than expected. Markets seem to be pricing some movement on more fiscal stimulus in the US although a deal has yet to be agreed upon by Congressional Democrats and the administration. The curve bear steepened with yields on 2yr USTs flat w/w at 0.1289% while on the 10yr they gained more than 4bps to close with a 0.7% handle for the first time since August.

Emerging market USD bonds held ground last week, snapping three consecutive weeks of losses. Spreads over treasuries narrowed considerably, back to less than 350bps after pushing up over 400bps in the week prior.

S&P revised their outlook on Morocco’s sovereign rating to negative from stable and affirmed the sovereign at ‘BBB-‘. Morocco priced a EUR 1bn issuance at the end of September with a 5.5year tranche at 1.375% and a 10yr at 2%.

Last week the USD recorded a steady decline. The DXY index fell by -0.8% to settle comfortably below the 94 big figure at 93.844. The greenback's firmer tone established in the week prior seems to have been corrective in nature and the news that US President Donald Trump has contracted Covid-19 did not affect major currencies as heavily as other asset classes. USDJPY experienced minimal movement, trading mainly sideways for almost the entire week before declining by -0.23% on Friday to close at 105.29.

The GBP was amongst the biggest movers, rallying by 1.48% to settle at 1.2935. This comes off the back of renewed Brexit hopes after it was revealed that British PM Boris Johnson held talks with EU Commission President Ursula von der Leyen. The EUR advanced by 0.73% and finished at 1.1716. Both the AUD and the NZD recorded significant gains, rising by 1.85% and 1.45% to close at 0.7161 and 0.6641 respectively.

US equities in particular were hit by Friday’s news that US President Donald Trump had contracted Covid-19, the effect of which was compounded by a disappointing NFP jobs report later in the day. The NASDAQ was the biggest loser, dropping -2.2%, while the Dow Jones (-0.5%) and the S&P 500 (-1.0%) held up better. Nevertheless all three remained up on the week, by 1.5%, 1.9% and 1.5% respectively.

Elsewhere, European equities also closed higher w/w, bolstered by expectations of further stimulus. France’s CAC gained 2.0% w/w, Germany’s DAX 1.8%, and the UK’s FTSE 100 1.0%. Asian markets closed lower on the week, although trading was skewed by the unplanned outage in Japan on Thursday and holiday closures in Hong Kong and South Korea on Friday, while China’s markets are closed from October 1 to 8 for Golden Week.

Oil prices sank last week on news that US President Trump has contracted coronavirus and the pending political uncertainty just weeks ahead of a presidential election. Brent futures fell by 6.3% and closed at USD 39.27/b while WTI settled at USD 37.05/b, down almost 8% over the course of the week. Front month spreads in both contracts were broadly weaker over last week as well with the 1-2 month spread in Brent at 0.54/b in contango and USD 0.29/b in WTI.

Total production from OPEC members was broadly flat last month as muted gains from Saudi Arabia, Kuwait and others were offset by a sharp drop in the UAE’s production, down 310k b/d m/m as it seeks to make up for missing targets over the summer months. At 2.68m b/d in September the UAE is not far off its target of 2.6m b/d for Q4. Meanwhile Libya’s production is reportedly increasing week by week and is nearing in on 300k b/d from an average of 150k b/d in September.