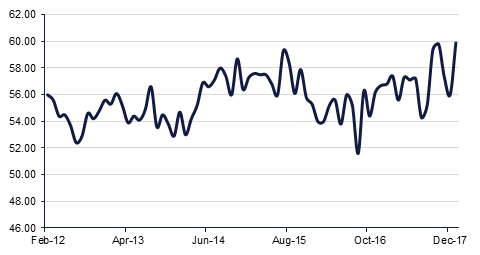

The US ISM non-manufacturing composite data was released last night, and at 59.9 it considerably outpaced consensus expectations of 56.7. The rise in the ISM survey was driven mainly by a surge in the new orders component, which could be a sign that recent US tax cuts are starting to boost demand. The employment index rose to a record high, which was particularly meaningful after Friday, when better-than-expected jobs numbers had a significant effect on markets. US stock indices posted another day of dramatic losses yesterday, and volatility has returned.

India’s Nikkei Markit Services PMI came in at 51.7 in January, rising from 50.9 in December. This indicator is among the latest high frequency data points which support our view that growth is picking up as disruptions induced by the goods and services tax bill introduced last year dissipates. Having said that, concerns over a pick-up in inflation remain and that is likely to weigh on the Reserve Bank of India when it meets later this week. The RBI is expected to keep interest rates on hold at 5.75%, and to maintain a neutral stance.

Turkey’s CPI inflation fell to 10.4% y/y in January, from 11.9% in December, according to data released by Turkstat on Monday. This is down from a 13-year peak of 13.0% in November, and was lower than consensus expectations of 10.6%. Cheap credit conditions in Turkey have fed inflationary pressures in recent quarters, but these have been salved somewhat over the past two months by US dollar weakness prompting an appreciatory lira. President Erdogan has been a vocal opponent of hiking rates in the past, but in an emailed statement, Deputy Prime Minister Mehmek Simsek said that the government would increase efforts to bring inflation back down to single digits.

Saudi Arabia has announced plans to fund subsidised home loans to the tune of SAR120bn, as part of a plan to boost private home ownership from around 50% to 60%. The aim is that the mortgage market will grow by over 70% by 2020, ideally through greater private-sector involvement. The government provides 65% of home loans at present, but Housing Minister Majed Alhogail hopes that this will change. This ties in with the wider aims of the Vision 2030 development plan.

US Treasuries rallied following the strongest risk-off move in the past few months. The S&P 500 index dropped -4.0% and the VIX index simply doubled. Yields on the short-end of the curve was lower by 10 bps with yields on the 2y USTs, 5y USTs and 30y USTs closed at 2.02% (-12 bps) and 2.43% (-15 bps) respectively.

Regional bonds still continue to trade in a relatively tight range with the YTW on the Bloomberg Barclays GCC Credit and High Yield index rising 2 bps to 3.98% and credit spreads widening by 8 bps to 1.49%.

Issuers in the GCC have issued bonds totaling USD 12.7bn in January, the most on record and the trend is set to continue with multiple banks in the market at the moment.

AUD underperforms this morning, losing ground against the other major currencies. The currency has weakened in the aftermath of softer than expected economic data and no action from the RBA. The central bank decided to leave the RBA Cash Rate Target unchanged at 1.50% for the 16th consecutive meeting. The AUD came under pressure after policy makers communicated that the increases in inflation and a reduction in unemployment were likely to be gradual, despite positive data over the summer. In addition, data released from the Australian Bureau of Statistics showed that the trade surplus in November of AUD 36mn had reversed into a trade deficit of AUD 1.358mn in December, disappointing for expectations for a surplus of AUD 200mn. As we go to print, AUDUSD trades 0.26% lower at 0.7857 and is on target to fall for a seventh day. We see the next support at 0.7828, the 61.8% one year Fibonacci retracement, which has held since breached on 2 January 2018.

Developed markets sold off with the Dow Jones Index losing -4.6%. It was the largest single-day sell off in six-and-half years. While there was no apparent trigger, fears over inflation seems to the driving force. The VIX index gained +115.0% to top 37.0 level. Such sharp sell-off would have triggered various stop-loss levels and that is likely to have exaggerated the selling.

Regional markets remained largely range bound with the exception of the Qatar Index which lost -1.4%. It appears that most regional markets are in a drift mode with volume moving lower as well.

Oil markets fell victim to the same risk-off selling as other risk assets to begin the week. WTI closed nearly 2% down at USD 64.15/b while Brent fell 1.4% and is now trading below USD 67/b. Market structures remain on a softer footing while the calendar strips for both benchmarks are heading downward.

While most markets moved into a tailspin, gold and most of the precious metals gained as investors sought safe-haven bids. Gold closed up nearly 0.5% at USD 1,339/troy oz while silver had nearly double the gains to close above USD 16.73/troy oz.

Click here to Download Full article