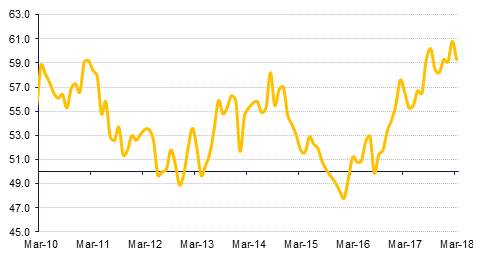

Economic data in the US came in softer than expected, with the headline ISM manufacturing index falling to 59.3 in March from 60.8 in the previous month. The decline was broad based, with the new orders index falling modestly to 61.9, from 64.2, and the employment index slipping back to 57.3, from 59.7. The prices paid index climbed to a seven-year high of 78.1, from 74.2, mainly as a result of an 8% y/y decline in the dollar. The surprise element was the drop in public construction spending which alludes to slowing investment growth. That said, the data is consistent with annualised GDP growth of circa 2% which is in line with the previous years’ readings, whereby the first quarter generally reflects weaker growth compared to the following quarters.

President Abdel Fattah el-Sisi has won a second presidential term with 97% of the votes, exceeding the 92% reported in preliminary results. While turnout dipped to 41%, from 47% at the 2014 presidential election, the strong victory will be seen as a mandate for continued economic reform. On the economic front, Egypt’s net international reserves climbed to USD42.6bn in March. While this marked a record high, the pace of accumulation has slowed considerably, given that reserves stood at USD42.5bn in February.

Further details surrounding the discovery of a huge shale and natural gas deposit off Bahrain’s west coast are planned for release tomorrow. Following on from the positive sentiment generated on the back of this ‘find’, the Bahrain sovereign may plan to re-approach the bond market for completing bond sales that were shelved last week.

Looking ahead, the Reserve Bank of Australia is expected to leave cash rate unchanged at 1.5% at its meeting this morning mainly as inflation remains below the central bank’s 2-3% target range. Also due later today is PMI data out of the Eurozone and from the UK.\

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Softer economic data and continued safe haven bid left US treasury yields range bound with slight tightening bias. Yields on 2yr UST dropped by two bps to 2.25%, 10yr were down by a bp to 2.73% and 30yr yields closed at 2.96% (-1bp). Across the Atlantic, yields on sovereigns remained unchanged as much of the Europe was on holiday. 10yr Gilt and Bund yields are trailing at 1.35% and 0.49% respectively. Credit spreads had a widening bias in the US as rising interest costs and fears of trade wars weighed on investor sentiment. CDS levels on US IG and Euro Main moved in opposite directions, closing at 68bps (+2bps) and 60bps (-2bps) respectively.

Expectations of large new supply continued to push credit spreads in the GCC higher. Option adjusted spreads on Barclays GCC bond index increased another three bps yesterday to 176bps, taking the average yield on the index higher by 2bps to 4.28%.

Primary market expects launch of new deals from SIB, DAMAC and possibly Noor Bank this week.

AUD trades firmer this morning in the build-up to the RBA Cash Rate Target decision. While the central bank is expected to keep the interest rate at a record low of 1.50%, investors will scrutinize the monetary policy statement for further guidance. As we go to print, AUDUSD is trading 0.26% higher at 0.76832 and has pared most of Monday’s losses.

US markets closed sharply lower as technology stocks declined. The S&P 500 index dropped -2.2% while Nasdaq declined -2.7%. European markets were closed for Easter holiday.

Most regional equity markets drifted lower with the Tadawul losing -0.2% and the DFM index dropping -0.9%. Egyptian equities continued to gain strength with the EGX 30 index adding +0.5% to take their year to date gains to +17.8%.

Oil markets fell heavily to start the week on news that Russia’s oil production increased to nearly 11m b/d in March and expectations that Saudi Arabia will cut its official selling price in May. Brent futures are recovering slightly this morning at USD 67.84/b while WTI is up around 0.25% at USD 63.17/b.

Click here to download full publication