.jpg?h=457&w=800&la=en&hash=45B6B2C3F97ABA931EEDBCC40CF43FE2)

The G-20 meeting over the weekend provided some succour to financial markets following the notable bilateral between the US President Donald Trump and Chinese President Xi Jingping. The initial details about the meeting suggest that both sides have agreed to a 90-day ceasefire on fresh tariffs with the US also holding onto the increase in tariffs from 10% to 25%. It was also said that China will be buying more agricultural goods from the US. While further details about meeting still remains vague, it does appear that China has made some soft commitments. The US President alluded to it in his tweet where he said that China will reduce import duties on cars.

There was also a bilateral meeting between the Russian President Vladimir Putin and Saudi Arabia’s Crown Prince Mohammed Bin Salman where both sides decided to continue the agreement on oil production cuts into 2019. This sets the stage well for the official OPEC+ meeting scheduled for later this week.

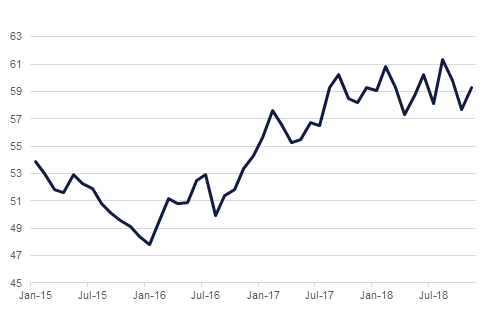

The US ISM manufacturing data for November came in at 59.3, stronger than consensus estimates of 57.5 and previous month’s reading of 57.7. The rebound was primarily driven by a jump in the new order component which rose to 62.1 from 57.4. However, with the new export order component remaining unchanged at 52.2, it appears that domestic demand in the US continues to remain strong. The data point becomes important at a time when Fed officials are increasingly conveying the message that the trajectory of further rate hikes will depend firmly on the economic data.

At its last meeting of the year, the Reserve Bank of Australia left the cash rate unchanged at 1.5%. The decision was in line with consensus expectations. The central bank expects the GDP growth to average around 3.5% over this year and next and inflation to pick up gradually over the next year with expectations of 2.25% in 2019.

Treasuries closed mixed as inflation expectation for 2019 continues to drop and comments from Fed officials indicate a more cautious approach in 2019. The Federal Reserve Vice Chairman Richard Clarida said that he is more concerned about falling short of the 2% inflation target than running past it. Yields on the 2y UST, 5y UST and 10y UST closed at 2.82% (+4 bps), 2.81% (flat), 2.96% (-2 bps).

Regional bonds rallied sharply following a move in benchmark yield over the weekend. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped 5 bps to 4.67% and credit spreads tightened 4 bps to 182 bps.

S&P affirmed Bahrain’s rating at B+ with stable outlook.

The AUD is holding steady against the other major currencies in the aftermath of the RBA decision. The central bank kept interest rates at a record low of 1.50% for a 28th consecutive month. Governor Philip Low highlighted that “growth in household income remains low, while debt levels are high and some asset prices have declined”, showing that policy makers are assessing the impact of the housing market slowdown on the economy. In November, house prices had posted their largest monthly decline since the global recession. As we go to print, AUDUSD is trading 0.15% higher at 0.7370 with resistance expected at the 200-day moving average (0.7416).

Developed market equities closed higher as sentiment improved following an agreement between the US and China for a 90-day ceasefire on the fresh tariffs. The S&P 500 index and the Euro Stoxx 600 index added +1.1% and +1.0% respectively.

Regional stock markets also closed higher following a sharp move up in oil prices. The Tadawul and the Qatar Exchange added +0.9% and +1.3% respectively.

Oil prices rallied sharply as an agreement between the Russian President and Saudi Arabia’s Crown Prince to extend output cuts into 2019 raised expectations from the OPEC meeting scheduled for later this week. Additionally, the decision of Canada’s Alberta Province to cut production by 325,000 barrels a day also helped boost prices. The Brent oil rallied +5.1% while the WTI oil gained +4.0%.