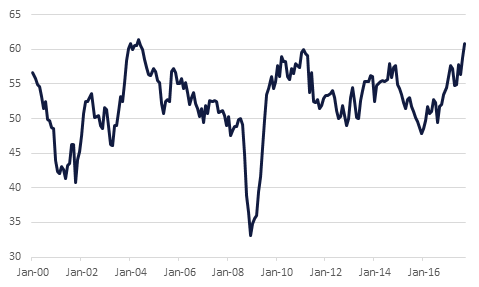

While the EUR has continued to lose ground following the Catalonia ‘yes’ vote in Sunday’s unofficial referendum, the main driver behind its weakness would seem to be the USD which is gaining ground as rate hike expectations continue to grow. Yesterday saw the US ISM manufacturing index reach a 13 year high of 60.8 in September, while US construction spending climbed by 0.5% in August. The data bolsters the case for the Fed to act to hike rates in the coming months, in addition to the tightening in policy that will result from the reduction of its balance sheet which starts this month.

In fact most data released in the last 24 hours appears to show the global economy picking up momentum rather than slowing down which might be expected at this point in the recovery cycle. The Bank of Japan’s Tankan index rose to a decade long high in Q3 with business conditions for large manufacturers rising to 22 from 17 in Q2, while the outlook component rose to 19 from 15 for these companies. The UK fared a little worse with its manufacturing PMI dipping to 55.9 in September, lower than expected, but still a relatively firm reading after two previously strong months.

This region also saw relatively stable to softer outturns from its PMI readings released this morning, with the UAE’s easing back to 55.1 in September, which is the slowest rate of expansion since May, while the Saudi Arabia reading also dipped slightly to 55.5. Egypt’s PMI also declined to 47.4, which was the lowest reading since June.

Finally, the Reserve Bank of Australia left interest rates unchanged at 1.5% at its policy meeting this morning, with the RBA signalling there will be no early departure from current low levels of interest rates. In fact its comments were more pitched towards the risk of slower growth and CPI going forward if the AUD keeps rising.

Source: Emirates NBD Research

Source: Emirates NBD Research

US Treasuries traded in a tight range at the start of the new month following stronger than expected ISM data in the US. Yields on the 2y USTs and 5y USTs remained flat and increased 1 bps on the 10y USTs.

The periphery Eurozone sovereign 10y bonds came under pressure in the aftermath of the results of the unofficial referendum in Spain. Yield on the 10y Italy bond rose 5bps, on the 10y Spanish bond rose by 9 bps. In contrast, yield on the 10y bunds declined by 1 bps.

Regional bond markets continued to remain under pressure from the rise in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 2 bps to 3.54% while credit spreads remained flat at 156 bps.

The Emirate of Abu Dhabi is in the market to raise as much as USD 10bn by issuing USD bonds in three tranches. The initial pricing guidance has been set at T+85 bps for 5y, at T+105bps for 10y and T+150bps for 30y tranche. This is tighter than the pricing of the recently issued Saudi bonds by 25bps to 35 bps across the tranches. The 5y Abu Dhabi CDS is currently at 60 level compared to 85 level for Saudi Arabia. Yield on the current ABUDHABI 21s rose to 2.27%.

According to reports, Kuwait is mulling an annual spending cap of USD 70bn as the country seeks to redefine its debt strategy.

The USD has continued its recent good run overnight benefiting further from the perceived political risk in Spain as well as from rising conjecture about who Donald Trump will nominate to replace Janet Yellen as Fed Chair when her term runs out early next year. Suggestions that Stanford University’s Kevin Warsh might be selected was seen as potentially positive given his previous track record at the Fed after working in the Bush White House. The AUD lost ground following the RBA meeting announcement this morning which repeated warnings about slower growth and inflation if the currency continues to rise.

As we go to print, the dollar index is trading 0.32% higher at 93.863, having closed yesterday firmly above the former capping line of the daily downtrend that had been in effect since 10 April 2017. A further close above this key level today would give further support to our call on Sunday that the next likely route is for the index to climb to 94.034, the 23.6% one year Fibonacci retracement. A breach of this level is likely to catalyse further gains towards the 100 day moving average (94.661).

Developed market equities closed higher on the back of better-than expected manufacturing data from the US. The S&P 500 index and the Euro Stoxx 600 index added +0.4% and +0.5% respectively.

It was largely a positive day of trading for regional equities with the DFM index adding +0.5% and the Qatar Exchange gaining +0.1%. There was no major movements on single names.

Oil markets started the week lower as news of an increase in the US drilling rig count and estimates of higher OPEC production for September dragged on prices. Brent futures closed more than 2.4% lower while WTI gave up more than 2.1%. Persistent militant activity in Libya is threatening one of the country’s largest oil fields which may help temper price declines somewhat. A healthy performance from the dollar also helped to weigh on commodity prices generally.

Market structures continue to ebb from recent highs. Brent’s 1-2 month backwardation compressed overnight and is now trading close to USD 0.3/b while the narrowing of contango at the front of the WTI curve has halted around USD 0.3/b.