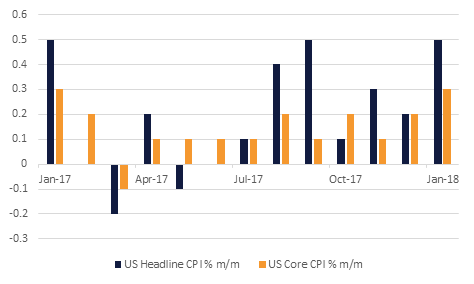

The dollar sold off across the board last night and US bond yields rose further as US inflation increased by considerably more than expected in January. Headline CPI rose 0.5% while the core index (excluding food and energy) rose 0.3%. On a yearly basis headline CPI was steady at 2.1%, and the core y/y growth rate also held at 1.8%. Energy prices grew 3.0% in January, with a 5.7% increase in gasoline prices, and clothing prices surged by 1.7% following a 0.3% drop in December. Even after the strong rise in wages seen in January the increase in CPI has come a lot earlier than many had anticipated, before fiscal stimulus measures have had a chance to have any meaningful impact, so setting the stage for an interest rate rise by the Federal Reserve in March.

The Fed has factored in three rate hikes for this year, which is also our forecast, but the question is likely to turn to whether it will ultimately have to raise interest rates by more than this. Meanwhile January retail sales fell -0.3% m/m, while sales ex-autos were unchanged during the month, which was a slight surprise in the context of rising inflation pressures. However, this dip looks likely to be temporary given the strong fundamentals that should underpin consumption going forward including strong job levels of creation and high levels of consumer confidence.

The other notable development overnight has been the resignation of South African President Jacob Zuma, prompting the South African rand to rise to a 3-year high. The resignation was not a complete surprise as the ruling African National Congress has been plotting for weeks to remove him from office. Zuma is likely to be replaced by his deputy, Cyril Ramaphosa, who is viewed as more likely to promote business friendly reforms and tackle corruption in the run-up to elections due to be held next year.

Treasuries fell on strong CPI data with yields on 2yr 5yr and 10yr rising to 2.18% (+2bps), 2.66% (+3bps) and 2.91% (+1bp) respectively. European government bonds followed suit with 10yr Gilts and Bunds yields also closing higher at 1.64% (+2bp) and 0.75% (+1bp) respectively. However credit spreads reduced as investors took good economic news as ‘good news’. CDS levels on US IG and Euro Main were both tighter by two bps each to close at 56bps and 55bps respectively.

Bonds in the region followed the macro trend. Average yield on Barclays GCC bond index rose 3bps to 4.15%, much in sync with benchmark yield widening even though credit spreads declined 4bps to 154bps. CDS levels on GCC sovereigns, barring Kuwait, have largely remained range bound despite weakening oil prices. 5yr CDS spread on Qatar, Abu Dhabi and KSA closed at 60bps, 91bps and 84bps respectively.

Result announcements in the region have been mixed with Emaar and Aldar reporting better than expected profits and Etisalat missing the estimates yesterday.

The dollar fell across the board last night as inflation shot higher, bond yields rose and markets became alarmed about the prospect of the twin deficits widening in the wake of fiscal stimulus steps announced in the last few weeks. While the dollar initially rallied after the data, sellers quickly stepped in, taking the DXY to lows of 88.84. EURUSD bottomed at 1.2276 before rallying to a high of 1.2473. USDJPY printed 15-month lows of 106.31. USDCAD bottomed at 1.2480, as GBPUSD moved above 1.4000.

The ZAR was also in the spotlight rallying to 11.66 against the USD in the wake of South African President Jacob Zuma’s resignation, the highest levels it has reached since 2015.

Global equity markets shrugged the fear of higher US interest rates crumpling economic growth. After the initial jitters, S&P 500 closed up by more than 1.30% yesterday and Euro Stoxx was up by 0.87%. Asia had closed in green as well and is away for rest of the week for Chinese New Year holidays.

Regional equity bourses were mixed. Kuwait and Qatar were up by 1.61% and 0.81% without any material catalyst, however, Abu Dhabi and Dubai stock exchanges closed weaker despite positive result announcements.

Oil prices increased by the most since December 2017 in the aftermath of the US Department of Energy inventory reports. Compared with expectations for an increase of 3.1 million barrels, inventories grew by 1.84 million. This news in combination with a resurfacing of market risk appetite was constructive for hydrocarbon prices. Since Wednesday morning NYMEX WTI Crude Futures are trading 3.62% higher at USD 61.32/bbl while ICE BRENT Crude Futures are trading 3.46% higher at USD 64.90/bbl.

Click here to Download Full article