UK employment data was mixed for the three months up to April. The overall unemployment rate held steady at 4.2% where it has been for the last three data prints. Total employment rose by 146k jobs, larger than market expectations. However, wages fell below market estimates: earnings (ex-bonuses) rose by 2.8%, slightly slower than the previous print and softer than the market expected. Wage growth has been improving as the labour market tightens and inflation accelerates. CPI data is expected out from the UK later this week which is expected to show price growth of around 2.5% in May.

Investor sentiment in Germany deteriorated in June as the Eurozone economy fixated on political risks in Italy and escalating trade rhetoric with the US. The headline economic sentiment indicator fell to -16.1 from -8.2 a month earlier while the current conditions figure fell to 80.6 from 87.4. PMI figures for Germany have slowed in 2018 and the latest ZEW figures paint a picture of further slow growth ahead.

India’s CPI for May 2018 came in at 4.87% y/y, higher than previous month’s reading of 4.6% y/y. Core inflation rose to 6.18% from 5.92% in the previous month. The increase in inflation was primarily on account of pass-through impact of higher fuel prices. India’s industrial production rose 4.9% y/y in April 2018. The expansion was rather broad based with most categories registering growth. Overall, both these macroeconomic data affirm the broad trend of sustained pick-up in growth along with upside pressure on inflation. It also firms our view that the RBI is expected to hike one more time in FY 2019.

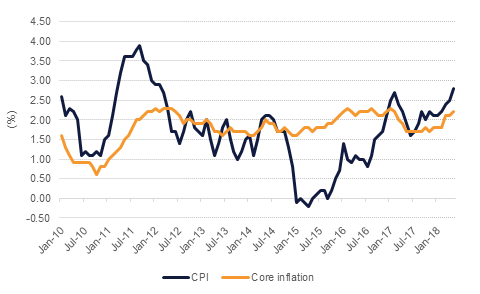

CPI in the US accelerated in May to a six-year high of 2.8% y/y. Core inflation, stripping out energy and food prices, also move higher to 2.2% thanks to low base level effects from 2017 and broad price growth across sectors. This is the last major data point ahead of today’s FOMC meeting and will affirm market expectations for a rate hike by the Fed. Most of the market will, however, be watching the language from the Fed in how they assess how many more rate hikes the economy can absorb this year.

Treasuries traded in a tight range ahead the Fed decision later today. The Fed is widely expected to raise rates by 25 bps. According to reports, Fed Chair Jerome Powell is considering taking questions after every meeting. Yields on the 2y UST, 5y UST and 10y UST closed at 2.53% (+1 bp), 2.80% (+1 bp) and 2.96% (+1 bp).

Regional bonds drifted marginally lower as it continued to trade in a tight range. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +1 bp to 4.64% and credit spreads widened 1 bp to 188 bps.

The dollar gained against the other majors after inflation accelerated to a six year high (see macro), as investor expectations over tighter Fed policy were raised. Over the course of the day, Dollar Index rose 0.22% to reach 93.82 and is currently trading 0.10% higher in the Asia session at 93.89. We expect initial resistance at the 61.8% one year Fibonacci retracement (94.20) followed by stronger resistance at the 200 week moving average (94.91), a level which capped and repelled gains last week.

The main catalyst of dollar strength going forward will be the updated forecasts from policy makers at the Federal Reserve. Should economic projections be upgraded, it could significantly contribute to further gains for the greenback.

With the US-North Korea summit now behind us, the focus of investors shifted to the various central bank meetings and important decisions in the Brexit process. The S&P 500 index added +0.2% while the Euro Stoxx 600 index dropped -0.1%.

Regional market closed mixed as volumes dropped ahead of the Eid holidays. The DFM index declined -0.6% while the Tadawul added +0.3%. Stocks which have rallied in the recent past saw profit booking.

Oil prices split yesterday as WTI gained 0.39% and Brent lost around 0.76%. OPEC monthly oil market report showed the producers’ bloc giving an uncertain outlook for oil markets in the second half of the year, particularly centred around demand. OPEC is poised for a difficult meeting next week as various members debate whether or not to raise production to try and stem prices from rising too quickly. Also out overnight, the EIA raised its expectation for US oil production growth this year to more than 1.4m b/d from 1.37% previously.

Click here to Download Full article