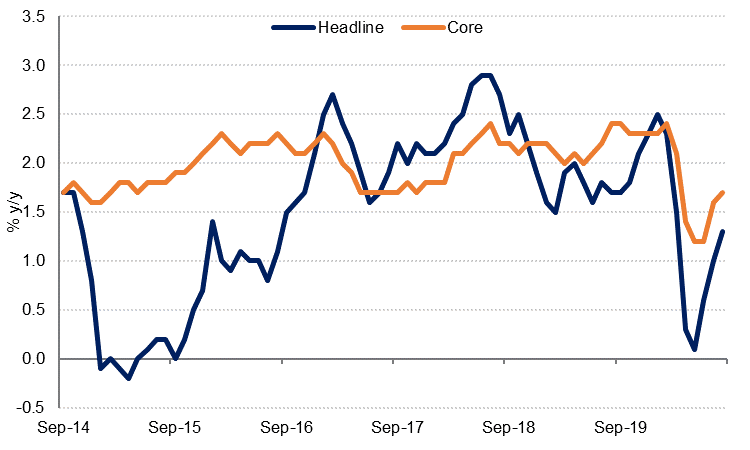

US inflation rose by a larger than expected 0.4% m/m (1.3% y/y) in August, with core inflation also up 0.4% m/m (1.7% y/y). The main driver was a surge in used car and truck prices, which accounted for 40% of the rise in core CPI last month. Rising prices in other goods categories (such as household furnishing and apparel) could reflect lower inventories as manufacturing in some sectors is still catching up with recovering demand. Meanwhile, the senate did not pass the “skinny” USD 650bn relief bill proposed by the Republican Party last week, and it seems much less likely now that any new stimulus will be approved before the November presidential election. The focus this week will be the FOMC meeting, scheduled to finish on Wednesday. While the Fed is not expected to announce any policy changes, the market will be looking for revisions to economic forecasts and adjustments to forward guidance.

As expected, the ECB made no changes to monetary policy at its meeting last Thursday. ECB president Lagarde indicated that the recovery in the Eurozone was proceeding broadly in line with expectations, but recognised that momentum in the services sector had recently slowed. On the euro, Lagarde stressed that the ECB does not target the exchange rate but would monitor currency developments as they would have implications for inflation. Separately, ECB Chief Economist Philip Lane said that the euro’s appreciation this year had already dampened the inflation outlook. The market expects the ECB to expand its asset purchase programme by the end of this year.

In the UK, economic data for July released on Friday was largely better than expected, except for headline GDP which came in at 6.6% m/m in July against a forecast of 6.7%. Industrial production, manufacturing production and construction output all beat forecasts but services growth was slower than expected. Looking ahead, the expiry of the government’s furlough scheme in October, rising coronavirus cases and increased uncertainty around Brexit are likely to weigh on the recovery in in the coming months. The latter also weighed heavily on the pound at the end of last week. The Bank of England is expected to keep rates on hold on Thursday.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

All eyes will be on central bank decisions this week, with the Fed, the BoJ and the BoE scheduled to meet, following from the ECB at the close of last week. No major changes are expected, but there could be clarification on revised outlooks or forward guidance.

Yields on US treasuries ended the week lower last week, with bond prices rising despite the stronger-than-expected inflation figures released on Friday. Concerns over the recovery and the Fed’s ability to boost inflation longer-term remain to the fore. The 10-year lost five basis points on the week to close at 0.666%, while at the shorter-end the two-year ended the week two basis points lower at 0.127%.

In the UK, Brexit-related concerns kept pressure on gilt yields. The 10-year closed the week eight basis points lower at 0.182%, while the two-year closed five bps lower at -0.126, having traded at record lows earlier in the week.

FX

GBP was by far the biggest mover last week, decreasing by -3.64% on Friday and closing at 1.2796, its lowest point since late July and its biggest weekly drop (over 5% against the USD) since March amid ever-growing Brexit concerns and broad-based USD strength. This marks a fall well below the 50-day moving average of 1.2965. The NZD also underwent a big decline, falling by -0.80% and settled at 0.6666.

The USD continued its positive rebound despite some choppy movement. The DXY index held onto gains of 0.58% and finished at 93.257. Other major currencies failed to establish definitive movement either way. The JPY has remained stable around 106.15, the EUR was largely unchanged at 1.1846 and the same can be said for the AUD which settled at 0.7284.

Equities

US equity indices were the global underperformers last week, as the S&P 500 (-3.3%), the Dow Jones (-2.2%) and the NASDAQ (-5.3%) all closed down w/w. The tech stock rout which began at the close of the previous week was largely responsible, although the sell-off weakened at the end of last week and the S&P 500 and the Dow both closed higher on Friday. Nevertheless, all three remain sharply higher compared to a month ago, with the S&P 500, the Dow Jones and the NASDAQ up 9.9%, 9.1% and 13.2% respectively.

Elsewhere, the Shanghai Composite was also weak, losing 2.8% w/w as fears regarding a rollback of stimulus and rising tensions with the US continued to weigh on sentiment. The Hang Seng also closed down 0.8% w/w. The rest of Asia was broadly positive, however, and European equities also gained on the week, with the CAC, DAX and FTSE 100 gaining 1.4%, 2.8% and 4.0% respectively. Within the region, the Tadawul closed up 1.1% w/w while the DFM lost 0.5%.

Commodities

Renewed concerns over the global economic recovery brought oil markets under concerted pressure last week, with WTI futures losing 9.8% over the period to USD 37.3/b – levels last seen in June. Brent wasn’t much stronger, losing 6.6% to USD 39.8/b – also back at June levels. While OPEC’s 60th birthday celebrations in Baghdad are no longer going ahead this week, the bloc and its associates will hold a virtual meeting, with the easing of its production curb limits firmly in focus. Meanwhile, the potential return of Libyan volumes onto the market could exert greater downward price pressure this week.

Click here to Download Full article