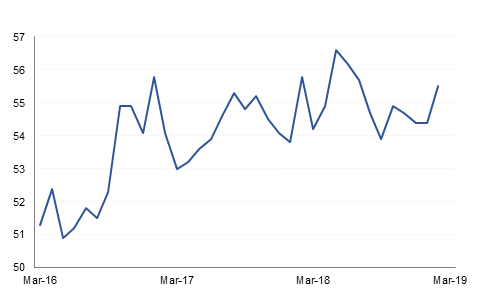

In the US, February Markit Services PMI index rose to 56 from 54.2 in January. The Composite PMI index rose to 55.5 from 54.4 in January though slightly lower than 55.8 reported a year ago. Employment component rose to 55.2 vs 53.2 in Jan, supporting our expectation that the unemployment level in the US is likely to come down from current 4% level which in turn may increase the pace of wage growth and inflation going forward. Also new home sales rose 3.7% in December to 621k, better than expectations and up from 599k in the prior month.

President Trump has announced his intention to end key trade preferences for India and Turkey. India benefits from duty free exports of circa USD 6bn to the US under the Generalised System of Preferences and saves circa USD 190m on tariffs. Financial markets seem to have taken the news in their stride.

GDP growth in Australia in Q4 of last year slowed more than expectations to an annualised rate of 2.3%. Consumption growth was slower and net exports were weaker due to drought hit farming. If growth continues at this pace, the RBA is unlikely to meet its forecast of 3% growth in 2019, thereby increasing the odds for a rate cut.

In the UK, the Markit Services PMI rebounded from 50.1 in January to 51.3 in February which compares with 54.5 a year ago. This rise more than offsets the fall in manufacturing PMI. That said, the increase in Composite PMI from 50.3 to 51.4 still alludes to GDP growth stagnating in Q1. However, if a Brexit deal is agreed, then the release of some pent up consumption and investment demand could spur growth to at or above the last year’s 1.4%.

In the Euro zone, the final February Composite PMI was revised up to 51.9 (flash 51.4) and was higher than January level of 51. However, it still is well below its average level of 53.3 recorded in the second half last year when GDP growth was 0.2% per quarter. The 1.3% increase in retail sales in January is seen as neutral as it followed a revised 1.4% fall in December. The ECB at its meeting on Thursday is expected to revise growth and inflations forecasts downwards for the region.

Lacking any new catalyst, US treasuries were mostly stable. Yields on 2yr, 5yr, 10yr and 30yr USTs closed at 2.54% (unchanged), 2.53% (unchanged), 2.72% (unchanged) and 3.08% (-1bp) respectively. Sovereign bonds across the Euro area were also range-bound albeit with slight hawkish bias with yields on 10yr Bunds and Gilts rising to 0.17% (+1bp) and 1.28% (+1bp) respectively.

Regionally, average yield on Barclays GCC bond index continued to increase, closing 4bps higher to 4.33% yesterday as credit spreads widened by another 4bps to 173bps on the back of receding appetite for risk assets.

In the primary market, Qatar is likely to approach investors with a jumbo USD 10bn offering within a week or two. Emirate of Sharjah is also believed to be talking to banks for a benchmark dollar sukuk.

It was another day of dollar strength overnight with greenback gaining against most of its peers. CAD was among the biggest losers as political pressure on the prime minister mounts while this morning sterling and the Antipodean currencies are off sharply. Negotiations between the UK’s attorney general and EU Brexit negotiators broke off without any ground gained by the UK on revising Prime Minister Theresa May’s Brexit deal. Weak GDP data out of Australia (Q4 GDP expanded just 0.2% q/q) is weighing on the AUD this morning.

EM currencies were more mixed as markets responded to lower growth forecasts from China. The INR managed to extend its gains overnight while EGP and ZAR also strengthened. TRY has continued to drift upward even as inflation data came in better than expected.

European equity markets ended yesterday higher with the FTSE up nearly 0.7% and the CAC and DAX both gaining 0.2%. US markets sagged; the S&P 500 slipped 0.1% despite some positive data out from the services sector and housing market.

Regional markets were negative overnight. The DFM and Abu Dhabi indexes both fell more than 0.2% while the Tadawul was slightly lower on the day.

After a relatively quiet day, oil futures are down this morning in response to a build in US crude stocks reported by the API. Data from the private sector indicated a 7.3m bbl build last week with official EIA data out later today. Brent futures are off around 0.7% to USD 65.38/b while WTI is down 0.8% at USD 56/b. Exxon and Chevron also released forecasts for large increases in production from the Permian basin, the largest shale basin in the US.