As a further sign of economic activity returning to normal, residential housing starts in the US rose more than 22% to 1.5m in July, their best performance since October 2016. The data far outstripped market expectations and the prior month’s level of 1.2mn. Applications for building permits, a better forward-looking figure, also performed well, rising by almost 19% to 1.5mn. Lower interest rates in the US are feeding through to the retail level, easing the costs of mortgage and construction. However, there has been a surge in mortgage delinquencies as job losses or pay cuts take their toll on the economy. Mortgage delinquencies in the US as a share of total loans spiked to over 8% in Q2, compared with just 4.4% in Q1 and less than 4% at the end of 2019. During the peak of the financial crisis delinquencies account for around 10% of total mortgage borrowing.

Exports from Japan were down 19% y/y in July, led by poor external demand for cars and car parts. Japan’s exports have slumped in response to the coronavirus but had already been declining on a persistent basis over the past few years. Machinery orders out of Japan underperformed in July, declining by 7.5% on a monthly basis. The Bank of Japan has extended considerable liquidity support to its banking and corporate sectors to fend off a wave of bankruptcies but the underlying fundamentals for Japan’s economy are only likely to improve once a broader upswing in global growth takes hold.

The trade talks between China and the US that were meant to take place over last weekend were apparently cancelled on the instructions of US president Donald Trump. The president said at an event in Arizona he didn’t “want to talk to China right now” as hostile rhetoric regarding the origin of the coronavirus pandemic remains a tool of the president in his re-election campaign.

Oman undertook a restructuring of ministries, folding several into each other and appointing a new finance minister, Sultan al Habsi, and new foreign minister, Bader al Busaidi. The ministry of oil has also been expanded and restructured to the ministry of energy and minerals.

Algeria’s economic reform programme is moving ahead, as President Abdelmadjid Tebboune has said that the country will allow privately operated banks and air and sea transport firms for the first time. Under long-serving President Bouteflika, who stepped down in the face of popular protests last year, Algeria was governed along the state-led developmental model, with very little space for the private sector or foreign investment.

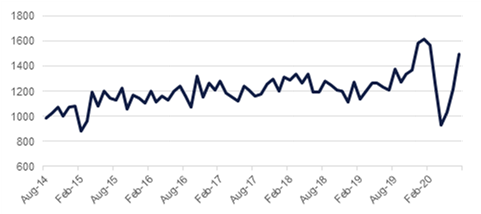

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Bond markets generally were higher as investors continue to hedge positions in equity markets—which have hit record highs. Yields fell across most of the UST curve although the moves were moderate. Yields on 2yr USTs closed at 0.14%, down less than 1bp while 10yr yields were off a little less than 2bps at 0.67%.

The moves in the US were broadly matched in Europe with modest declines on French and German 10yr bonds. The only notable outlier was the UK where yields ticked up marginally.

It was yet another day of losses for the dollar. The DXY index declined by -0.6% to close at 92.271. A deadlock in fiscal stimulus talks alongside further tensions between the US and China on Huawei has kept the dollar under pressure. USDJPY fell by -0.56% to trade at 105.41, a level close to the 38.2% one-year Fibonacci retracement.

Meanwhile the euro soared to a daily high of 1.1966, its highest point since May 2018, and currently sits at 1.1935. Sterling was the real winner of the day, advancing by over 1% to trade at 1.3240 amid the resumption of face-to-face Brexit negotiations. The AUD managed to extend recent gains to trade up to 0.7240 even as minutes from its latest meeting highlighted the negative effect of a resurgence in Covid-19 cases in some states. It was slightly more positive for the NZD which also increased to 0.6600.

After closing just shy of it for the past week or more, the S&P 500 closed at a new record of 3,390 yesterday, gaining 0.2% on the day. The index is now up 4.9% ytd, having regained all its pandemic-related losses in a spectacular recovery driven by fiscal and monetary support in the face of the still-salient threat to the economy of the ongoing spread of coronavirus. If agreement is reached by US politicians on renewed fiscal support, the index could push higher yet. Aside from the Shanghai Composite and the Kospi, most other major indices continue to languish with double-digit ytd losses still. Germany’s DAX has fared comparatively well, down only 2.8% ytd now, but it closed down 0.3% yesterday, alongside losses in the UK (the FTSE 100 closed down 0.8% as the pound strengthened and the high street shed more jobs) and France (the CAC lost 0.7% yesterday).

Oil markets were generally flat ahead of the OPEC+ JMMC. Brent futures continue to hold onto a USD 45/b handle while WTI is struggling to push above USD 43/b. We don’t expect much change in policy from OPEC+ later today as the absence of volatility in oil markets at the moment should be taken as a win compared with what the market endured over March-May. More clarity on how producers that fail to hit targets can make up for past misses may emerge as one possible outcome.

API data showed a draw in US crude stocks of 4.3mn bbl last week but a substantial build in gasoline of almost 5mn bbl. The US holiday driving season—if there was one this year—is coming to a close and the elevated level of gasoline stocks will remain a burden for oil market structures.