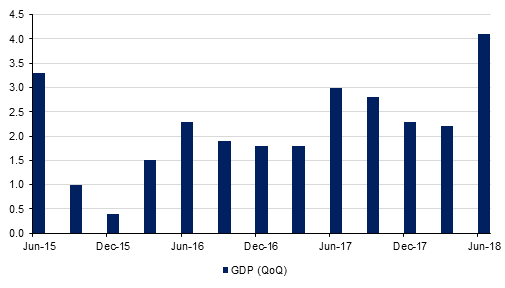

US Q2 GDP growth, released on Friday, expanded by 4.1% on an annualized basis broadly in line with consensus expectations but a little softer than some rumours had suggested. Consumption and business investment were the main drivers of growth, with support also coming from net exports. Fiscal stimulus measures, including the Trump tax cuts, were probably responsible for some of this strength, but may not be counted on to last which might mean that the Q2 growth rate may well turn out to be the high water mark of the current growth cycle.

Consequently a rate hike at the upcoming Fed meeting this week is unlikely, but a September move looks more certain. A December rate hike is also probably still a reasonable assumption, but this will depend on the data remaining firm through the rest of the year, which is not a done deal, especially with past rate hikes still to bite and with trade tensions remaining. The core PCE inflation rate increased by 2.0% annualized and the y/y core rate rose to 1.9% very close to the Fed’s target.

Central banks will feature prominently in the week ahead following on from the ECB’s unchanged rate decision on Thursday. ECB President Draghi struck a dovish tone at the ECB’s press conference, with the Bank reiterating its ‘patience’ regarding the first increase in interest rates which is likely to come pretty late next year, and then to proceed gradually after that. Mario Draghi did say that ‘the exchange rate is not a policy target’ but he also indicated the ECB would not be rushed into early hikes by charges of currency manipulation. The Eurozone also sees a lot of data in the coming week with the highlight being Eurozone Q2 GDP, which is expected to have risen by 0.4% the same as in Q1.

Focus will also be on the BOE and the BOJ which both meet this week as well as on the RBI. Interest rate increases are expected in the UK and in India, but the BOJ meeting is an enigma as the BOJ has been hinting (somewhat incongruously in view of still low inflation) that it is mulling a move away from its zero percent yield curve target. Worries that such a move could be an early warning of a shift away from ultra-low policy rates saw JGB yield spike higher last week, which forced the BoJ to step in and offer to buy an unlimited amount of paper.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

U.S. treasuries prices have remained steady as the markets open with the 2 year yield currently unchanged at 2.6694 while the 5 year yield remains at 2.8428 and the 10 year has climbed by almost 1 bps to 2.9600. Despite future volumes trading at approximately 80% of their regular average, 10 year futures have remained supported by a declines in US equity futures and have resulted in the a steepening of the U.S. curve.

The dollar was steady last week dipping slightly after Q2 GDP growth, released on Friday, expanded by 4.1% on an annualized basis broadly in line with consensus expectations but a little softer than some rumours had suggested. The JPY has softened a little going into today’s BOJ meeting, with markets starting to doubt whether the BOJ will go ahead with the changes to its yield curve target as have been rumoured.

As we go to print, the Dollar Index is trading 0.06% higher at 94.722, remaining above the 50 day moving average of 94.424 that was breached towards the end of last week. While the index remains above this level, a retest of the 2018 highs of 95.652 remains a possibility.

Global equities had mixed results on Friday. US markets closed in the red with the S&P 500 losing 0.66% to close at 2818.82 while the Nasdaq fared significantly worse and declined 1.46% to fall to 7737.42. On the other side of the Atlantic, European markets gave a stronger showing with the Euro Stoxx 50 gaining 0.51% to reach 3527.18 while the DAX gained 0.40% to close at 12860.40. Matching the performance of their global counterparts on Friday, regional equity markets had mixed results and while the ADX, DFM and Tadawul closed 0.3%, 0.2% and 0.7% lower respectively, Muscat gained 0.1% while Qatar Ex gained 0.2%.

This morning, Asian equity markets have opened with a negative performance and as we go to print, the Nikkei is trading 0.72% lower, while the Shanghai Composite is 0.16% in the red.

Brent futures closed at USD74.29/b on Friday, a w/w gain of 1.7%, while WTI closed the week down 2.5% at USD68.69/b. The widening spread between the two contracts was likely driven by a combination of rig count data from the US released Friday and geopolitical tensions in the Middle East. US rig count data showed that active oil rigs rose by three over the week, taking the total number up by 90 as compared to the same time last year. US production remains at the high levels of 11.0mn b/d. Meanwhile, an attack by Houthi militia on Saudi oil tankers at the end of last week has led to a temporary suspension of Saudi shipments through the key Bab el-Mandeb waterway, which introduces a new potential supply constraint for the increased volumes Saudi Arabia is producing as of the past several months.