The US FOMC left the funds rate band unchanged at 1.25% to 1.50%, as expected, and slightly upgraded its outlook on growth and inflation, saying that the Committee ‘expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate’. The Fed said ‘the labor market has continued to strengthen and that economic activity has been rising at a solid rate’. In December the Fed also said the economy was ‘solid’ although it indicated that household spending was rising ‘moderately’ and fixed investment ‘remained soft’’. On inflation the Fed said that ‘Market-based measures of inflation compensation have increased in recent months but remain low’ whereas in December the Fed said market based measures were ‘little changed.’ The statement is certainly consistent with a 25bp tightening at the March meeting, and the FOMC is also likely to leave the dot-plot unchanged showing three rate hikes overall this year.

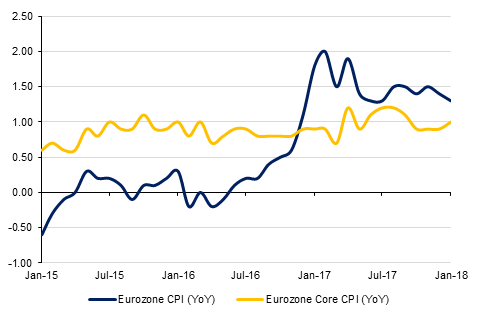

Inflationary pressures remain lethargic in the Eurozone with headline inflation dropping to 1.3% in January compared to 1.4% in December, in a fall that can be largely attributed to a decline in energy prices. In contrast to the drop in headline inflation, core consumer price inflation actually accelerated from 0.9% to 1.0% during the same period, which is likely to help the ECB policy makers overlook the slow down.

Turkey’s trade deficit widened by less than expected in December. Compared with market estimates for an expansion to USD 9.6bn, the trade deficit grew to USD 9.21bn, up from USD 6.34bn the previous month. This data means that Turkey’s trade deficit widened from USD 56.1bn in 2016 to USD 76.7bn last year, as cheap credit boosted household and business spending. The wider trade deficit raises risks in Turkey, as an overreliance on hot money inflows leaves the country more susceptible to balance of payments crises.

With the Federal Reserve statement coming in line with broad market expectations, month-end balancing drove US Treasuries. Yields on the 2y UST closed at 2.14% (+2 bps), 5y USTs 2.51% (+1 bps) and 10y USTs at 2.70% (-1 bps).

Regional bonds remained largely unchanged as it is now following the move in benchmark yields and absorbing the flurry of new supply. The YTW on the Bloomberg Barclays GCC Credit and High Yield index closed at 3.90% and credit spreads remained flat at 144 bps.

NZD outperformed on Wednesday, gaining against all the other major currencies. The kiwi found itself supported by AUDNZD selling following softer than expected Q4 2017 Australian inflation data. Data from the Australian Bureau of Statistics showed that consumer prices rose 1.9% y/y in Q4 2017, up from 1.8% in Q3 but missing expectations for a gain of 2.0%. NZDUSD has reversed the losses earlier in the week and is now on target to rise for an eighth consecutive week, its longest winning streak since 2009.

Developed market equities closed mixed with the S&P 500 index adding +0.1% and the Euro Stoxx 600 index losing -0.2%. While the Federal Reserve kept rates unchanged, it did signal a push towards higher rates in 2018.

Regional equities closed mixed with the DFM index losing -1.3% and the Tadawul adding +0.3%. Banking sector stocks continue to lead the Tadawul higher. Elsewhere, it was simply a case of investors’ locking in their gains. Emaar Properties has now lost -3.7% since the stock went ex-dividend.

Oil prices remained largely unchanged following mixed inventory data from the US. While crude stockpiles rose by 6.78mn barrels, US gasoline inventories dropped by 1.98mn barrels last week.