.jpg?h=457&w=800&la=en&hash=ED011365D0E77B067B9CB442FF265B0E)

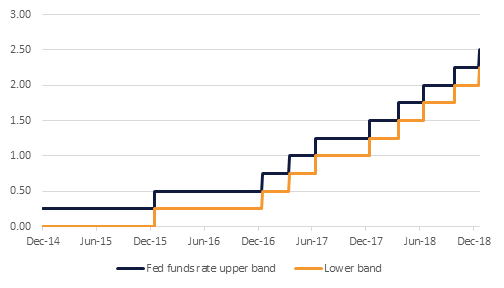

The U.S. Federal Reserve Open Market Committee (FOMC) voted unanimously to raise interest rates by 25bps yesterday as expected, taking the fed funds band to 2.25-2.5%. However, the Fed cut its growth and inflation forecasts and lowered the dot plot to imply two hikes in 2019 instead of three, in line with our own forecast. The new median projection puts the fed funds rate at 2.9% by end-2019 and 3.1% by end-2020, down from 3.1% and 3.4% in the September projections. At the same time the median estimate of the neutral rate was also lowered to 2.8%, from 3.0%. The statement said there was still a need for "some further gradual increases in the target range for the federal funds rate," although the addition of the word ‘some’ tempered the impact slightly. The FOMC also said that that the balance of risks is ‘roughly balanced’ and it ‘will continue to monitor global economic and financial developments and assess their implications for the economic outlook’ signalling greater data dependence going forward. On the whole the Fed’s actions fell a little short of the ‘dovish’ hike that was expected by the markets, with the FOMC shrugging off recent market turmoil and appearing intent on continuing the tightening process. The USD firmed as a result and equity markets sold off.

UAE inflation eased to 1.34% y/y in November down from 1.62% in October and 4.7% at the start of the year. The inflation rate continues to reflect the dwindling impact of the introduction of VAT at the start of the year, and next year this will also fall out of the base. Also of note was the -5.53% y/y drop in the housing, fuel light and water component in November which would seem to reflect both lower oil prices and the weak property sector.

UK inflation also declined to 2.3% in November from 2.4% in October as expected largely reflecting the fall in oil prices. Given that oil prices have continued to fall in December the likelihood at the moment is that UK inflation will fall further this month, taking it closer to the BoE’s 2.0% forecast. This will a BOE rate hike in the coming months less likely irrespective of how Brexit proceeds.

This is the last Daily Outlook until January 7, 2019. We wish you all the best for the holiday season!

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

US treasury yields fell after the Federal Reserve raised benchmark rates by 25bps and lowered its projections for rate hikes in 2019 to two from three. The Fed was less dovish than the market had been looking out for and Fed Chair Powell’s comments that the drawdown in the balance sheet would continue was taken as a neutral to hawkish tone. Yields on 10yr USTs dipped nearly 5bps while the 2yr fell less than 1bp. The spread between the two tenors flattened considerably to trading now at just 11bps.

The Fed chair also explicitly said policy no longer “needs to be accommodative” and that the economy continues to perform well. The Fed had come under pressure from US president Trump to hold off from raising rates considering the weakness in US and global equity markets but a lower forecast for the neutral rate suggests that Fed itself may be prepared to slow down from even the two hikes it has forecast for next year.

Earlier in the week Fitch cuts its rating on Oman to ‘BB+’ and put the sovereign rating on stable. The agency cited Oman’s vulnerability lower oil prices and an expansionary fiscal position that is widening its non-oil primary deficit.

In the aftermath of the Federal Reserve not being as dovish as some had anticipated, the USD recovered from earlier losses on Wednesday (see macro). The Dollar Index had fallen as low as 96.55 but recovered to close at 97.10 after the fed raised interest rates for the fourth time in 2018. With policy makers still signalling the need for gradual tightening, we expect USD to remain supported going into the new year.

This morning NZD has given up ground against the other major currencies, following softer than expected economy data. Reports from Statistics New Zealand showed that economic expansion slowed to 0.3% q/q in Q3 2017, down from 1.0% q/q the previous quarter. As we go to print, NZDUSD is trading 0.40% lower at 0.67405, the lowest level in over one month. With the price headed towards the 50-day 0.6734, there is the risk that a break and daily close below this level, leaves the cross exposed to further declines towards 0.6670 (the 100-day moving average).

Developed equity markets had a mixed performance yesterday. In Europe, the Euro Stoxx 50 was able to climb 0.37%, while the DAX gained 0.24% and the FTSE 100 rose 0.96%. Their U.S. counterparts were less fortunate and while the S&P500 retreated by 1.54%, the Nasdaq fell by 2.17% and Dow Jones lost 1.49%. Regional equity markets had similar mixed results and while the DFM and ADX rose by 1.31% and 0.61% respectively, the Saudi Tadawul fell by 1.11%.

This morning begins with Asian equity markets in the red. As it stands, the Japanese Nikkei is currently 1.70% lower while the Shanghai Composite is down by 0.82%

Oil prices managed to rally overnight on a reasonably positive EIA report. Brent gained 1.7% while WTI was up more than 2% at the close. Crude inventories fell slightly and there were decent draws in fuels along seasonal lines (distillates and propane both fell). Production was unchanged. However, yesterday’s gains have already been unwound as the oil market reflects on the Fed’s hike and appear to be declining in sympathy with global equities.

Click here to Download Full article