Last week was a momentous one in terms of economic data, policy responses, and in terms of political developments, all of which will have short and long term implications for financial markets.

The most prominent news saw the U.S. Federal Reserve become more dovish after months of hinting that it was moving in this direction. At its March FOMC meeting the Fed saw fit to remove any tightening from its dot-plot projections through the rest of this year, only retaining one projected hike in 2020. The Fed’s median GDP growth forecast was revised down for both 2019 and 2020, and while Fed Chairman Powell re-iterated that policy decisions remain data dependent, it would likely take a very strong rebound in growth and inflation to get the Fed back on its tightening path. As this seems unlikely to happen the Fed has effectively finished its tightening cycle begun in 2015. This not only has implications for interest rates but also for the dollar which weakened initially on the news.

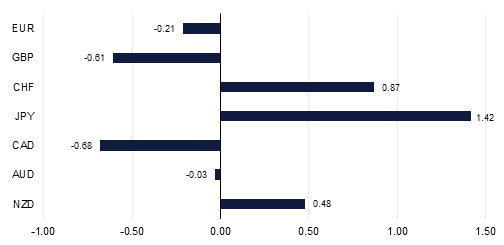

However, subsequent economic data released suggested that the dollar’s course may not be straightforward. In many ways the Fed’s message was eclipsed by bad European economic news at the end of the week which showed the Eurozone composite PMI falling to 51.3 in March from 51.9 in February, suggesting that the Eurozone economy barely grew in Q1. Most striking of all, the German manufacturing PMI dropped to 44.7, its lowest level since 2012 when the German economy was in recession. While the dollar reacted negatively to the message from the Fed on Thursday, the Euro saw even bigger falls on Friday highlighting that it is in the Eurozone where the biggest threat to global growth resides. A tussle between the Euro and the Dollar appears to be looming as to which currency will weaken the most in the coming months, with the Euro for the moment appearing the most vulnerable.

Not to be forgotten in these stakes is also Sterling, with Brexit still ominously hanging over it. Once again the week ended without a definitive conclusion to the Brexit saga after another turbulent few days. And with only five more days to go to the original 29th March deadline (now extended) , rather remarkably all of the options are still on the table between Prime Minister May’s deal, ‘no-deal’, a long term delay, revoke article 50 and another referendum, with an amalgam of other options also likely to be considered in the coming weeks as well. What did change, however, was the timeline, with Brexit effectively being postponed to either 22nd May if Parliament backs May’s deal this week, or 12th April if they do not. EU patience with the May’s government is clearly running thin, but somewhat surprisingly the market’s patience with the pound appears more or less intact. By now it might have been previously assumed that a ‘no-deal’ Brexit would have been written off as a possibility, but it is probably because it has not been that the pound remains rooted in the low 1.30’s, seemingly steady, but in reality still sitting on a knife edge.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg