A massive explosion in Beirut yesterday evening, the cause of which is as yet unknown, presents an additional challenge to a country already struggling with a collection of crises. Swathes of the area around the port have been destroyed and the resulting concerns over regional stability served to push Brent crude higher in the immediate aftermath. The damage could not have come at a worse time for Lebanon, which is striving to reach agreement on a reform plan to take to the IMF. The rapid depreciation of the pound on the parallel market pushed y/y inflation to 89.7% in June, and these latest events will compound the hardship for many.

Turkey’s July inflation print came in at 11.8%, down from 12.6% in June and just beating expectations of 12.0%. On a monthly basis there was a significant slowdown from 1.1% to 0.6%. The surge in inflation over recent months had led the TCMB to pause its rate-cutting cycle at its last two meetings, and raise the likelihood that it would start to hike. While the slowdown in price growth last month diminishes this likelihood, there remains the risk of an inflationary sting in the tail should the lira begin to sell off again.

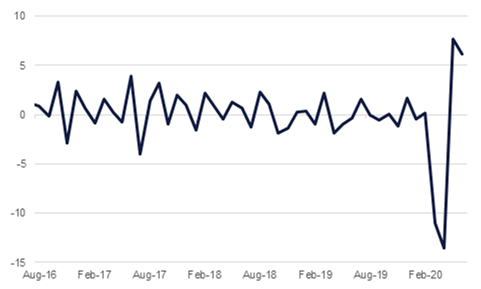

There was more positive news in the US manufacturing sector, as factory orders rose 6.2% m/m in June. While this was slower than the downwardly revised 7.7% climb in May (and orders remain off pre-pandemic February levels), it still beat expectations of 5.0%. The growth was again boosted by a rise in orders for transportation equipment, which rose 20.2%.

The UAE PMI rose to 50.8 in July, from 50.4 the previous month. This marked the second consecutive month of positive, expansionary readings, after the index spent the first five months of the year in sub-50.0 territory.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries rallied further as the market awaits the outcome of negotiations between the Trump administration and Democrats over a new round of fiscal stimulus in the US. Yields at the front end of the curve were little changed while 10yr yields fell nearly 5bps. A deal may apparently be reached as early as the end of this week which should snap the downward move in yields, at least in the short-term.

Emerging market bonds rallied as well, spurred on by a deal between Argentina and private creditors over restructuring the country’s USD 65bn outstanding bonds. Regionally Morocco’s finance minister told the press that a bond issuance could take place in September although no size, tenor or currency was indicated.

There was little apparent reaction in Lebanon’s debt markets following the news of a massive explosion that destroyed sections of Beirut. Government officials have indicated that it was a detonation of explosive industrial material. Yields on Lebanon 2030 USD bond have been marching higher as the country endures an economic crisis and has failed to make headway in negotiating a deal with the IMF. Yields touched 43.35% overnight.

The dollar weakened against most peers overnight, snapping two consecutive days of gains. Uncertainty over whether a new fiscal deal can be reached in the US is pushing UST yields lower and dampening demand for the USD which is extending its losses this morning, down by 0.3% on the DXY index. JPY and CHF were significant movers overnight as markets continue to balance risk and equity market performance. USDJPY fell 0.2% for the pair to settle at 105.72. The 105 level has been a significant support for the pair since 2017, only sliding below it earlier this year during the peak of coronavirus anxiety in March. Meanwhile the Swiss franc strengthened by almost 0.5% against the dollar with USDCHF down at 0.9133 and testing lower this morning.

Elsewhere AUD was up strongly as the RBA kept rates on hold but has restarted buying bonds (AUD is up another 0.4% at 0.72 handle today) while both the NZD and CAD gained.

Trade in global equities was relatively muted yesterday, with the summer slowdown compounded by a dearth of big data releases this week. No surprises are expected from the Bank of England tomorrow so all eyes remain on the US and the likelihood of a new fiscal support package being agreed, but until then the trading will likely remain fairly flat. In Europe yesterday, the DAX closed down 0.3% while the FTSE 100 and the CAC rose 0.1% and 0.3% respectively. In the US, the S&P 500 climbed 0.4%, the Dow 0.6% and the NASDAQ 0.4%. In Asia, the Shanghai Composite rose just 0.1%.

Oil prices rallied a third day running as the API reported a healthy draw in US crude inventories of nearly 9m bbl last week, along with a decline in gasoline stocks. Brent settled up 0.6% at USD 44.43/b while WTI was up 1.7% at USD 41.7/b. There were few other fundamental catalysts to push oil prices in either direction.

More significant was the announcement of BP’s results and its new strategy to strongly move away from oil and gas extraction, pledging to cut output by 40% over the next 10 years and plans to no longer explore for oil in new countries. IOCs, and European ones in particular, are pushing ahead with a major shift in the oil and gas industry to adapt to a lower-carbon economy that may leave regional governments with assets less attractive than they may have been 10 to 20 years earlier.