Better than expected economic data helped propel US equities to record highs yesterday. The ISM non-manufacturing index rose to a six-month high, indicating an improvement in services sector activity in January. This was consistent with the Markit US services PMI which also beat expectations and rose to 53.4 last month. The ADP employment survey showed a much bigger than expected rise in private sector employment in January, with 291k new jobs added, against a consensus forecast of 157k. While the ADP reading is not a particularly good predictor of the overall jobs market, the data has boosted sentiment ahead of Friday’s non-farm payrolls release where the consensus is currently for 163k new jobs added in January.

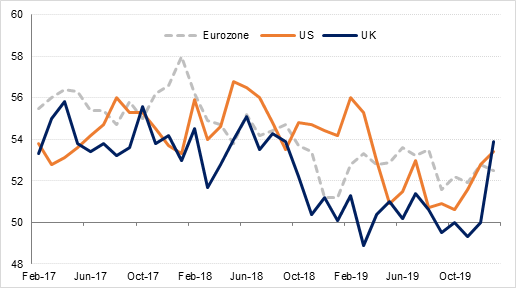

The Eurozone services PMI also came in ahead of forecasts at 52.5, but down from 52.8 in December, while the composite PMI rose to 51.3 from 50.9. However retail sales contracted by a larger than expected -1.6% m/m in December indicating a sharp slowdown in consumption in the bloc in Q4 2019. In contrast, UK data continues to surprise on the upside suggesting that the economy is improving now that some of the political uncertainty has been resolved. The services PMI rose to 53.9 in January, a full point higher than forecast and up sharply from December’s 50.0, while the composite PMI rose to 53.3 from 49.3 in December.

The meeting of OPEC+ technical experts will continue for an unscheduled third day today, as the group has yet to find consensus on how to respond to the impact of the coronavirus on oil prices. Bloomberg reports that the Russians continue to resist Saudi pressue to deepen production cuts even further, but may be open to extending the existing production curbs (announced in December and due to expire end-March) beyond Q1 2020.

Source: IHS Markit, Bloomberg, Emirates NBD Research

Source: IHS Markit, Bloomberg, Emirates NBD Research

Treasuries traded lower as risk appetite continued to rebound. The curve bear steepened with yields on the 2y UST and 10y UST closing at 1.44% (+4 bps) and 1.65% (+6 bps) respectively.

Regional bonds closed flat as investor’s remained cautious amid moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index closed at 3.02% and credit spreads tightened to 143 bps.

The Central Bank of Bahrain cut one-month deposit rates by 15 bps to 2.45%. The lending rates, 1 week deposit rate and overnight deposit facility was kept unchanged.

Amid reports that Qatar sovereign is planning to tap international bond markets as soon as this quarter, Qatar National Bank raised USD 1bn in a 7 year paper which was priced 128 bps over midswaps.

Amid a positive performance on equity markets and increasing risk appetite, USDJPY has climbed towards the 110 level, currently trading at 109.95. The price is currently on course to close above the 50-day moving average (109.23) for a third consecutive day. In addition, the price has also closed above the 61.8% one-year Fibonacci retracement (109.37) during this period. While the price remains above this level, a test of 110.50 is possible in the short term, with the next level of resistance being the 76.4% one-year Fibonacci retracement (110.53).

Developed market equities closed higher as investor’s continued to take a positive view on global economy and shrugged off the short term impact of coronavirus. The S&P 500 index and the Euro Stoxx 600 index added +1.1% and +1.2% respectively.

It was a sluggish day of trading for regional equities with no positive follow through from global markets. The DFM index added +0.2% while the KWSE PM index dropped -0.2%. In terms of stocks, Arabtec continued to remain under pressure. The stock dropped -0.4% after dropping -10.0% in the previous trading session. There were reports that the company’s CFO has resigned.

Oil prices gained overnight and extended into trading this morning on expectations that a solution to the coronavirus outbreak could be delivered soon. Brent futures are trading up 1.75% at USD 56.25/b while WTI is up more than 2% at USD 51.89/b.

OPEC+ continues to debate an appropriate response to the impact of the coronavirus on demand, extending their technical meeting in Vienna for a third day. Russia reportedly is favouring extending the current production cuts beyond their initial expiry at the end of March while Saudi Arabia is seeming to seek a much deeper cut.

US crude inventories rose by 3.3m bbl last week although draws across the rest of the barrel helped to take overall petroleum inventories down by 891k bbl. US production slipped by 100k b/d to 12.9m b/d while crude exports dropped 96k b/d to 3.4m b/d.