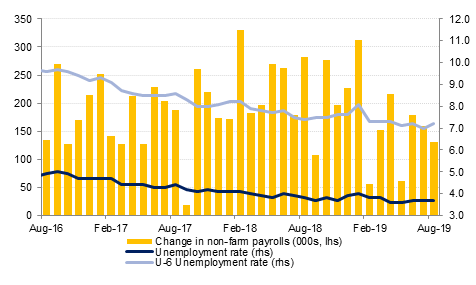

US August employment data was weaker than expected, showing a rise in non-farm payrolls of 130k, after a net -20k of revisions for the previous two months, taking the 3-month average to 156k. The unemployment rate was steady at 3.7% for a third straight month and average hourly earnings ticked up to 0.4% from 0.3%, but still slowing slightly to 3.23% y/y from 3.283%. The workweek was also firmer at 34.4 after dipping to 34.3 in July. The labor force rose another 571k following July's 370k gain, with labor force participation rate rising to 63.2% from 63.0%. Overall the report was not as weak as the headline suggested and Chairman Powell also downplayed the risks of a U.S. recession in a speech he gave at the end of last week. This may have been an attempt to assuage criticism that the Fed is ‘enabling’ President Trump by cutting interest rates to bolster growth that is being negatively impacted by Trump’s trade policies. However, it will probably still not get in the way of the Fed cutting rates at least twice more this year in our view.

China’s PBOC cut reserve requirements at the end of last week by 50bps and all eyes turn to the ECB in the coming one where a raft of easing measures are expected. The focus will also remain on Brexit following another government resignation over the weekend, and amidst an apparent rapid descent of UK politics into a state of chaos and uncertainty. PM Johnson may try to get a general election passed again today, but the opposition is likely to continue to block one without an extension to the October 31st deadline first leaving the government in limbo.

King Salman of Saudi Arabia has appointed a new energy minister, replacing Khalid al Falih with Prince Abdulaziz bin Salman. Prince Abdulaziz served as assistant oil minister for 12 years before becoming minister of state for energy affairs. At this stage, there is not expected to be a significant change in Saudi Arabia’s oil policy, which has focused on curbing output to support prices in an environment of increased non-OPEC supply and weakening global demand.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries ended the week lower as risk sentiment revived following confirmation of trade talks between the US and China in October. In fact, weak non-farm payrolls data and comments from Fed Chair Jerome Powell which reinforced expectations of a rate cut at next week’s meeting had limited impact. Yields on the 2y UST, 5y UST and 10y UST closed at 1.54% (+4 bps w-o-w), 1.43% (+5 bps w-o-w) and 1.56% (+7 bps w-o-w) respectively.

In Europe, there was intra-week volatility in UK bond yields as the Brexit process unfolded. However, on a w-o-w basis, yields on 10y Gilts rose marginally to 0.50% as risks of a no-deal Brexit receded.

Regional bonds closed flat for the week as investors track moves in benchmark yields and hold position ahead of key central bank meetings over the next two weeks. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained flat at 3.07% while credit spreads tightened 5 bps w-o-w to 153 bps.

Over the last week, a 0.42% rise helped EURUSD close the week above the 1.10 level, at 1.1029. During the week, the price fell as low as 1.0926, the lowest level since May 2017 and below the 23.6% five-year Fibonacci retracement of 1.0967. While this break was not sustained, the price remains well below the 50-day moving average (1.1154) and as a result the cross is still vulnerable to further declines. A daily close below the 1.0967 level can trigger a more significant decline towards 1.07.

A 1.07% gain over the last five trading days resulted in GBPUSD closing the week at 1.2287, the highest Friday close in six weeks. The week was volatile, with the cross ranging from a new 2019 low of 1.1959 to climbing as high as 1.2354, briefly breaking above the 50-day moving average (1.2300) for the first time since May 2019, before selling pressures pared these gains. The close below the 50-day moving average and the 23.6% one-year Fibonacci level (1.2295) mean that despite these gains, sterling is still vulnerable and as a result a close above the 50-day moving average is required for the cross to see a more medium term change in fortunes.

A respectable rise of 0.60% last week took USDJPY to 106.92, in a second consecutive week of gains. Over the course of the week, the price broke and closed above the 23.6% one-year Fibonacci retracement (106.84), and briefly broke above the 50-day moving average (107.18). While the price remains above this 23.6% retracement, it can be expected to retest the 50-day moving average. A break and daily close above this level may result in a further climb towards 108.30, close to the 100-day moving average and the 38.2% one-year Fibonacci retracement (108.32 and 108.31 respectively).

Regional equities closed mainly lower. The DFM index dropped -0.7% as investors locked in gains from the previous week. Emirates NBD (-2.9%), Emaar Properties (-0.2%) and Emaar Malls (-1.9%) were notable losers. Shuaa Capital lost -1.5% after the company informed that they will sell their brokerage and market making businesses to a unit of International Holdings Co in an all cash deal.

Oil prices rallied last week amid a positive inventory report from the US and a broad risk-on sentiment. The EIA report indicated that inventories dropped by 4.8mn barrels for week ending 30 August 2019. Overall, Brent and WTI prices rose +1.8% w-o-w and +2.8% w-o-w respectively.

Gold prices closed lower for a second consecutive week. It appears that comments from the Fed Chair Jerome Powell where he ruled out a recession weighed on investor sentiment. The spot prices dropped -0.9% last week.

In another development, Saudi Arabia named Prince Abdulaziz Bin Salman as the new energy minister.