Early results in the US presidential election put Joe Biden in the lead on electoral college votes as of this writing, although we caution that with a record 100mn postal and early votes this year, the final results may not be known for another couple of days. Some key states including Pennsylvania and Wisconsin only started processing mail-in ballots on election day. Counting in the key swing state of Florida shows Trump narrowly in the lead. While Florida is often considered an early indicator of the eventual result, Biden does not have to win it to secure a path to the White House. The Senate elections are arguably as important as the presidential election, with the Democrats seeking to gain control of the upper house. Democrats are projected to maintain control of the House of Representatives.

Economic data in the US overnight was largely in line with expectations, with factory orders up 1.1% m/m in September and durable goods orders up 1.9% m/m.

Turkey’s CPI rose 2.13% m/m and 11.89% y/y in October, slightly lower than the median Bloomberg forecast but higher than the September reading of 11.75%. Core CPI was up 1.9% m/m and 11.5% y/y.

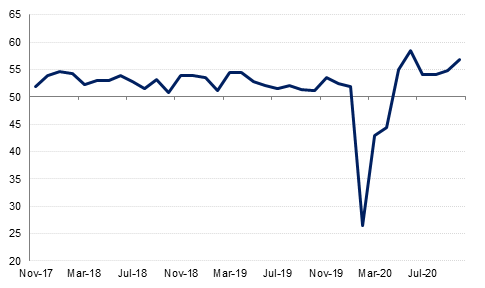

China’s Caixin services PMI rose by more than expected to 56.8 in October from 54.8 in September reflecting a continued recovery in the domestic economy. The reading was the highest since June. Employment in the sector rose for the third month in a row. The IMF expects China to be the only major economy to post GDP growth this year, forecasting a 1.9% expansion in real GDP.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasury markets are fluctuating in the wake of the still uncertain results coming out of the US presidential election. Overnight markets seemed to be pricing in a definitive outcome, for either candidate but more probably looking to Democrat Joe Biden as winning, and yields gained, particularly on the longer end of the curve. Yields on the 10yr UST were up 6bps to just shy of 0.9%. However, in early trading today as the results swing back and forth between Biden and incumbent Republican president Donald Trump, Treasuries have received a bid and yields have more than given up yesterday’s gains: the 10yr UST yield is down 7bps to below where it was at the start of the week.

Bond markets were generally weaker overnight in anticipation of a definitive victory with yields across major European economies higher: 10yr gilt yields were up more than 5bps while bunds added 2bps to close at -0.209%. Emerging market bonds (USD denominated) managed to rise, however, perhaps in anticipation that a Biden win would mean a less hostile attitude toward global trade.

The USD experienced its biggest one-day decline in more than two months on Tuesday, only to recover beyond last week's closing price on US presidential election volatility. The DXY index fell to a low of 93.290 but now trades at 94.130. USDJPY has been operating in a tight range in recent times but increased by 0.51% this morning to reach 105.23.

The EUR subsequently dropped dramatically following the USDs surge and is largely unchanged at 1.1640. The GBP recorded similar movement, reaching a high of 1.3140 only to fall to 1.2990, still marking an increase of 0.54%. The AUD staged a tremendous rally, at one point reaching a daily high of 0.7222 but has reversed a big portion of these gains. The currency still recorded an increase of 0.85% however and trades at 0.7115, whilst the NZD advanced by 0.43% to trade at 0.6665.

Both US and European equities closed the day higher yesterday, with European stocks outperforming as mining stocks and banks gained. The EuroStoxx 50 index rose 2.6% yesterday, with the Dax up a similar amount. The FTSE 100 gained 2.3%.

In the US, the S&P500 was up 1.8% while the DJIA gained 2.1%. Banks and financials led the US markets higher, rising the most since September. The Nasdaq Composite rose 1.9%, the most in more than three weeks.

Stock indices in the region were mixed yesterday, with the DFMGI down -1.2% and Tadawul ALSI down -0.3%. The ADX was fractionally higher at 0.3% while Egypts EGX30 closed up 0.8%.

Oil prices moved higher overnight along with other risk assets in the hope that the presidential election would at least result in a clear victory for one party or the other. Brent futures rallied 1.9% to close at USD 39.71/b while WTI was up 2.3% at USD 37.66/b. Both contracts are also pushing higher in early trade today but are likely to be highly volatile until a clear picture emerges as to who has won the election.

Gold prices are lower this morning, down 0.7% to USD 1,895/troy oz, giving up its overnight gains, even though a tight electoral race is taking hold