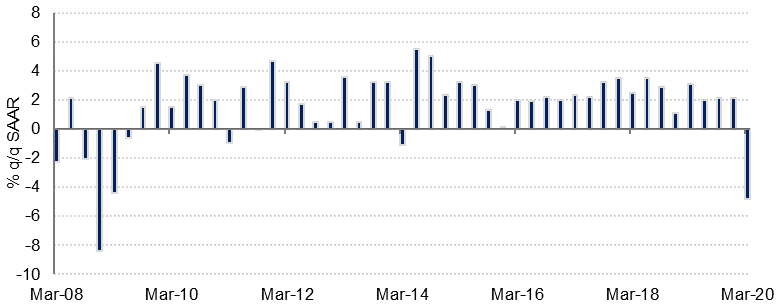

US Q1 GDP has registered the sharpest drop since 2008, contracting at an annualized rate of 4.8%, as measures to curb the spread of the coronavirus choke the economy and bring the longest economic expansion run on record to a halt. Of concern to markets was the very sharp decline in economic activity in the last two weeks of March as millions of Americans sought unemployment benefits. Furthermore, US personal consumption fell 7.6%, the biggest drop since 1980, adding concerns to the outlook in Q2, given the outsized role of the US consumer as a driving force behind two-third of economic activity in the country. Somewhat surprisingly the healthcare sector was the biggest drag on US consumption, with some market estimates putting it behind 40% of the fall, as medical facilities around the country ceased elective medical surgeries for example to focus on dealing with Covid-19. Business consumption also contracted, clocking the steepest fall in 11 years, having been already weighed down over the previous three quarters by US- China trade tensions. Markets are now preparing for what is set to be a very challenging Q2, which is expected to more fully reflect the effects of the economic lockdowns and realized job-losses.

The US Federal Reserve kept interest rate close to zero on Wednesday, pledging to take additional steps if needed, however stopping short of any new monetary policy action or guidance. The federal funds rate target range was maintained between 0 and 0.25 per cent, the same level since the 15th of March, when policymakers slashed rates and boosted asset purchases as the coronavirus pandemic began to bite. The FOMC projected an even more pessimistic view of the economy that in did back in March saying, “The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term”. Counter-intuitively, the grim Fed language is in a certain way assuring markets that Fed officials will be extremely sensitive to market conditions and ready to provide support to the economy and financial markets as needed.

Germany’s Economy Ministry cut its estimate for GDP growth in 2020 to -6.3% from +1.1% earlier in January. It expects economic activity to pick up again, only after the recession bottoms out in Q2, conditional on controlling the pandemic and avoiding a second wave of infections. Germany’s Economy Minister said the pandemic will sink Germany into its worst recession since World War Two. The Ministry expects consumer price inflation to drop to 0.5% in 2020 before rebounding to 1.5% in 2021. Unemployment is seen rising to 2.62 million in 2020 from an average 2.27 million in 2019, with the number of people under government backed short-time work schemes is expected to touch 3 million.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries closed mixed as the Federal Reserve reaffirmed the current policy stance. The central bank made a somber assessment of the situation and said that the ongoing public health crisis ‘poses considerable risks to the economic outlook over the medium term’. The Fed Chairman also said that they are not going to be in a hurry to raise rates. The curve steepened with yields on the 2y UST and 10y UST ending the day at 0.20% (-1 bp) and 0.62% (+1 bp) respectively.

Regional bonds made sharp gains on the back of strength in oil prices and sustained risk-on sentiment. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -12 bps to 4.09% and credit spreads tightened 12 bps to 349 bps.

Moody’s downgraded DEWA’s ratings to Baa2 from Baa1 with negative outlook.

The dollar extended its losses for a third day following the Fed's policy decision and month-end flows. The DXY remains well below the psychological 100.00 mark at 99.600 whilst the JPY made modest gains reaching 106.70.

The weakening dollar as well as countries laying out plans to reopen their economies are providing positive movement for the Euro, reaching its peak for the day in the evening, currently sitting at 1.0860 this morning. Sterling continues to trade above 1.2400 despite slipping below the mark in the afternoon. Lockdowns in the UK are set to continue as new estimates show a higher death toll than previously estimated. Meanwhile the AUD and NZD are easing back from some of their strong overnight gains with both antipodeans gaining more than 1% against the dollar.

Developed market equities closed higher amid optimism about a drug to fight coronavirus and rally in oil prices. The S&P 500 index and the Euro Stoxx 600 index added +2.7% and +1.8% respectively.

Regional equities continued their positive momentum. The Tadawul and the KWSE PM index added +1.5% and +1.1% respectively. The sharp rally in oil prices drove market heavyweights on the Tadawul higher. Saudi Aramco and Al Rajhi Bank added +0.8% and +2.7% respectively. Elsewhere, banking stocks with exposure to NMC closed lower.

Oil prices spiked overnight as the market looks to the introduction of production cuts from OPEC+ beginning from tomorrow and some modest signs of stabilization in demand in the US. WTI prices rose more than 22% to settle at USD 15.06/b and are up nearly 10% in trading this morning. Brent futures, which expire today, were up 10.2% overnight and have added another 7% this morning to push back above USD 24/b. Norway was the latest country to announce plans to cut output, by 250k b/d in June and then by 134k b/d for the rest of the year.

Inventory data from the EIA showed an 8.99m bbl build in crude stocks, including nearly 4m bbl at Cushing. Gasoline and kerosene stocks, however, dipped. That limited the total petroleum stock increase to “just” 10.4m bbl. In any other phase of the market such a build would be taken as exceptionally bearish but as the market was clearly expecting far worse the impact was relatively positive. Production continues to decline slowly, down by just 100k b/d last week to 12.1m b/d in the US while product demand jumped by 1.7m b/d w/w even as its more than 4.6m b/d lower y/y.