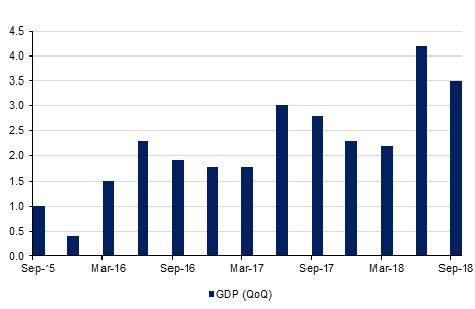

Although US GDP grew by 3.5% in Q3 (after 4.2% growth in Q2) the breakdown shows a shifting dynamic that will likely result in growth slowing in 2019. Although consumption rose 4.0% annualized, business investment only increased by 0.8%, while equipment investment rose by just 0.4%. Even more telling residential investment actually contracted by -4.0%, the third consecutive quarterly decline and consistent with recent monthly declines in home sales. From these it can be seen that consumers are still carrying growth, propped up by the tax cuts of earlier in the year, but looking ahead businesses are becoming more concerned about whether this can be maintained, especially in sectors that are sensitive to interest rates. Net trade also subtracted from growth in Q3 after contributing positively in Q2, a trend that may get worse should trade disputes intensify. Markets reacted negatively to the release, as the data was seen increasing the likelihood that the Fed will press ahead with rate hikes despite current financial market turmoil.

Today the focus will be on the UK’s autumn budget statement, which with the help of the Office for Budget Responsibility lowering its forecast for the deficit this year, will mean that the Chancellor will meet his fiscal targets this year. This is likely to leave the Chancellor space to deliver more funding to public services, and be supportive of economic growth. However, Chancellor Hammond has alarmed some opponents by signalling that a no-deal Brexit could bring back austerity and fiscal belt tightening next year.

Brazil has elected controversial right wing candidate Jair Bolsonaro to be its new President, winning almost 56% of the final votes. The pro-market populist candidate has promised to get tough on crime and root out corruption and promote privatization and ties with the US, but has controversially also stirred concerns about the future of democracy, given his praising of past military regimes and other Latin American dictators. The BRL has strengthened throughout October in anticipation of Bolsonaro’s victory, gains which could be extended if he gets to grips with some of Brazil’s big structural issues such as pension reform.

Treasuries closed higher as US equities closed sharply lower. The change in yields closely tracked the moves in equity indices. The curve steepened with yields on the 2y UST, 5y UST and 10y UST closing at 2.80% (-10 bps w-o-w), 2.90% (-14 bps w-o-w) and 3.07% (-12 bps w-o-w).

Following the drop in equity markets, inflation expectations seem to be dropping in the US bond market. The five-year breakeven rate, which represents bond investors’ view on inflation through 2023, dropped to the lowest level since January 2018 to 1.92%.

Regional bonds closed higher. However the gain was smaller compared to the move in benchmark USTs as oil prices dropped as well. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped 4 bps w-o-w to 4.61% while credit spreads widened 8 bps w-o-w to 172 bps.

Fitch affirmed Investcorp Bank ratings at BB and revised the outlook to stable from positive.

EURUSD fell 0.96% last week, closing at 1.1403 in a move which has many technically significant observations. Analysis of the daily candle chart shows that the former supporting baseline which had been in effect since December 2017 has been breached. In addition the price has now closed below the 100-week moving average (1.1528) for a second week and looks likely to test the 200-week moving average (1.1318), a level which was last broken in November 2017. A weekly close below this key level, could catalyze further declines towards 1.10.

USDJPY fell by 0.58% last week, to close at 111.89. The cross had seen more significant declines towards 111.38 before finding support close to the 100-week moving average (111.34) and closing back above the 100-day moving average (111.57). Over the week ahead, we look for a break above the 76.4% one-year Fibonacci retracement to signal further gains, while a daily close below the 100-day moving average hints towards further weakness.

Regional equities closed mixed amid a weak global backdrop. The DFM index lost -0.4% while the ADX index added +0.3%.

Sabic reported Q3 2018 net profit of SAR 6.1bn (+5.4% y/y), in line with market estimates of SAR 6.08bn. Revenues for the company came in at SAR 43.71bn.

Oil markets extended their losses last week, the third consecutive weekly drop. Brent futures are holding onto a USD 77/b handle and are roughly flat on where they ended last week while WTI is at USD 67.63/b. Forward curves remain split with a shallow contango still at play in WTI and backwardation, although flattening, in Brent markets.

Speculative length in oil markets continues to flood out with both WTI and Brent losing longs last week and shorts showing more signs of confidence. The drilling rig count in the US still managed to show growth, up two rigs last week.